GBP/USD Rally Obstructed by Major Technical Resistances On the Charts

- Written by: James Skinner

"Not a lot of damage to the set up on the charts for the GBP/USD as these are just reversals of the weekly trend more than big break outs to the downside. There is moving average support just below in the 1.2148 zone where we find the 50dma" - Jefferies.

Image © Adobe Images

The Pound to Dollar exchange rate ebbed from almost two-month highs ahead of the weekend after being frustrated by a rebounding greenback that has so far precluded a third attempt by Sterling to overcome a major technical resistance level looming overhead on the charts.

Sterling slipped against a broadly stronger U.S. Dollar, Japanese Yen and Swiss Franc on Friday while edging higher against other G10 counterparts as financial markets turned their attention toward a large German investment bank.

This is barely a week after speculation about the future of Credit Suisse led the Swiss government to force a merger with UBS and comes in the early stage of a Federal Reserve (Fed) investigation into the failure of Silicon Valley Bank, which led other firms into failure or otherwise distress.

"Silicon Valley Bank management failed badly. They grew the bank very quickly. They exposed the bank to significant liquidity risk and interest rate risk. Didn't hedge that risk," Fed Chairman Jerome Powell said on Wednesday.

"We know that SVB experienced an unprecedented, rapid and massive bank run. So this is a very large group of connected depositors, a concentrated group of connected depositors in a very, very fast run. Faster than the historical record would suggest," he added in the Fed's monetary policy press conference.

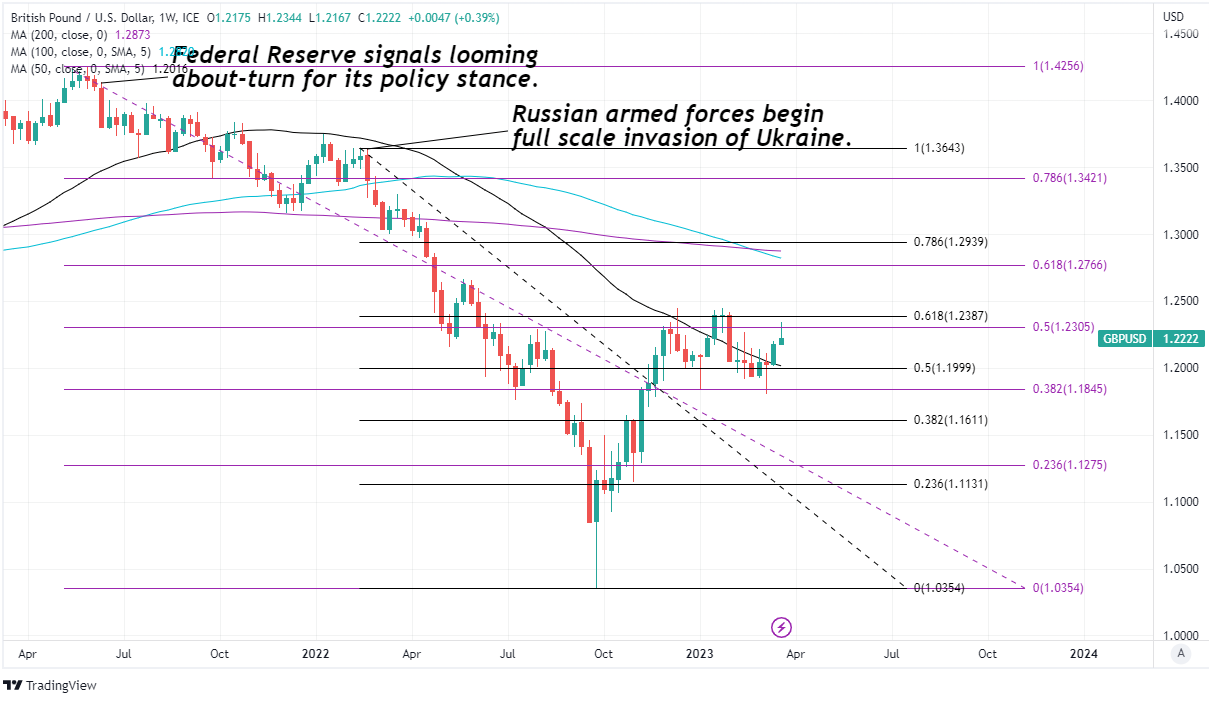

Above: GBP/USD at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling, and including selected moving averages. Click image for closer inspection.

