Pound to Hold Firm in Tight Range Against Dollar as Traders Refuse to be Panicked by Election Fever

- Written by: Gary Howes

Above: Kathleen Brooks of City Index says market behaviour points to expectations that the UK's political scene will be remarkably similar to what it is today following the June 8 vote.

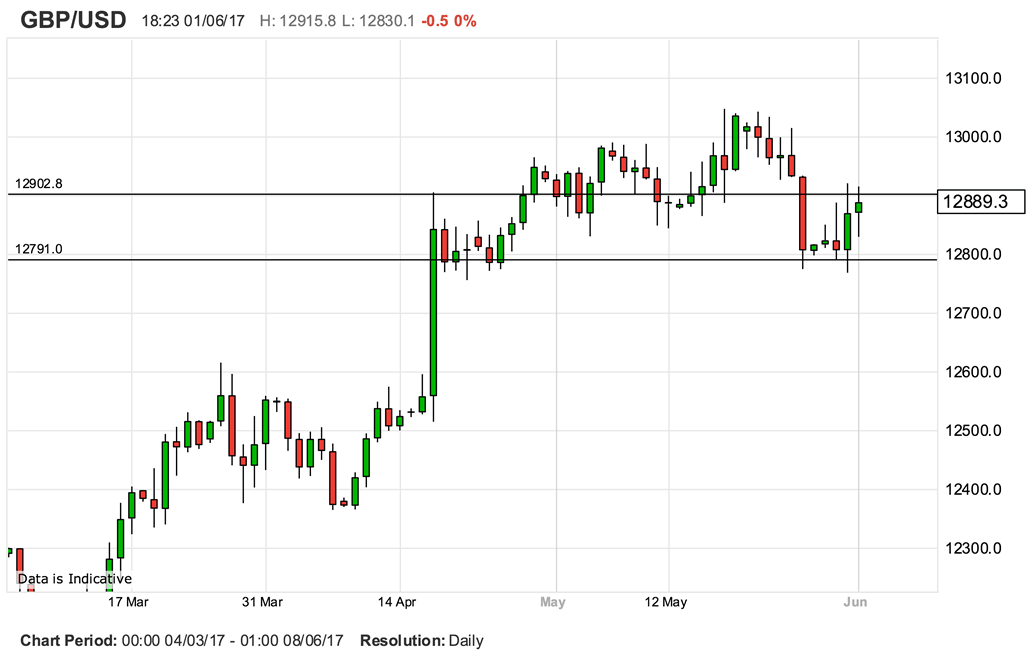

The GBP/USD exchange rate starts June more or less where it closed out the previous month - at 1.2887.

Despite recent election jitters spooking Sterling over recent days we note the GBP/USD exchange rate is not willing to go below support at 1.28.

But at the same time appears unable to go above 1.29, let alone 1.30.

We would expect this to be the immediate range for coming hours and days.

"You get the feeling that the pound just wants to go higher but keeps on getting knocked back down again. Be it a poll showing Labour’s deficit eroding or data out this morning from the Nationwide showing that the UK house prices have slipped for the third month in a row. GBPUSD just seems to be hitting a wall anytime it builds some momentum," says a note from Jonathan Pryor, a foreign exchange dealer with Investec in London.

Market focus remains resolutely on politics at present and with the UK due to vote in one week’s time it should come as no surprise that a tightening of polls is causing much volatility.

The UK currency whipsawed at the turn of the month on evidence that the Conservatives are now on course to lose their majority in Parliament.

However, the Pound was seen recovering on another poll that showed the Conservative’s majority remains intact.

It would seem uncertainty has risen, and currencies hate uncertainty.

“At this late stage of the UK election campaign, the pollsters are more divided on the size of the Conservative Party’s lead than at any other time during the election. This makes the outcome even harder to predict, and makes it difficult to price in the potential impact from the election result ahead of time,” says Kathleen Brooks at City Index.

Brooks notes that a lot of support for Labour has come from younger people who tend not to vote, so who knows what will happen on June 8th.

“We continue think that the market is expecting Theresa May and the Conservatives to win the general election. 1-month at the money volatility for GBP/USD has moved a little higher, but is still at the same level as April, while GBP/USD 1-month risk reversals do not suggest that there are a wave of bearish bets for sterling right now,” says Brooks.

This explains the 1.2750-1.30 range for GBP/USD leading up to this election, “which hardly suggests panic stations”.

The FTSE 100 attempted to make a record high on Wednesday, although it failed at that endeavour, and the 10-year UK Gilt yield, although retreating, has found support at the critical 1% level.

The UK Gilt yield has dropped by approximately 20 basis points over this election campaign, which again suggests to Brooks that election risks are not impacting the bond investor, yet.

Perhaps the market is underestimating the risks from this election, and the prospect of a Labour manifesto that claims to nationalise UK utilities and the Royal Mail, the latter is up 10% in the last month, has been virtually ignored by investors.

“We have a sneaking feeling that the market actually expects a pretty similar election result to what we have today, which would leave things virtually unchanged. This is looking like an increasingly likely outcome, if you average the polls; hence the muted response from the market is hardly surprising,” says Brooks.