US Dollar Flashing Green Lights as we Head into Thursday's 'Perfect Storm'

The US Dollar is flashing multiple green lights both in terms of economic events and technical clues which combined make a compelling case for the currency to rally.

The delay of the publication of the first draught of Donald Trump's tax reform bill until Thursday has added yet another market-moving event onto an already packed day, which now promises to be a rollercoaster for foreign exchange markets.

Other drivers aside - tax reform alone has the potential to be a major market moving moment for the Dollar.

"If done right and passed successfully, tax reform could be a game changer for US Treasury yields and the Dollar," says Richard Perry at London-based brokers Hantec Markets.

The reason is that it would be expected to increase inflation, by leaving more money in tax payers' pockets which they are then more likely to spend, pushing up prices.

Higher inflation is likely to make the Federal Reserve raise interest rates, which will almost certainly lead to a stronger Dollar.

The Dollar tends to appreciate as a result of higher interest rates because they attract more foreign capital which tends to flow to where it can earn the most return with the least risk - ergo increased demand for the Dollar and higher Dollar.

Repatriation Risk

But there is another reason tax reforms are likely to push up the Dollar and that is from the repatriation of foreign earnings by multi-national companies, as a result of either a blanket reduction in the corporation tax rate or a one-off tax-free repatriation holiday.

If anything this could be the bigger driver of the Dollar as past experience - from a similar repatriation holiday in 2004 - led to a massive rally in the Dollar.

Companies have absolutely tonnes of money stashed overseas which they have not brought home usually to avoid tax, which in the US is surprisingly relatively high at 35%.

The new bill promises to reduce the headline corporation tax rate to 20%, which in itself could be an incentive to bring money home - but if it also has a provision for a tax holiday on overseas repatriations, as some have suggested, that could lead to an even higher influx and the Dollar could go stratospheric.

Given we will have the first draught of the tax reform bill to view tomorrow, we will know all the details.

Next Fed Head

Also expected on Thursday, is the decision as to who will take over from Janet Yellen as the next chair of the Federal Reserve, with the most likely candidates as either Jerome Powell or John Taylor.

This is also a potentially market-moving moment for the Dollar.

If the academic John Taylor is picked then that will push up the Dollar substantially because he originated the 'Taylor Rule' used by economists and academics the world over, and the Taylor Rule states that when inflation is at its current level interest rates should be much higher than they actually are.

Therefore if Taylor takes over the assumption is that he would increase interest rates more aggressively than is currently being proposed.

Jerome Powell, meanwhile, is already a member of the Fed policy committee and is seen as Dollar-neutral since he rarely expresses opinions on Fed Policy as his remit has always been regulatory matters.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

What is EUR/USD Telling us About the Dollar?

Whilst it is impossible to know without insider information which candidate is likely to win the stewardship of the Fed and what the exact details of the tax reform bill will be, looking at charts - and Intermarket analysis of several Dollar sensitive assets can provide clues as to which way the Dollar might go tomorrow.

The main Dollar pair is EUR/USD and this is showing the most compellingly bullish set up for years after having formed a common bearish topping pattern on the charts in the form of a head and shoulders top.

On its own, this would be a bearish sign, but coupled with the fact that oil is looking toppy as well, the Dollar-positive indicators are substantially reinforced.

EUR/USD has already breached the neckline of the H&S pattern which is the line under the pattern which joins the two intervening troughs of the H&S and provides strong confirmation of further bearishness in line with that dictated by the pattern.

Although the pair has pulled back up to the underside of the neckline after the initial break below the neckline, this is a common feature of how these patterns evolve.

The post-break pull-back is known as a 'throwback move' and often precedes the start of the big wave lower - see it as prices taking a small step back before the big heave-ho - or metaphorically speaking like an athlete rocking back on their heals before the starting gun fires.

This means the pair is literally poised to jump off a cliff edge with only a nudge required to bring it down.

In addition, the expected downside from an H&S is considerable - equal to its height at its tallest point extrapolated lower from the neckline.

Using this as a guide indicates a downside target in the 1.1250s, although for a more conservative target we recommend 1.1500 where the monthly pivot (S2) is situated.