Above: GBP/USD at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling, and including selected moving averages. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Dollars were bought widely through much of Friday including after S&P Global PMI surveys indicated that recessionary conditions in the U.S. manufacturing and services sectors may have given way to a rebound in March.

This was after Census Bureau data indicated earlier that business investment in transportation items like aircraft fell further than was expected in the February and by more than was previously thought in January, while other forms of business investment barely grew at all.

Earlier in the session, S&P Global PMI surveys suggested the UK's February growth rebound lost momentum in March and just hours after the Office for National Statistics said retail sales had built on an upwardly-revised 0.9% January increase with a 1.2% gain in February.

UK retail sales numbers were much stronger than anticipated by the economist consensus but were overlooked in risk-averse global market conditions that saw many analysts fixated on U.S. and European banking sectors to the detriment of risky assets and most currencies other than the Dollar.

"Not a lot of damage to the set up on the charts for the GBP/USD as these are just reversals of the weekly trend more than big break outs to the downside. There is moving average support just below in the 1.2148 zone where we find the 50dma," says Brad Bechtel, global head of FX at Jefferies.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling while daily moving averages denote prospective areas of technical support . Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling while daily moving averages denote prospective areas of technical support . Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"The BoE gave us a hike with 2 dissenters yesterday and they are in a similar position to the Fed on their tightening path, leaving the ECB as the only one really still going for it. One would suspect EUR should outperform in that world as long as spreads hold in there but its hard to position too aggressively when you get these sudden and massive reversals out of nowhere," Bechtel adds.

Friday's price action comes after the Bank of England (BoE) raised Bank Rate from 4% to 4.25% on Thursday and pegged the outlook for it to the outcomes and inflation implications of economic data emerging in the months ahead.

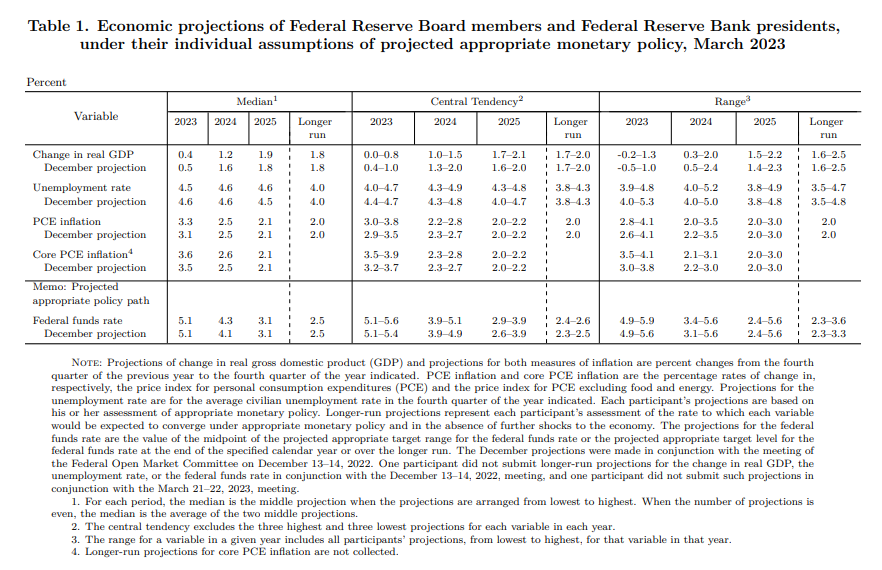

Previously, the Fed raised its Fed Funds rate to between 4.75% and 5% but also released Federal Open Market Committee economic forecasts indicating only one further increase in U.S. borrowing costs is likely before year-end.

"Central banks face a near-term dichotomy between inflation and cracks appearing in the financial sector," writes Freya Beamish, chief economist at TS Lombard, in a Friday research briefing.

"Whether the financial system forces central bankers to abandon their attempt to separate macropru and rates/QT policy or whether the credit crunch pulls the economy into recession, our call for significant cuts to the Fed funds rate this year has been reinforced," she adds.

Above: Summary of FOMC projections released in March. Source: Federal Reserve. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: Summary of FOMC projections released in March. Source: Federal Reserve. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)