Analyst Forecasts Pound-to-Dollar Rate will Test 1.40 but Key Resistance Point Tests the Uptrend

The GBP/USD exchange rate is presently toying with a major band of resistance which could thwart the ongoing uptrend; but a number of analysts believe a break higher will ultimately occur.

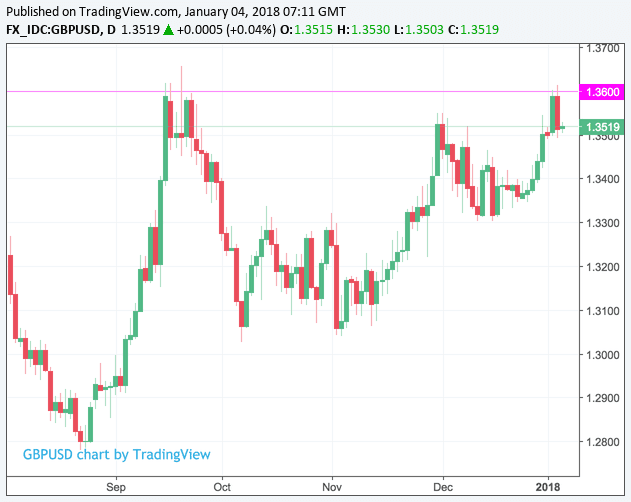

The Pound-to-Dollar exchange rate is presently located above 1.35, but below a key ceiling located just above 1.36 which represents the September 2017 highs.

Key technical levels - as exemplified by 1.36 in GBP/USD - tend to form a focus for currency traders as they set buy and sell orders in anticipation of change or acceleration in trend.

Currency commentators and analysts are focussed on this level and appear split as to whether Sterling has the energy to break above this key region; for example, Société Générale's Alvin Tan says this is a hurdle too far for a currency that will struggle in 2018 and GBP/USD is destined to head back towards 1.30.

Above: A reckoning for Sterling bulls in the $1.36 region.

Yet, others are more optimistic, noting that the overarching theme of Brexit will prove to be more constructive for the Pound in 2018.

Analyst Viraj Patel at ING Bank N.V.'s London branch is one such optimist and believes Sterling has the ability to rise against the Dollar over coming weeks, citing expected progress on Brexit negotiations.

Specifically, Patel and his colleagues prefer to focus on potential catalysts for a positive reassessment of the U.K. economic cycle that would result from progress in Brexit negotiations.

Progress on this front should in turn prompt expectations for further interest rate rises at the Bank of England; and recall, rising interest rates is typically supportive of a currency.

"Progress during Phase II of Brexit negotiations – and subsequent clarity over the UK’s new macroeconomic paradigm – will be the overarching theme dominating GBP’s direction of travel in 2018," says Patel.

Negotiations will turn to the issue of a future transitional agreement between the E.U. and U.K. in early 2018. Markets, and those advocates of a soft-style Brexit are advocating for the U.K. to keep its current relationship with Europe intact through this period in order to ensure clarity for business is guaranteed.

"We see some structural upside for GBP if a transitional deal emerges early next year along with a re-rating of the growth outlook," says Deutsche Bank analyst Oliver Harvey, an analyst who has been bearish Sterling for sometime but acknowledges the fundamental backdrop for the currency is improving.

However, ardent Brexit supporting politicians want the chord the ties the United Kingdom with Europe severed on the strike of Brexit in March 2019; how the U.K.'s negotiating team balances these demands with a more pragmatic 'soft' Brexit transitional period could be key to how Sterling trades.

If those looking for a clean and immediate cut from Europe ultimately hold sway then ING's base-case for a stronger Pound in the first quarter of 2018 could be proven incorrect.

Nevertheless, ING's Patel argues "the bar to actively sell the Pound on UK politics remains high," noting that only the prospect of a general election in 2018 would provide problems for Sterling.

Indeed, even the hardest of Brexit supporters in the ruling Conservative party know that destabilising Theresa May's Government risks the entire Brexit project as a General Election will likely usher in a Labour Government which is decidedly ambiguous on what Brexit should look like.

Markets are increasingly aware of this dilemma facing lawmakers in the 'hard Brexit' camp and discounting the threat they pose to the stability of the May government and the U.K., and are thus finding it hard to find reasons to sell Sterling.

"This has been evident in GBP positioning data; while speculative investors have turned net long in recent months, this adjustment in positioning has been mainly driven by GBP shorts bailing – which suggests to us that the attractiveness of selling GBP has been fading given the absence of any factor that could seriously delay Brexit talks and push the U.K. closer towards the March 2019 cliff-edge," says Patel.

ING's conviction call is for GBP/USD to rally up to 1.40 on this story, with EUR/GBP moving to 0.85-0.86.

EUR/GBP at 0.85-0.86 gives us a GBP/EUR exchange rate in the range of 1.16-1.1750.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Sterling Supported by Better-than-Forecast Services Sector Data

Pound Sterling was seen trading at near-unchanged levels in the wake of the release of Services PMI data from IHS Markit and the CIPS.

Accounting for in excess of 80% of U.K. economic activity, the release tends to impact direction in Sterling whenever it surprises against analyst expectations.

The problem for those hoping for volatility is that the data came in more-or-less in line with economist expectations - analysts were forecasting a reading of 54.1 for the month of December, a tick up on November's 53.8.

The confirmed reading was for 54.2, which confirms the sector continues to grow at a decent enough clip. However, for a currency trader the beat was not enough to justify a fresh bid on Sterling.

At the time of writing the Pound-to-Euro exchange rate is quoted at 1.1239 and the Pound-to-Dollar exchange rate at 1.3524 - both key rates are well within recent ranges.

Nevertheless, the strong reading of 54.2 confirms the U.K. economy enters the new year with decent impetus and this should underpin the Pound longer-term which reinforces those forecasts that see Sterling appreciating in the year ahead.

“The services sector experienced mixed fortunes in December, as business activity expanded at an accelerated pace but the flow of incoming new work was the slowest since August 2016," says Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply.

Elsewhere, the Bank of England’s money and credit figures for November revealed that the number of mortgages approved for house purchase rose from 64,887 in October to 65,139, above the consensus expectation for a further fall, which had seemed likely following the decline revealed in the UK Finance measure which covers the main high-street banks, released on 27th December.

At the same time, consumer credit continued to expand at a fairly strong £1.4bn on the month.

"All in all, then, the latest data suggests that the economy maintained a decent amount of momentum in Q4, which we expect to be built upon in 2018. Indeed, our forecast is for GDP growth of 2% or so, compared to the consensus forecast of a slowdown to 1.4%," says Paul Hollingsworth, UK Economist with Capital Economics.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.