Commerzbank see Pound's Gains vs. Dollar Fading, Exit 'Long Position' on Exchange Rate

- GBP/USD uptrend nears a potential ceiling

- Commerzbank think it will start correcting back down now; Lloyds are more bullish

- Singapore-based UOB are neutral in their veiw of the pair

© kasto, Adobe Stock

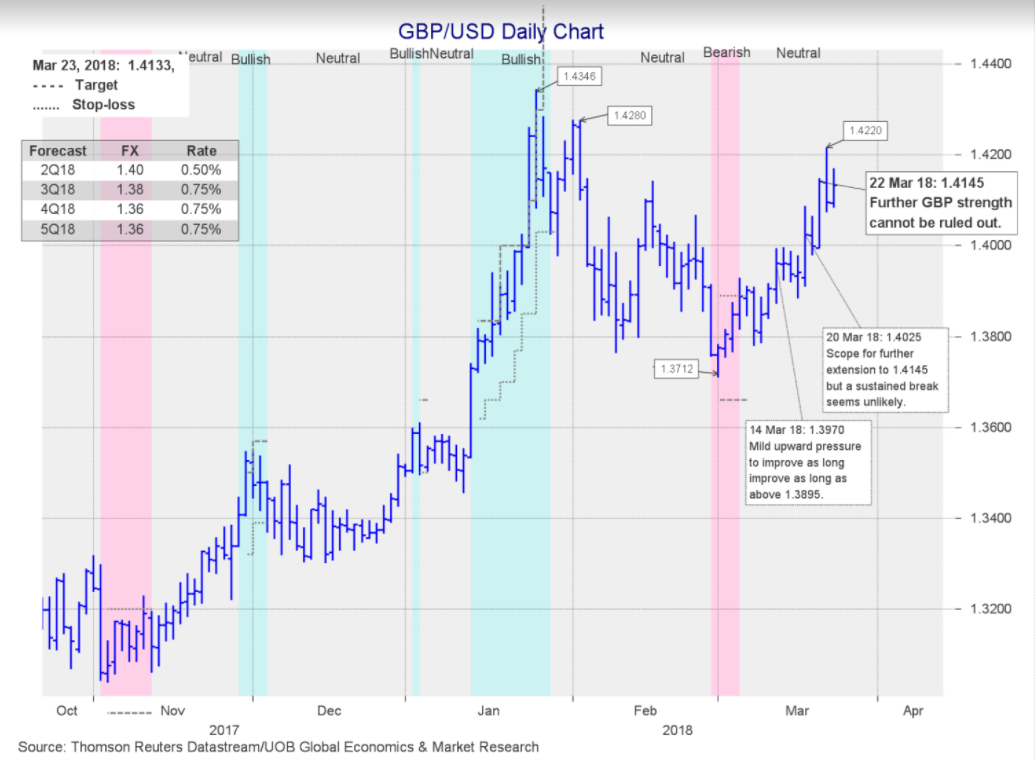

Pound Sterling has rallied up another half a percent to 1.4222 versus the Dollar on Monday morning, however, its gains are likely to be short-lived, according to analyst Karen Jones from Commerzbank.

"We think upside scope is now limited," she said in a research note this morning, adding that the main impediment to further progress was likely to be the 200-week MA at 1.4272, although another minor impediment is likely to be the 78.6% Fibonacci ratio retracement of the previous rally at 1.4210.

Large moving averages present obstacles to established trends and are often the site of pull-backs and reversals, due to increased buying and selling around them since they are highly popular indicators.

Fibonacci retracements are used by technical analysts to gauge how far corrections will move back from the main trend. Evidence appears to point to a natural tendency for corrections to retrace to one of four key retracement levels: 23.6%, 50.0%, 61.8% and 78.6%. These correspond to the Fibonacci ratios discovered by the 13th century Pisan mathematician Lionardo Fibonacci.

But this is not the only sign that the pair may be reaching the end of the trend, Jones also notes how the pair is 'TD Perfected' on the daily chart, which means it has reached exhaustion point using an indicator developed by Tom Demark, which measure exhaustion and turning points on charts.

"We would highlight the TD perfected set up on the daily chart which is also indicating that the market is likely to fail. We have exited our long position," she concludes.

The next question is that if the market is going down, how far down is it likely to go?

"Support is offered by the 55-day ma at 1.3940, below here lies the four-month uptrend line at 1.3852," says Jones, adding, "further support can be seen between the February and the current March lows at 1.3765/12 and also at the 1.3658 September peak."

A break above 1.4345 would disprove the bearish hypothesis and turn Jones bullish instead, with the next target to the upside situated at the 1.4565 April 2015 low.

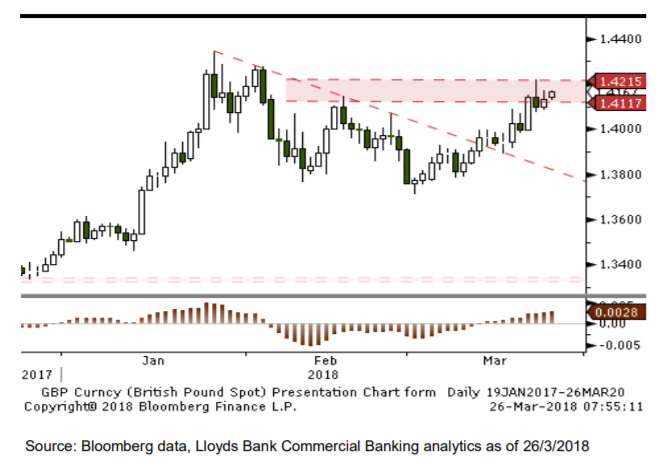

Another regular contributor of analysis on GBP/USD, Lloyds Commercial Banking's cross-asset strategist Robin Wilkins, was bearish the pair but has changed his mind.

"Our base case is that we develop a lower high under here, for a move back towards the recent 1.3712 lows," said Wilkins in a note this morning.

Yet he added that if the pair, "move through 1.4215/20 it would negate the immediate bear bias and risk a further push towards the 1.4280-1.4345 highs from earlier this year, if not a new high."

Overall, longer-term Wilkins also remains of the view that the bear trend from 2007 has bottomed and the pair is now trending higher.

"On a multi-year basis, this suggests meaning reversion back to 1.50-1.60. Brexit issues risk sharp pullbacks with 1.35-1.30 region the main support for now," adds the Lloyds analyst.

A more neutral view, meanwhile, is offered by Singapore based UOB Bank's strategist Quek Ser Leang.

Over the next 24-hours, "‘Flat’ indicators continue to suggest range trading for now, likely between 1.4120 and 1.4200," says Leang.

Over the next 3 weeks, he is a little more bullish, saying "GBP strength cannot be ruled out but it would be surprising if GBP can move above the February’s peak near 1.4280."

1.4000 is a line in the sand for bears, under which the analyst would turn bearish, but as long as it holds, either upside or sideways market action is forecast as most likely.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.