Strategists see Pound Sterling Advancing in 2018 Amidst Growing Brexit Clarity

Above: Theresa May and the E.U.'s Jean-Claude Juncker. (C) European Commission.

The British Pound is forecast to go higher in 2018 by strategists as clarification over Brexit improves sentiment towards the currency.

2018 is the year in which the shape of Brexit finally becomes clear allowing businesses and individuals alike the ability to plan for a Britain outside of Europe.

Since the E.U. membership referendum of June 2016 there has been a substantial lack of certainty available to businesses and individuals which would allow them to make key investment decisions; and this has in turn resulted in below-par economic growth.

Currency markets reflected fears of a slowdown well in advance of any slowdown actually taking place, culminating in a double-digit decline in the value of the Pound. However, at the start of 2018 we can confidently say that the initial slump in Sterling was excessive when compared with the actual decline in U.K. economic activity.

2016 - the year of the referendum result - saw the U.K. outperform all other major global economies by recording economic growth of 1.9%.

While 2017 did see economic growth decelerate - we are still waiting for the final figure from the ONS - it will likely come in above 1.0%, well above recessionary territory.

Markets have conceded a misalignment between the U.K. currency and U.K. economic performance and have thus allowed Sterling to recover - particularly against the US Dollar where we have seen GBP/USD move well above the ~1.20 lows recorded at the start of 2017. At the time of writing we are watching Sterling attempt a move above 1.36.

The Pound-to-Euro exchange rate is at 1.1242 - well above 2017 lows at 1.08, but we must recognise the significant Euro strength we have seen over recent months saw the Euro advance 4% against Sterling in 2017 thanks to improving Eurozone economic growth.

Brexit Clarity and a Stronger Pound

How much further can this recovery in Sterling run? We believe the theme for the year head is one whereby markets reflect that Brexit is unlikely to be the economic disaster initially assumed and Sterling continues to correct higher as a result.

"The Brexit issue is set to remain the main driver for GBP in 2018 and while uncertainty and fundamentals justify an undervalued GBP for now, we see prospects of a recovery in 2018 as clarification on Brexit increases," says a strategy note from Danske Bank where analysts are betting the Pound will recover against the Euro in 2018.

Danske Bank have told clients that betting on a rise in Sterling against the Euro in 2018 is one of their key strategy recommendations; but the success of the trade rests with the politicians.

Late-2017 saw Sterling move higher against the Dollar and Euro after Prime Minister Theresa May clinched a deal with her European counterparts in which the so-called 'divorce settlement' with Europe was reached.

This included sticky points such as financial obligations and the Irish border; progress here means negotiations in 2018 will firstly focus on the shape of a transitional deal that will cover the period between the exit date and the final Brexit state.

"We see some structural upside for GBP if a transitional deal emerges early next year along with a re-rating of the growth outlook," says Deutsche Bank analyst Oliver Harvey.

Sterling has in the past shown it likes talk of a transitional state that reflects the current status quo; and should this be confirmed in the opening months of 2018 the Pound could well go higher.

"This should eventually bring investors back to GBP assets due to attractive valuations," say Danske Bank in their note to clients. "What matters for GBP is the future E.U.-U.K. relationship and, not least, reassurance that it can avoid a ‘cliff-edge Brexit’, where there is no deal and no plan when the current 2Y negotiation window ends and the UK formally leaves the EU."

The transitional period is widely tipped to last for two years but expect U.K. Prime Minister Theresa May to face stiff opposition to the deal from those members of her party that favour a clean and swift exit from Europe.

Should this wing of the party get their way expect the good faith shown to the Pound to be rapidly reversed. This remains the key risk to Sterling in 2018.

“Trying to second-guess what Britain's future trading relationship with the E.U. will look like – and by extension the degree of U.K. economic openness that should be priced into GBP – is currently a mug's game,” warns currency analyst Viraj Patel at ING Bank N.V.

"But this doesn't make the Pound an untradeable currency,” adds Patel.

More generally, ING note that a lot of bad news is already priced in "and despite a tricky year of domestic politics, GBP's resilience – and discreetly rising bias – confirms to us that there is a high bar to sell the currency."

Others agree that much of the advance experienced by Sterling will be against the single currency.

"2018 will be the year where a Brexit deal gets done. As the market has completely discounted the Brexit mess, breakthroughs and progress in the coming year will be positive for Sterling and its greatest gains will be against the Euro," says Kathy Lien, Director with BK Asset Management in New York.

The Pound-to-Euro Exchange Rate Forecast to Rise Above 1.17

The base-case scenario towards Sterling adopted by Danske Bank is that progress between Europe and the United Kingdom will continue to be made, and the Pound therefore continues to advance.

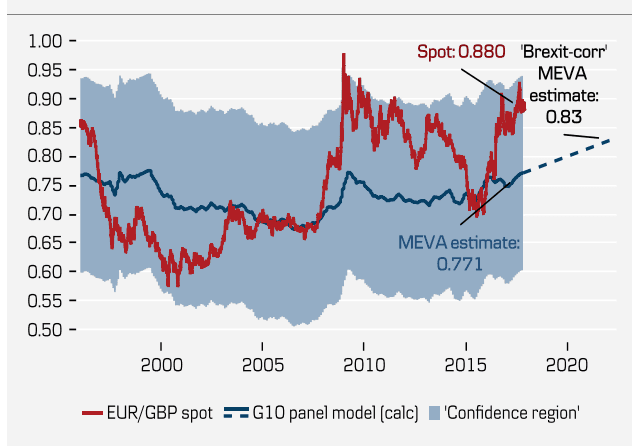

"GBP is significantly undervalued according to our MEVA model, indicating GBP strength over the medium term," say Danske.

Danske's Brexit corrected MEVA is calculated by assuming a net deterioration in UK terms of trade by 10% vis-à-vis the EMU. If we look at the following, we see the EUR/GBP trades towards the top of what the model implies.

Above graph (C) Danske Bank.

In short - the Euro is looking too expensive against the Pound and the easiest route forward is lower (i.e. higher Pound).

Danske estimate the EUR/GBP exchange rate could fall below 0.85 in 2018, giving us a rise in GBP/EUR above 1.17.

Above graph (C) Danske Bank.

"But it all depends on the final deal between the E.U. and U.K. and the U.K.’s ability to establish trade agreements outside of the E.U.," caution analysts at the Scandanavian lender.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.