GBP/USD Week Ahead Forecast: Cooling Heels Below Resistance on Charts

- Written by: James Skinner, Contributions from Gary Howes

- GBP/USD stalled by resistance near 1.2850 on chart

- Risks corrective losses back toward 1.2621 or below

- BoE, Fed, UK economy, Russia, U.S. PCE CPI eyed

Image © Adobe Images

The Pound to Dollar exchange rate wilted late last week after testing a major technical resistance just above 1.2850 on the charts but further corrective losses could lead it back to or even below 1.26 up ahead if the outlook for the UK economic risks undermines market appetite for Sterling and the Dollar extended a broader rebound.

Pound Sterling remained one of the top-performing major currencies of the month and year on Monday but was almost an underperformer last week after Thursday's larger-than-usual increase in the Bank of England (BoE) Bank Rate was followed by selling near and around its best level against the Dollar since April 2022.

The BoE over-delivered on many economist forecasts when raising Bank Rate from 4.5% to 5% and warning that further increases are possible but Sterling's earlier rally above 1.28 was cut short for it to close near the round number of 1.27 on Friday.

"The Committee hasn’t been clear how much progress it needs to see before it takes a breather, and it is clearly leaning towards doing too much rather than too little," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"As things stand, then, we think the MPC will raise Bank Rate to 5.25% in August and to 5.50% in September," he adds in a Monday research briefing.

Above: GBP/USD shown at 4-hour intervals with EUR/USD.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Sterling also drew little benefit when the Office for National Statistics said Friday that retail sales rose further in May rather than falling in line with the consensus, while the Pound remained suppressed against the Dollar after S&P Global said the manufacturing and services sectors cooled notably in June.

"June PMIs surprised sharply on the downside, especially in the EA but also in the UK. The survey confirms that the softening in May was not a one-off. The deterioration was remarkably broad, and forward-looking indicators worsened too. On the plus side, inflationary pressures are easing," says Abbas Khan, an economist at Barclays.

The BoE decision followed a disastrous set of inflation figures in which the overall inflation rate stalled at 8.7% following a steady decline from 11.1% in September 2022, and the core rate rose again for the second month running in another sign of homegrown inflation becoming more of a problem for policymakers.

"As to how much higher rates will go, the MPC will see only one more labour market and inflation release before its next meeting in August. With these unlikely to be game changers, we expect another 50bps hike at that meeting," says Andrew Goodwin, chief UK economist at Oxford Economics, in a Friday research briefing.

"But by the September meeting, a two further months' worth of data will be available and the impact of the recent tightening of financial conditions should be more apparent. We're pencilling in a final 25bps hike at that meeting. This would mean Bank Rate peaks at 5.75%, around 25bps lower than markets presently anticipate," he adds.

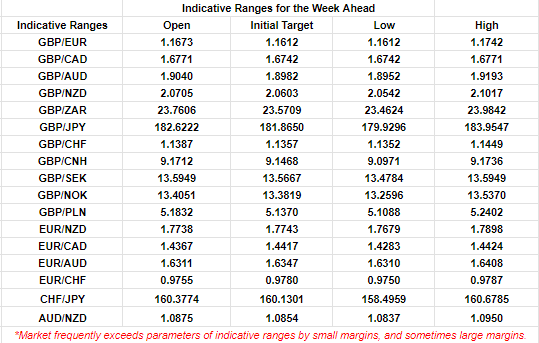

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

It's not clear if the Pound's losses resulted from investor disappointment with the size of the BoE's interest rate step - that's possible - or market concern about the outlook for the UK economy in the face of what is already the third most significant 'tightening' cycle since the establishment of the BoE in 1694.

The potential trouble is that earlier UK inflation declines resulted only from changes in the prices of imported things while market-implied measures now indicate an expectation for Bank Rate to be raised to 6.25% by year-end, which would leave only the 1978-to-1979 tightening cycle to surpass the present one in its size.

This suggests significant risk ahead for the economy and Sterling on the path ahead but with the calendar devoid of major economic data appointments this week, the highlight for GBP/USD is likely to be Wednesday's Policy panel discussion at the European Central Bank Forum on Central Banking featuring BoE Governor Andrew Bailey.

"Bullish territory is, however, distant at this point; a break above 1.2850/55 is needed to reignite near-term bullishness," says Shaun Osborne, chief FX strategist at Scotiabank.

Wednesday's panel is followed on Friday by the latest reading of the Fed's preferred measure of U.S. inflation - the Core PCE Price Index - and any fresh uptick there could have implications for market pricing of the outlook for U.S. interest rates and knock-on effects on the Pound-Dollar rate.

Above: GBP/USD at weekly intervals with Fibonacci retracements of selected downtrends indicating technical resistances for Sterling. Selected moving averages denote possible support and/or resistance.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

But meanwhile, the rupture between Wagner Group founder Yevgeny Prighozin and the Ministry of Defence in Russia might also garner attention after weekend reports suggested the Ukrainian defence may have led Russian mercenaries and armed forces counterparts to question the purpose or merits of the invasion.

"Questions abound," says Benjamin Picton, a macro strategist at Rabobank. "One of the more interesting theories is that the mutiny was an elaborate Maskirovka that gives Vladimir Putin a face-saving opportunity to scale back the war in Ukraine, while providing political cover to move against internal enemies in the Kremlin. The real test of this theory will be what happens to Prigozhin."

It's not clear what, if anything, all of this means for the ongoing attempt to annex further parts of the country but anything that brings the conflict closer to a peaceful resolution would almost certainly be positive for risk appetite in wider financial markets.

The latter would likely be supportive of, or even bullish for the Pound-Dollar rate.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks