The US Dollar is Back, for Now at Least

The performance of the Dollar is the dominant theme in global FX markets at present, and we find it rallying into month end.

The Dollar is undergoing a rebound after weeks of decline ensuring all other currencies are pushed aside. The Dollar's performance ensures the GBP/USD exchange rate has now retreated below 1.40 again, while EUR/USD is well off its highs at 1.25 and back in the 1.23s.

Whether this is the start of a major comeback for King Dollar, or just a 'dead-cat' bounce, is yet to be seen as it's a little early to say. What is for sure that a comeback was always necessary owing to the oversold conditions created by the declines seen thus far into January - the weakness was simply untenable.

Above: The US Dollar Index which is a measure of overall Dollar strength based on its performance against a basket of major currencies.

One of the factors which were weighing on the Dollar before was a negative perception of the longer-term outlook for interest rates, or what analysts call the 'terminal rate'.

Interest rates impact on currencies because they affect inflows of foreign capital. When interest rates are high they draw more capital; when low less - investors move their money to where they can get the highest return.

Although interest rates have been rising in the US and this should be positive for the Dollar the thing that was holding it back was the longer-term view of interest rates and where experts think the final, or 'terminal' rate - which is the peak rate in the cycle - will be.

It appears these expectations are now shifting with analysts now expecting the terminal rate to peak at a higher level than previously, however, and this may be helping to support a come-back in the Dollar.

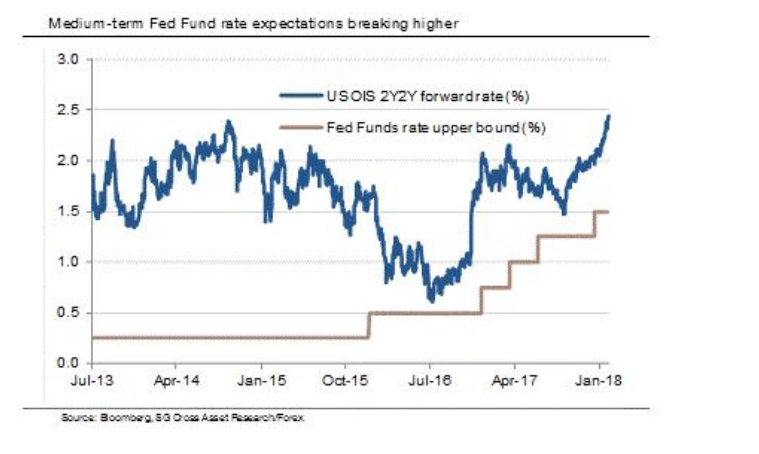

One way of estimating what the market expects interest rates to be in the future - sometimes known as the 'Fed Funds Rate' in FX jargon - is by looking at the pricing of Overnight Index Swap Forwards (OIS).

In the chart below, supplied by Société Générale Analyst Alvin Tan, the OIS 2year over 2year Forward Rate has been rising sharply in January indicating an adjustment higher in medium-term interest rate expectations, which could be the reason behind the Dollar's mysterious recovery.

Tan says, "what is significant in recent days is the medium-term market pricing of the Fed Funds rate seemingly breaking through the range highs. If the market expectation of the Fed Funds rate continues to rise beyond ~2.5%, then the higher interest rate cavalry may finally come to the dollar's rescue."

These changes in interest rate expectations also come at the start of the week when the US central bank, the Federal Reserve, meets to decide whether to put up interest rates again, so maybe having a magnified effect because of potentially influencing the meeting.

Currently, no-one expects the Fed's committee (FOMC) to raise rates on Wednesday - March in the cross-hairs for the first hike of 2018 - but market repricing may start to raise an outside chance of a surprise hike.

Ten Year Treasury Yields Surge

Another source of thrust for the US Dollar has probably been the rising yield on the US 10 year Treasury Bond, which is the official US government bond.

The yield basically indicates the degree of compensation bondholders can expect as a result of inflation erosion.

The higher it gets the higher the market thinks inflation will be in the future so the more compensation bondholders can expect to get.

Higher inflation is the main reason why central banks put up interest rates and these drive up currencies.

Therefore the recent spike in 10-year US Treasury yields is a positive sign for the Dollar.

"The Dollar was also supported by a spike in U.S. Treasury yields with the 10-year above 2.70%, the highest since 2014," says market analyst Joe Manimbo who works for money transfer giant Western Union.

Manimbo adds that the Dollar's recent fall has been caused by the perception that interest rates in the rest of the world (RoW) are going to rise and catch up with US rates, which are going to stay relatively low because of a modest terminal rate expectation.

This 'RoW' factor now means the Dollar needs exceptional data to propel it higher:

"To help brighten the dollar’s dim broader outlook, U.S. data would need to show strength that could hasten a more hawkish Fed," says the Western Union analyst.

The Ten year Treasury yield was also seen as a contributing factor to the Dollar's rebound by BK Asset Management Managing Director and veteran of the FX markets Boris Schlossberg:

"The dollar recovered slightly at the start of week's trade aided by continuing rise in US yields which broke the 2.70% barrier on the benchmark 10-year for the first time since 2014," he says.

Schlossberg notes the gulf there now is between US yields and the rest which are much lower. Normally this is a catalyst for US Dollar gains, however, this appears to only be happening now after some time in which the market has ignored the differential.

"The rise is the buck was modest given the massive yield differential that the US now commands, but nevertheless, it was the first time in weeks that the correlation between fixed income and FX was working, suggesting that the greenback may be finding some sort of near-term bottom," says Schlossberg.

However, Chris Turner, an analyst with ING in London is less convinced that the rise in bond yields will have a lasting impact on the Dollar.

"While we could see a little equity weakness extending into Europe today – and probably a little corrective dollar strength – we doubt current price action marks the start of a major new trend," says Turner in a briefing to clients dated January 30. Turner notes the rise in bond yields - which are a result of the selling of bonds - has thus far been orderly and nothing unremarkable.

Personal Consumption Expenditure Holds Firm

Further fueling the rally in the Dollar is the recent release of Personal Consumption Expenditure (PCE) which came out in line with and marginally higher than market forecasts for December.

Core PCE rose 0.2% on a monthly basis when forecasters had only expected a 0.1% increase.

It rose 1.5% compared to a year ago which was the same as in November and as forecast.

PCE is the favoured inflation gauge for the Fed.

Broad PCE, meanwhile came out at 1.7% year-on-year, down from 1.8% in the previous month.

Overall analysts seemed to be upbeat about the data, suggesting the slow inflation during the summer was behind us and a brighter outlook awaits.

"Core PCE inflation stable at 1.5% in December, as expected....Inflation has picked up somewhat since the trough in August, and is likely to rise further....Fed is expecting inflation to rise further and will hike rates again in March," says DNB analyst Knut Magnussen.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.