British Pound and Bank of England Outlook: Analyst and Economist Views

- Written by: James Skinner

"We believe inflation will begin to fall quite rapidly before the summer but as yesterday's release for February showed, we need to see that actually happen. I can assure you we will go on making the decisions needed to achieve sustained low inflation in this country" - Bank of England Governor Andrew Bailey.

Image © Adobe Stock

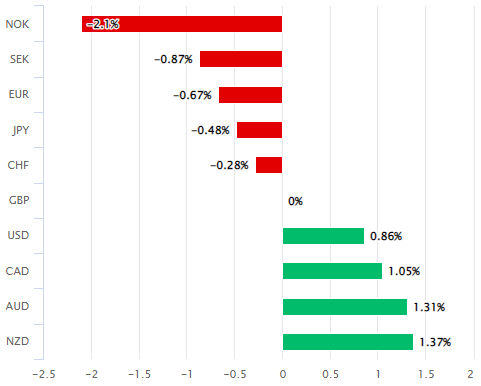

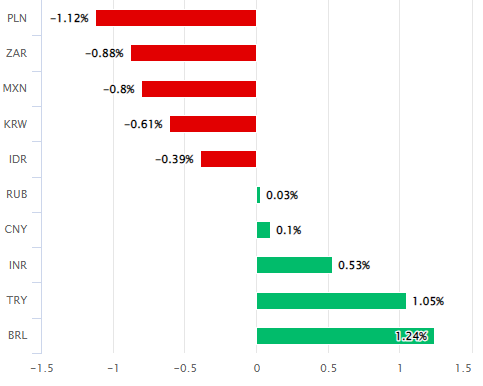

Pound Sterling was trading around the middle of the major currency rankings for the period in the final session of the week but with little help from the Bank of England (BoE), which drew mixed responses from analysts and economists when announcing its latest interest rate decision on Thursday.

Sterling was higher for the week against 'Dollar bloc' currencies of the U.S., Australia, Canada and New Zealand on Friday while carrying modest losses in relation to the Japanese Yen and European counterparts after the BoE raised Bank Rate to 4.25% but gave little explicit guidance about the outlook.

The BoE cited an economic performance that has been less weak than expected, leading to forecast upgrades and greater uncertainty about the timeframe over which inflation could be expected to return to the 2% target.

"We believe inflation will begin to fall quite rapidly before the summer but as yesterday's release for February showed, we need to see that actually happen. I can assure you we will go on making the decisions needed to achieve sustained low inflation in this country," Governor Andrew Bailey said on Thursday.

Above: Pound Sterling performance relative to G10 and G20 counterparts this week. Source: Pound Sterling Live. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"You may also have heard about recent problems at two banks operating in the UK. I can also tell you that we have been able to fix the problems, working with our international partners and the government, and using the tools we brought in after the financial crisis. The UK banking system remains safe and sound," he added in a statement following the decision.

All of this came after Office for National Statistics figures suggested on Wednesday that inflation almost fully reversed its January fall in February and when economists had looked for a continued decline.

The BoE noted on Thursday that often-volatile clothing and footwear prices were a significant driver of the increase as well as a reason for why inflation could still be quick to moderate, and emphasised that the outlook for Bank Rate is hinged entirely upon the economic data emerging in the months ahead.

That has left analysts and economists with mixed views about the outlook for Bank Rate and Sterling, some of which can be found below.

Andrew Goodwin, chief UK economist, Oxford Economics

"Though they may have subtly moved the goalposts in terms of which indicators they are prioritising, today's decision was consistent with the arguments advanced in February. Then the MPC had projected that inflation would undershoot the 2% target over the medium-term, but had argued that the risks were heavily skewed towards inflation remaining higher, and that this justified tightening policy further."

"Inflation is now expected to fall back more quickly in the near-term, partly because of last week's fiscal decisions. But this is also likely to mean that activity is stronger and – in the eyes of the seven hawks – this, alongside continued tightness in the labour market, adds to upside risks to inflation over the medium-term. This leaves the May MPC decision much more finely balanced than it had previously appeared."

"Assuming financial market conditions don't deteriorate, the bar for further rate hikes looks lower than it was before."

Francesco Pesole, FX strategist, ING

"We strongly suspected the BoE would refrain from offering any real bit of guidance to markets and that would have meant that the impact on the pound would have been very short-lived. This indeed appears to be the case."

"Our economics team thinks that a May pause is likely despite the recent rise in inflation: with around 30bp of tightening in the price, there is room for a repricing lower to favour a modestly higher EUR/GBP."

"Looking at Cable, the BoE does not appear to be much of a factor, and our view for dollar downside risks means that the key 1.2420 and 1.2500 levels can be tested quite soon."

"Today, UK PMIs will be watched after significantly stronger-than-expected retail sales this morning. Bank of England policymaker Catherine Mann speaks this afternoon."

To optimise the timing of international payments you could consider setting a free FX rate alert here.

Ibrahim Quadri, economist, Godman Sachs

"Taken together, today’s communication suggests that the MPC no longer has a bias towards tighter policy, and that the May decision will be fully data dependent."

"A number of considerations point to further tightening in May. First, the activity outlook has improved in recent weeks, reflecting better incoming data, lower gas prices, and more fiscal support (Exhibit 1). As a result, we no longer see a technical recession in the UK and our forecasts are above the MPC’s."

"That said, a number of developments point to a pause in May....We therefore maintain our view that the MPC is more likely to hold in May than deliver another hike. But we see a low bar for another 25bp hike if financial sector tensions recede quickly and key indicators of domestic price pressures remain firm."

Sanjay Raja, economist, Deutsche Bank

"With Bank Rate now moving to the lower bound of our long held landing zone (4.25% to 4.75%), and forward guidance unchanged, the bar for another hike is lower than we previously thought. But the case for another hike is still very finely balanced."

"What will determine whether the MPC hikes again or not? Services inflation, average weekly earnings, and credit conditions will all be key (among other peripheral things). While we see some upside to growth and pay, we see some downside to services CPI and credit conditions, leaving the May meeting outcome a difficult decision to call. On balance, we see more downside risks than upside."

"As such, we hold onto our call for Bank Rate staying put at 4.25% with risks tilted to one further hike in May."

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Abbas Khan, economist, Barclays

"There is one more labour market report before the May MPR meeting. As we highlighted in our preview, regular private sector month-on-month wage growth was weak in the latest data for December and January (Figure 2)."

"While two data points do not make a trend, another weak print in February could start to sway some members in favour of putting more weight on these developments rather than on stronger growth. Equally, this would have to be considered against any resilience in upcoming activity data."

Derek Halpenny, head of research EMEA, MUFG

"Declining inflation expectation measures in the UK (BoE/Ipsos quarterly survey & CBI data), signs of easing wage pressures (acknowledged today), the general increased risks of sharply weaker credit growth and the recent signs of greater GBP resilience all support that view of today’s being the final hike."

"Given the broader weakening of the dollar after the FOMC we see scope for further gains in GBP/USD over the short-term. Banking sector concerns in the US are greater than here in Europe based on the relative performance of banking stocks and with those risks set to persist, a move to the 1.2500 level is achievable."

"Normalising volatility in GBP/USD could allow for the recent trend stronger to be sustained going forward. GBP/USD is where there is greater scope to the upside whereas the more compelling prospects of ECB action based on recent rhetoric and based on the ECB being a bit further behind in its cycle points to EUR/USD moving higher in line with GBP/USD implying relative stability at these levels in EUR/GBP."