U.S. Dollar: Election Currency Strategy and Forecasts from U.S. Investment Banks

- Written by: Sam Coventry

File image of Kamala Harris. Source: Gage Skidmore.

Leading U.S. investment banks have laid out their strategies and forecasts for Dollar exchange rates as the countdown to the U.S. election approaches.

The consensus of investment bank forecasts shows the Pound-Dollar exchange rate can fall further from current levels, although one prominent U.S. bank thinks the exchange rate can rise above 1.30.

These figures are made available in Horizon Currency's U.S. election special, available as a free download, that details actionable exchange rate targets ahead of the November event risk.

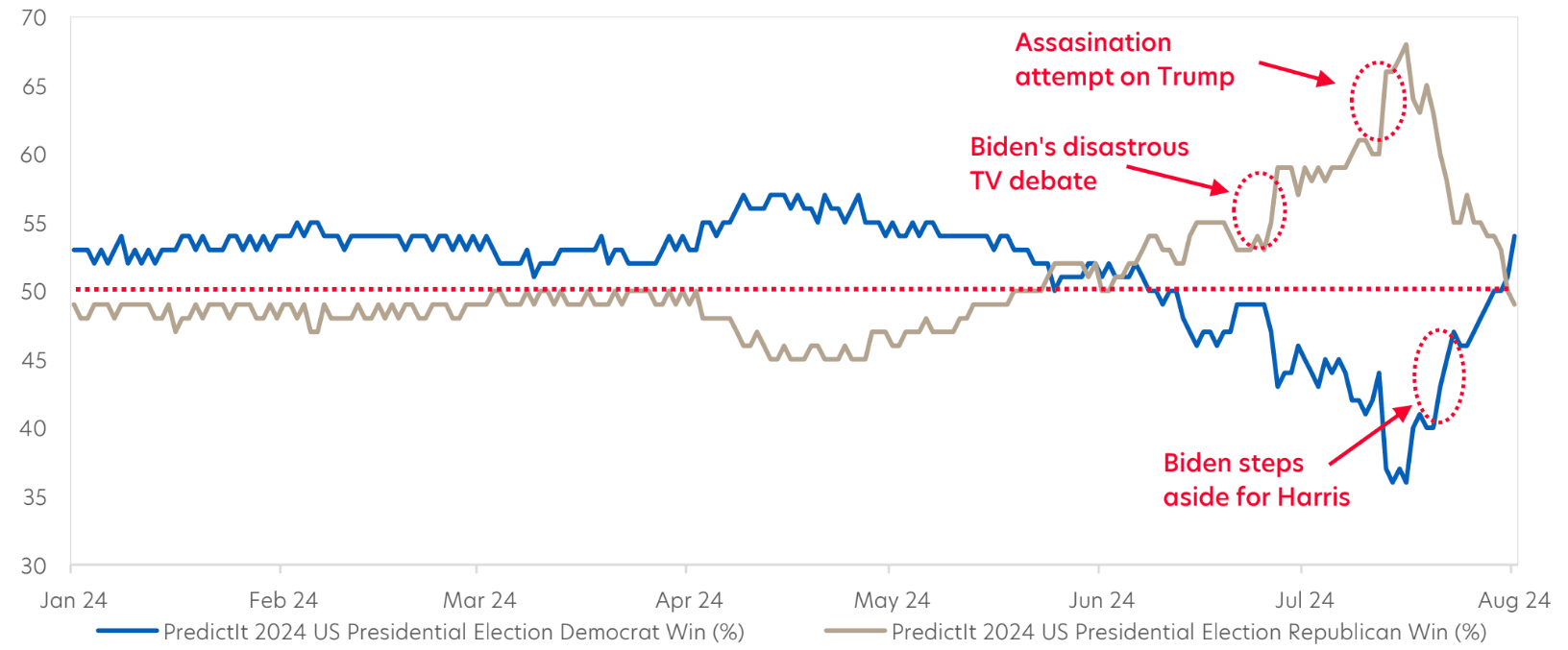

For now, all roads appear to a firmer Dollar, as the classic pro-Dollar 'Trump trade' can reboot if Donald Trump can regain the initiative in the polls.

Peter Chia, Senior FX Strategist at UOB, says there are potential inflationary implications should

Trump carry out his desired policy settings to the fullest across tax, trade and immigration domain.

"Such a scenario of further extension and deepening of tax cuts, increase trade tariffs and tighter immigration measures, pose upside risks to the current US inflation trajectory and risk prolonging the “higher for longer” narrative for rates and consequently offer more support for the USD," says Chia.

However, the exit of Joe Biden from the race has tightened the polls, yet a close-fought battle between Trump and Kamala Harris could provide the layers of uncertainty that tend to favour the USD by default.

"The odds for a Democrat win have improved sharply. Hence, given the uncertainties, it is premature to start to position for possible Trump 2.0 policy disruptions next year," says Chia.

Image courtesy of UOB.

The election is a looming background event, and for now, the Dollar will likely remain more attuned to developments at the U.S. Federal Reserve.

A slowdown in U.S. economic activity and a poor corporate earnings season are warning the economy is finally buckling under the weight of high interest rates.

Money markets reflect rising odds the Fed could deliver an emergency 50 basis point rate cut in September, which could wiegh on the Dollar.

"The focus for now remains on the start of Sep Fed rate cuts in the immediate horizon that is driving the renewed softening of the US Dollar," says Chia.