US Dollar Pensive Ahead of Trump, GDP + Housing Data Strong

The Dollar slipped 0.2% on Tuesday despite the release of data showing the US economy was in good health, as concerns Donald Trump would not deliver on his stimulus promises weighed..

The decline may be as a result of the recent pullback in Treasury yields due to a lack of investor concern about the impact of Trump’s fiscal stimulus policy on inflation.

Expectations that he will mention infrastructure spending in his state of the union address later tonight appear to have fallen to below 25% for many, and this would be the biggest boost to the economy, out of all his stimulus policies.

The recovery in bonds, however, is only likely to be temporary, according to Capital Economics’ John Higgins, who sees upward pressure on inflation as inevitable due to increased economic growth.

Indeed, market indicators for the probabilities of the Federal Reserve increasing interest rates in March seem to have risen to 35% recently showing the market also has higher inflation expectations.

This seems accurate judging from recent data which, especially on Tuesday, showed a set of strong figures.

The second estimate of GDP data for the fourth quarter came out at 1.9%, the same as the first estimate, which although nothing spectacular at least remained unchanged.

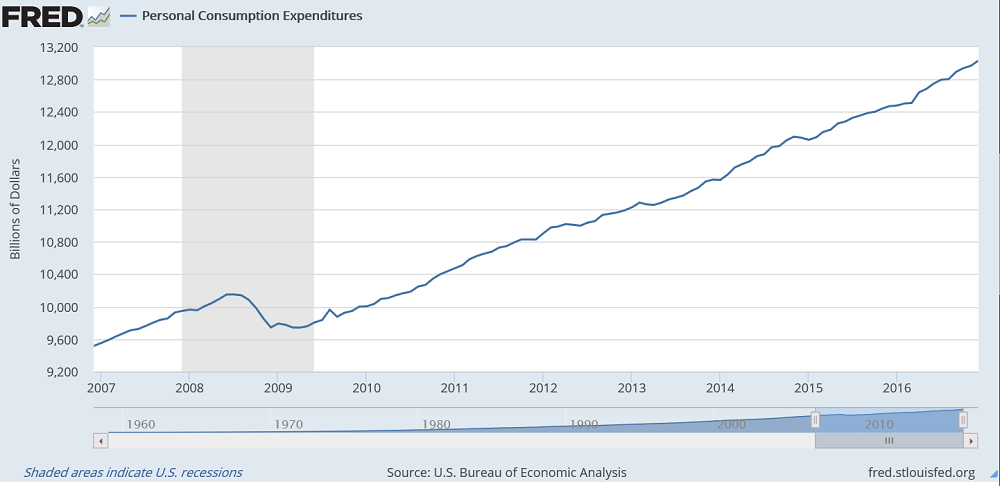

Personal Consumption Expenditure continued to rise steadily, increasing by 1.9% in Q4 versus the 1.5% previously, albeit slightly below the 2.2% forecast.

Conference Board Consumer Confidence, however, rose to a higher-than-expected 114.8 from 111 in the previous month of January and well above the expected 111.6.

“It remains at a 15-year high,” said Lynn Franco, Director of Economic Indicators at Conference Board.

“Consumers rated current business and labour market conditions more favourably this month than in January. Expectations improved regarding the short-term outlook for business, and to a lesser degree jobs and income prospects. Overall, consumers expect the economy to continue expanding in the months ahead,” she added

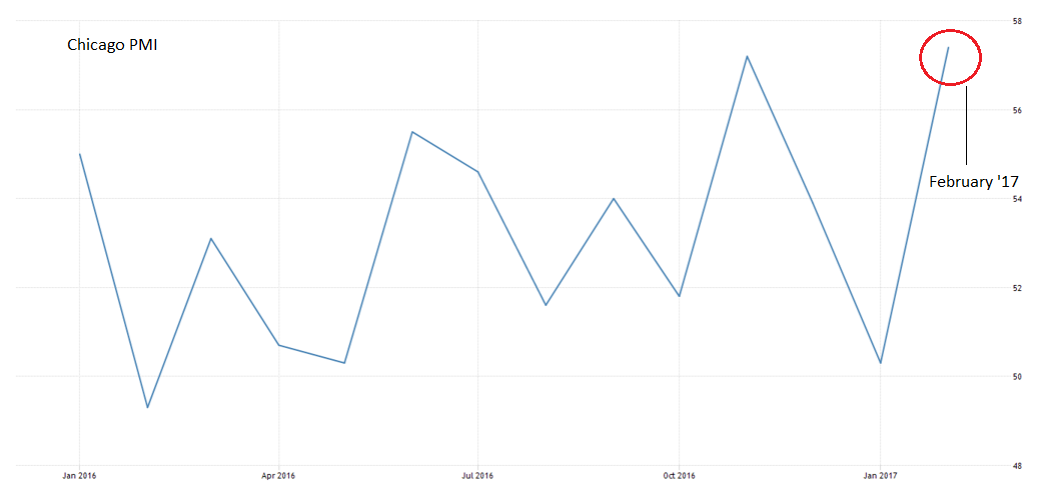

The Chicago area Purchasing Manager Survey (PMI) showed a rise in the index of activity to 57.4 in February from 50.7 in the previous month, as New Orders, in particular, moved into expansion territory.

The Case-Shiller House Price Index for 20 metropolitan areas increased by a higher-than-forecast 5.6% in December, beating expectations of 5.3% and the 5.2% increase in November.

“The US housing market remains in rude health, judging by Tuesday’s data from S&P CoreLogic Case-Shiller. Their index of national home prices rose by 5.6% y/y in Q4 2016 to a level that is now more than one third above its trough in Q1 2012 and similar to its pre-crisis peak in Q1 2007,” said advisory service Capital Economics’ John Higgins.

The data is for December which means it is not the most up-to-date, and more recent Pending Home Sales for January were not as strong, coming out at 555k, which was well below the 570k expected by economists.

The Pending Home Sales data showed the market sank to 535k in December.

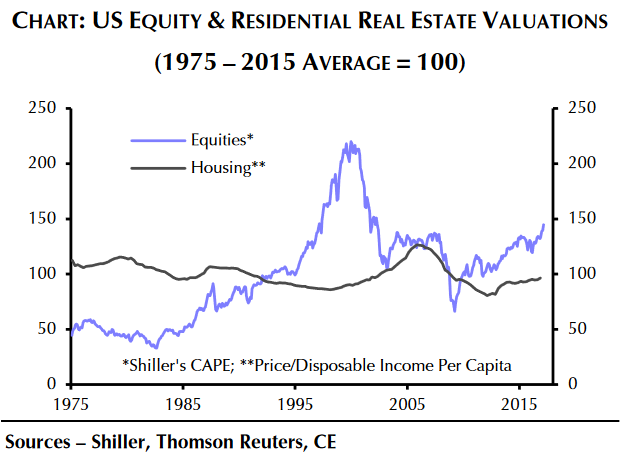

Some analysts like Nordea’s Aurelijia Augulyte have warned of a potential weakening in US Housing in 2017 but according to Capital’s Higgins - despite valuations rising well above their long-term averages, they are still not so high as to warrant concern.

He contrasts this to stocks and shares which have now risen dangerously high above their long-term average, and are vulnerable to a correction.

Wholesale Inventories fell by a lower-than-expected -0.1% in January as demand outstripped supply.

This was below the 0.5% rise forecast and was a positive sign for the economy.