U.S. Core Inflation is a Worry

- Written by: Gary Howes

Image © Adobe Images

The Dollar firmed in the wake of an above-consensus U.S. inflation report that put the brakes on rising bets that the Federal Reserve could cut interest rates in June.

The Pound to Dollar exchange rate broke below the 1.28 level on the day the U.S. Bureau of Labor Statistics said inflation rose 3.2% year-on-year in February, surpassing expectations for a reading of 3.1% and up on January's print of 3.1%.

Core inflation - which strips out energy and food - remained unchanged at 0.4% month-on-month in February, surpassing expectations for a slide to 0.3%. Core fell to 3.8% y/y from 3.9%, but was above expectations for a softer 3.7%.

Image courtesy of Pantheon Macroeconomics.

"Today's above consensus inflation report is not good news for the Fed," says Ali Jaffery, an economist at CIBC Capital Markets.

Driving the sticky U.S. inflation print was the price of gasoline and shelter (rents) which contributed more than 60% to the increase in last month's inflation increase.

"Shelter continues to be a thorn in the side for central bankers, and it continues to defy expectations that it should decline on the back of higher interest rates. The shelter index rose 0.4% last month. However, even if you strip out the shelter index, then the super core inflation rate is still too high for the Federal Reserve," says analyst Kathleen Brooks at XTB.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Brooks does however caution that historically, inflation tends to rise in the first few months of the year, as this is when businesses and companies can increase their prices.

And, CIBC's Jaffery says there's "no reason to hit the panic button."

"Labor market rebalancing and decelerating wage growth suggest softer service price gains down the road. The Fed will remain highly data-dependent, and we expect they will be more comfortable easing policy in the second half of the year," he explains.

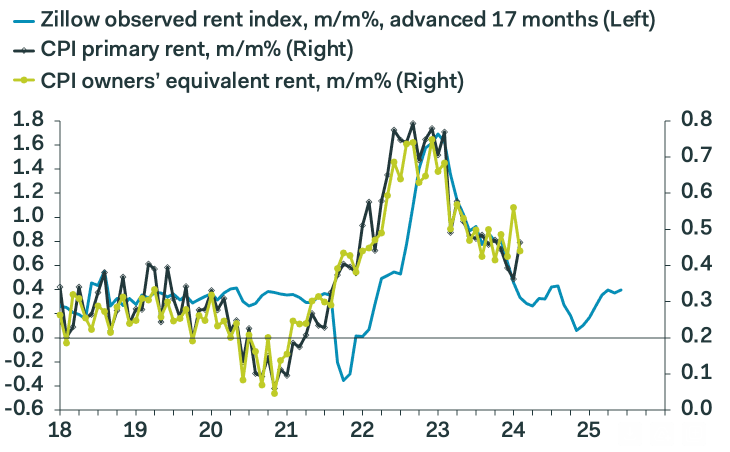

The bigger picture, though, is primary rents have been closely tracking the Zillow numbers with a lag, and the February spike looks like an anomaly. Assuming normal service resumes, then rents will be present no sustained inflation threat until the fall of 2025 at the earliest. In the short term, though, the past two months’ data make it clear that anything can happen.

Image courtesy of Pantheon Macroeconomics.

Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, says survey data from Zillow - the property site - shows the rental component will come down.

"The bigger picture is primary rents have been closely tracking the Zillow numbers with a lag, and the February spike looks like an anomaly," he says. "Assuming normal service resumes, then rents will be present no sustained inflation threat until the fall of 2025 at the earliest."

Shepherson points out that another CPI report will be published before the May FOMC meeting, as well as two full rounds of PPI and PCE data, "so Fed officials don’t need to rush to a snap judgement on the back of these data".

"We remain of the view that the upcoming inflation data, alongside a soft March payroll report and further evidence of slowing wage growth in the Q1 ECI, will give the Fed room to ease in May. But it’s a close call right now, and a delay until June would be no surprise," he says.