Soc Gen Buying the Pound-Dollar Citing Improving Brexit Narrative

- Sterling's longer-term outlook seen improving

- Dollar contrastingly remains under siege on trade pogrom

- GBP/USD a fertile buy candidate says Soc Gen's Korber

© DragonImages, Adobe Stock

Strategists at Société Générale have recommended buying GBP/USD in anticipation of a further extension higher, noting that Sterling is liable to find further upside on the Brexit negotiation narrative.

"The current FX trend sees Sterling going up twice as much on any good news as it goes down on bad news; and, at the margin, the news is helpful," says Olivier Korber, an FX derivatives strategist with Société Générale.

The Pound-to-Dollar exchange rate has moved steadily higher since the EU and UK agreed on a Brexit transition deal which will extend the UK's stay in the Union for an extra 21-months, enabling both sides to hammer out a new trade relationship.

This has had the positive knock-on effect of giving confidence to the Bank of England (BOE) to consider raising interest rates sooner than it might otherwise have, and there now seems to be a very high likelihood it will put up interest rates in May.

Higher interest rates will, in turn, boost the Pound, since they generally attract greater inflows of foreign capital drawn by the promise of higher returns.

Trade Wars Worse for the Dollar

The Dollar, meanwhile, seems more likely to see more downside. If trade tensions escalate the US could suffer from slowing growth and a fall in exports which will reduce the attractiveness of the US a destination for investors, and hurt the Dollar.

At the moment it looks like a global trade fears are easing up, however, with the news that the US has exempted more countries from tariffs.

Yet even this scenario could be negative for the Dollar as it might revive expectations of global growth, making investors prioritise riskier emerging market investment opportunities over US opportunities - which could also weigh on the Dollar.

The Dollar has more to lose than the Pound on trade war escalation.

"Trade wars worse for USD than GBP. With the G10’s biggest current account deficit, the UK stands to lose out from reduced capital flows but may have less to lose in trade wars than some," says Korber.

Soc Gen expects GBP/USD to trade in a range over the medium-term, with a ceiling at 1.50 and the lower band "floored by the 1.3610 horizontal support."

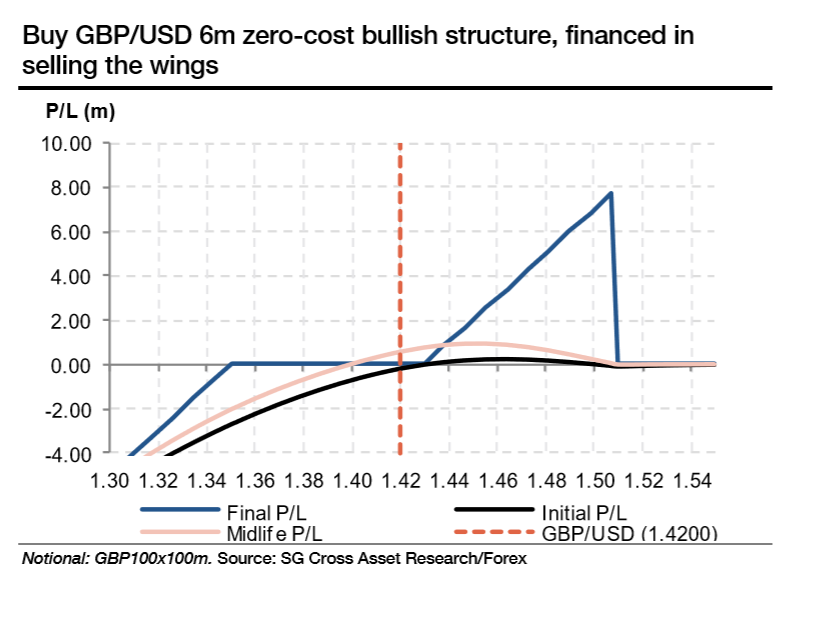

Korber recommends using a complex option's trade in order to trade his view of Sterling's evolution within this range.

The trade is designed to cost nothing as the cost of the call option (which is a bet on a rise) is financed by the sale of the put option (which is a bet on a decline).

Korber suggests buying a slightly out of the market (OTM) 6m duration call option with a strike price at 1.4300 (current market rate 1.4170), using the proceeds from selling a put option with a strike price of 1.3500.

The 'strike price' is the level the exchange rate must touch to open the option trade.

The option will make money if it simply rises from its current level above 1.4300 and higher but does not reach as high as 1.5100, which is a 'knockout' level, meaning that if the exchange rate touches it the option will expire worthless.

The knockout level condition adds risk to the call but reduces its price.

The diagram above illustrates how the option trade has been structure to ensure zero-cost. it also shows the profit and loss of the trade at different market levels.

Apart from over-extending higher, the main risk on Korber's option strategy is that the exchange rate rises above 1.43 but then promptly collapses and falls below 1.35 triggering the put payout and a loss on the call, or if it simply falls below 1.35.

"The short vanilla put exposes investors to unlimited losses below the 1.35 strike at expiry, while the long call would cease to exist if at any time the spot hits the knock-out at 1.51. As the structure would be knocked-out for GBP/USD as high as 1.51, the OTM put would be virtually worthless and thus constitutes a manageable risk because its strike would be 16 figures lower," says Korber.

The broadly bullish view is in line with technical analysts from Lloyds and Singapore based lender UOB who we noted in an article yesterday were also overall bullish the pair, at least in the long-term.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.