Pound Hits Two-Month Best Against US Dollar as Risk-on Market Conditions Make a Return

- Mnuchin is optimistic the U.S. can reach an agreement with China on trade

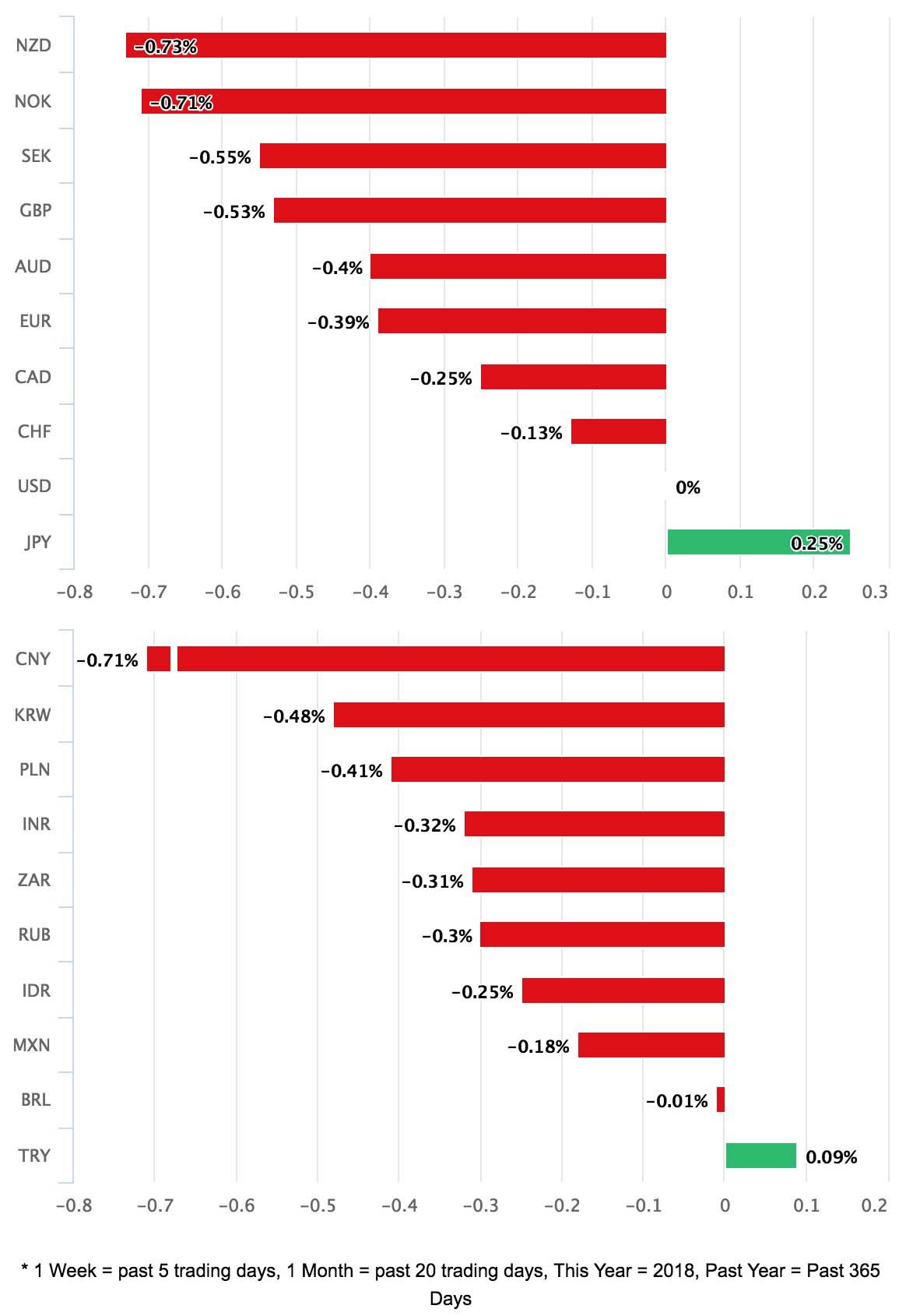

- Dollar and Yen are day's biggest losers

- The Pound is "good when risk recovers" - Morgan Stanley

- GBP/USD @ 1.4425, EUR/USD @ 1.1469

Above: US Treasury Secretary Steven Mnuchin triggers a 'risk-on' market move at the start of the new week. Image (C) The White House.

The US Dollar and Japanese Yen were underperforming rivals at the start of a new week characterised by renewed investor optimism.

That the Dollar and Yen - two so-called 'safe-haven' currencies - were under pressure signifies that overall global sentiment is in control of currency markets at the present time.

Investors were seen buying stocks and transferring funds into higher-yielding currencies amidst signs that the US is not in fact embarking on an aggressive anti-trade agenda. The previous week saw the Trump administration announce it was seeking trade tariffs on Chinese imports adding up to $50bn, and investors grew concerned that China would retaliate with its own fresh measures.

Markets fell heavily on the news with investors betting that a trade war would knock the impetus out of global economic growth and stocks were a prime target of these downbeat expectations. The Dollar and Yen caught bids as equity holdings are typically liquidated into Dollars and Yen.

However, on Monday March, 26 we hear that US Treasury Secretary Steven Mnuchin is optimistic the U.S. can reach an agreement with China that will avert any fresh tariffs. The news came hot on the heels of reports that the U.S. and South Korea had negotiated a settlement that would see South Korean steel products avoid swinging tariffs.

In short, Washington has signalled it is ready and willing to negotiate.

"After several intense days of risk aversion sparked by the announcements of trade tariffs last week, the markets were in much more upbeat mood as it became increasingly clear that Mr. Trump’s bark was much worse than his bite as the actual substance of his trade policy did not seem as punitive as initially feared," says Boris Schlossberg at BK Asset Management in New York. "Additionally, the signing of the US budget spending bill after much much bluster and grumbling from Trump also assuaged investors who were hopeful that the political risks have eased."

The Dollar's weakness is clearly evident:

The Euro-to-Dollar exchange rate trades at 1.2409, which is more-or-less the top of the March trading range.

The British Pound has meanwhile benefited, in line with the views we reported last week, which suggest the Pound needs global stock markets to be rising if it was to head higher.

Indeed, the Pound-to-Dollar exchange rate has risen in this environment of Dollar selling; the pair is quoted at 1.4225, the best level seen in this exchange rate since early February.

Hans Redeker, an analyst with Morgan Stanley says the Pound is "good when risk recovers" noting that "GBP has regained its correlation to risk and oil, suggesting that Brexit-related risks have been priced out."

"Sterling remains well-supported technically; gains are extending towards the early 2018 high (1.4336) and the rise remains well-supported by a bullish alignment of trend strength oscillators. This implies to us that price action will continue to grind higher and that counter-trend corrections will remain limited for the moment. We see support in the 1.4180/00 area now," says Shaun Osborne, an analyst with Scotiabank in Toronto.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.