US Dollar Struggles into New Month as Powell Now Tipped as Next Chair of Federal Reserve

- Written by: Gary Howes

Above: Continuity candidate Jerome Powell. Source: Federal Reserve Gallery.

The US Dollar is seen underperforming at the turn of the month amidst reports the new chair of the US Federal Reserve will be Jerome Powell.

One of the key drivers of the US Dollar of late has been the question of who will be the next chair of the US Federal Reserve with the next boss likely to adopt an interest rate policy agenda that would impact movements in the currency.

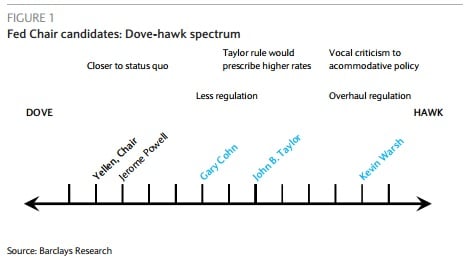

President Trump departs for a trip of Asia on November 3 and has indicated this to be his deadline for the announcement on who will take over the reins at the central bank. News that the favoured candidate is not a so-called 'hawk' - i.e. someone who favours a more agressive path of interest rate rises - has weighed on the Greenback.

“Reports on Friday confirmed our expectations that Jerome Powell is the most likely candidate taking out some momentum out of the USD,” says Manuel Oliveri, FX Strategist with Crédit Agricole in London. “If confirmed we expect some further moderate pressure on the USD but the market will probably keep its sights on the broader composition of the FOMC where the appearance of some hawkish figures would still be possible.

Incumbent Fed chair Janet Yellen’s four year term expires in February and it falls to President Donald Trump to nominate a candidate to lead the central bank for the next four years.

"President Trump’s nomination has the potential to materially alter market expectations over the outlook for Fed policy in the coming years," says MUFG’s Lee Hardman. “It is one of the key reasons why the outlook for Fed policy is subject to a heightened state of uncertainty at the current juncture.”

Governor Jerome Powell has been a member of the Federal Reserve Board since March 2012 and represents the closest thing to a continuity candidate given he is an existing Fed board member and a dove, in other words somebody who favours lower interest rates. Much like Janet Yellen herself.

“He could be viewed as a little more dovish than current Fed Chair Janet Yellen,” says Hardman pointing out his credentials that make for a broadly softer Dollar profile.

"He is part of the consensus that has set the current course for US monetary policy. If Trump

nominates Powell to replace Yellen it will imply continuity in the Federal Reserve’s interest rate and the balance sheet policy, at least for a time," says Lewis Alexander at Nomura.

In late-August Powell stated that lower than expected inflation “gives us the ability to be a little bit patient and that’s not a bad thing”.

He is also seen as modestly more supportive of bank deregulation.

"Over a longer horizon there is more uncertainty. As a governor, Powell has consistently

supported policies proposed by Chairs Bernanke and Yellen. However, it is unclear how

strong Powell’s own preferences for monetary policy are and it is unclear how those

preferences will evolve," says Alexander.

The rest of the FOMC will change as well, currently three Board seats are vacant and if Yellen resigns from the Board after her term as Chair expires in February, there would be four. So the story is one that has further to run beyond the appointment of the Chair.

Following the reports of Powell being favoured, and ahead of month-end, the Pound-to-Dollar exchange rate was seen trading at 1.3160, the Euro-to-Dollar exchange rate at 1.1636.

The US Dollar index is at 94.53.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.