The pivot is likely to be a tough obstacle to overcome given traders often use it as a line to trade against the prevailing trend - although in this case, fundamentals may be so powerful that bears could overcome any defense of the line relatively quickly.

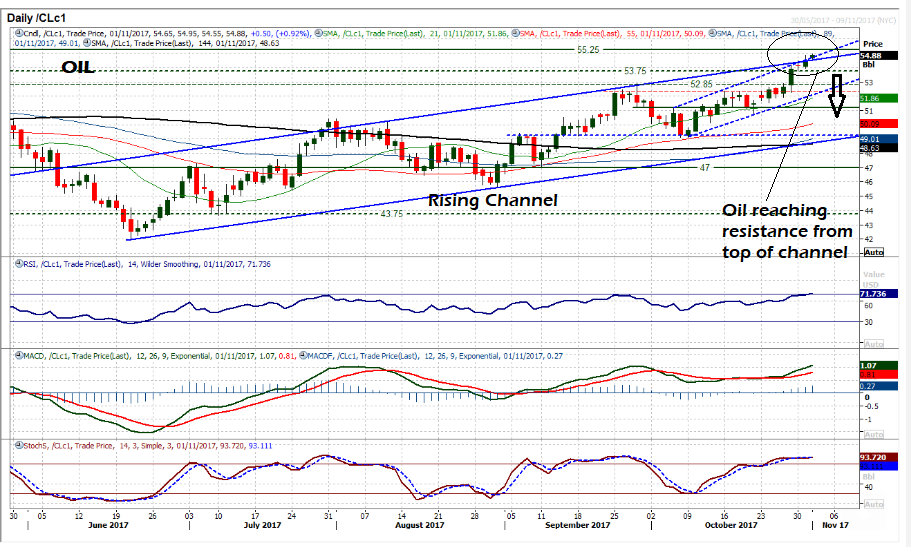

What is Oil Telling us About the Dollar?

The Dollar is related to oil because oil is priced in Dollars on international markets - thus if the Dollar strengthens, regardless of oil's fundamentals, that stronger Dollar can buy more oil, and therefore the price of a barrel of oil falls.

To summarise, a rise in the Dollar affects oil prices inversely, and so looking at the price chart of oil we note how oil is starting to look overstretched - but more importantly how it has reached tough resistance from the top of the rising channel, and is therefore now at high risk of being rebuffed back down.

Of a startlingly similar opinion is BNY Mellon Senior Currency Strategist, Niel Mellor, who says:

"One risk that is difficult to dismiss, given its typically inverse relationship with commodity prices, is the prospect of a continued USD uptrend.

"If this is what we are about to witness, in conjunction with Brent’s proximity to such important levels, then prudence surely demands caution among would-be buyers."

The current rally in oil is based on the supply outage caused by the hurricanes in the US, so it will only be temporary.

Mellor, however, sees geopolitics as the most likely catalyst for a sell-off from a purely fundamental perspective, after the conquest of intense oil-producing region Kirkuk by the Iraqi army now frees up production there, and potentially bringing oil prices down by adding to the supply glut.

Super-Thursday

Of particular interest for traders of cable is the fact that Thursday is not just a major market moving day for the Dollar but also probably for the Pound due to the Bank of England (BOE) rate meeting.

Although a rate rise from the BOE is now common knowledge and the market may well have adjusted for the fact, my experience of this kind of thing is that there is always a little more left to be priced in on the day so the Pound is at risk of rising due to the interest rate rise.

It is not any old meeting either, but a quarterly meeting, which means the BOE will also release their inflation report, adding further potential for volatility as it will contain their forecast for inflation.

Again, the potential for volatility is high as the main debate has now shifted to what the BOE will do after this rate rise - will it start a trend of increasing interest rates or is it a case of 'one and done' as some are saying?

The inflation report may shed light on what the policy trajectory is likely to be going forward, which is why it could cause fresh volatility for the Pound.

Given cable's sideways range-bound proclivity of late the expectation that both the Dollar and the Pound could rise tomorrow seems quite probable.

The strengthening of both currencies would cancel each other out leading to low volatility and more range-bound behavior.

This would seem to recommend selling volatility via an option straddle which would profit from a lack of directional movement.