Pound to Sink against Dollar on a Fed "Super Hike" says Western Union

- Written by: Gary Howes

Image © Adobe Images

The Pound and Dollar could see elevated volatility over the coming 48 hours with the Federal Reserve expected to hike rates again on Wednesday and the release of U.S. GDP data Thursday.

Analyst George Vessey at Western Union Business Solutions says those watching the foreign exchange mark should be wary of a potential "super hike" from the Federal Reserve, where rates are raised by more than the 75 basis points.

"Although unlikely at this stage, the dollar will soar if the Fed surprises with a 100-basis point hike this week," says Vessey.

The Pound to Dollar exchange rate has proven remarkably resilient over the past 24 hours, holding above the 1.20 level despite a sharp decline in the Euro-Dollar exchange rate in response to surging European gas prices.

The resilience would therefore likely continue if the Fed panders to the market and delivers the expected 75bp hike.

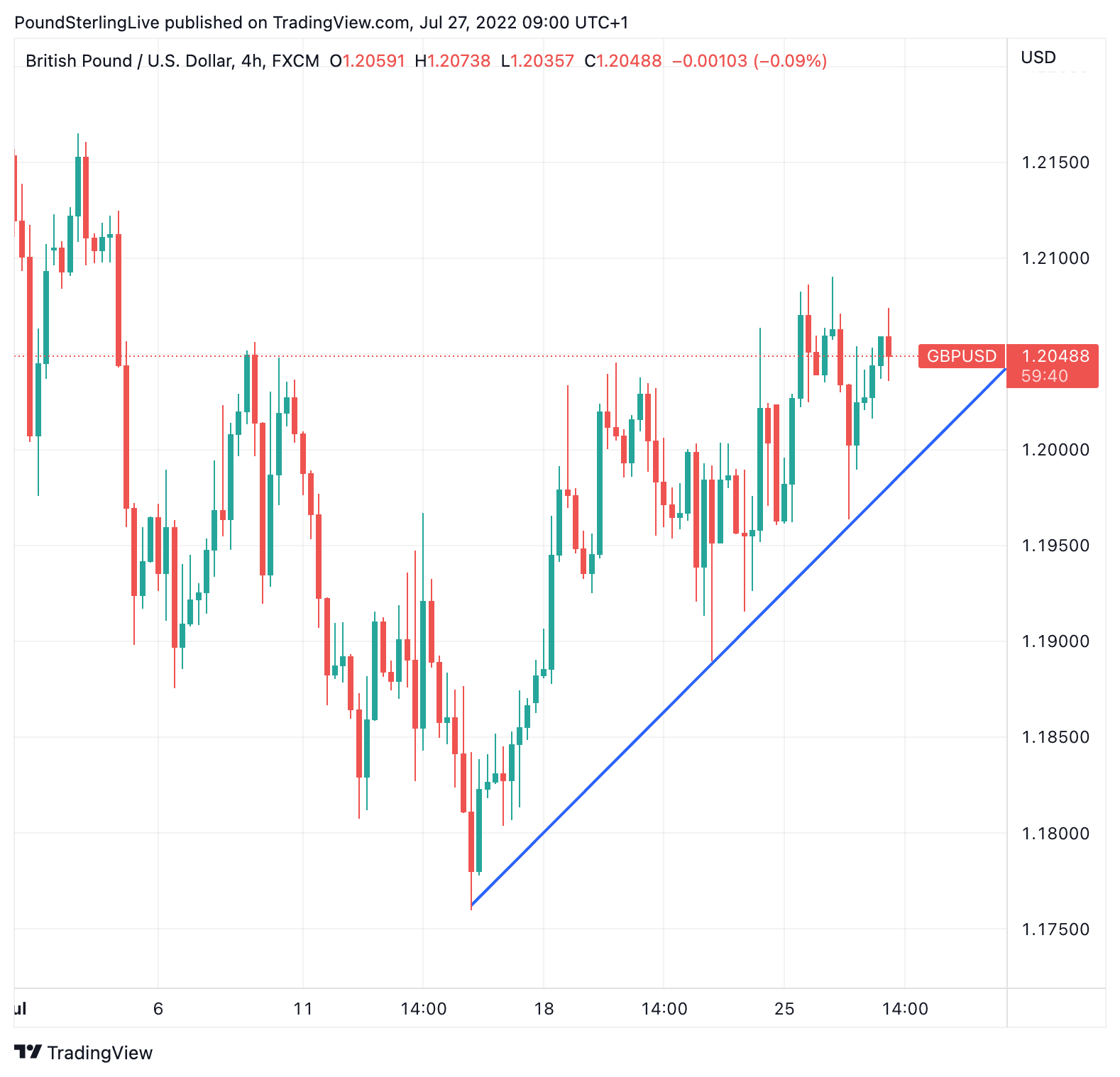

Above: GBP/USD at four-hour intervals showing the nascent recovery, in place since mid-July.

"Markets are expecting a 75-basis point hike by the US Federal Reserve (Fed) with a 90% probability of this occurring. A super hike worth 100 basis point is less likely given the weakening of leading economic indicators and some Fed officials not backing the speculation," says Vessey.

He explains interest rate speculation is a key driver of FX volatility, and a larger 100-basis point hike was shortly entertained by money market managers after inflation rose to a new 40-year high in June and a stronger-than-expected US jobs report this month.

Expectations for a 100bp hike shot up in the wake of this month's inflation data release, that showed U.S. inflation rose 9.1% year-on-year in June.

But a number of Federal Reserve board members promptly pushed back on this shift in market expectations in speeches and media appearances, calming market expectations.

This has since been aided by some softer-than-expected U.S. economic data readings that suggest the economy is to slow sharply over coming months, lessening the need for the Fed to squash activity and cool inflation via interest rate hikes.

"Key economic prints pointed to weakening growth and softer inflation on the horizon, which led to a weaker US dollar last week. EUR/USD climbed over 1.3% and GBP/USD over 1% on the week," says Vessey.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks