Does Peak U.S. Inflation Also Mean Peak Dollar?

- Written by: Gary Howes

- Economists say U.S. inflation has peaked

- Peak for U.S. rate hike expectations could be near

- Could mean USD top looms

- But for now USD remains on the offensive

Image © Adobe Images

Economists say the U.S. economy might be witnessing peak inflation levels: could this also mean the peak in expectations for Federal Reserve interest rate hikes is also near, as is the top in the Dollar?

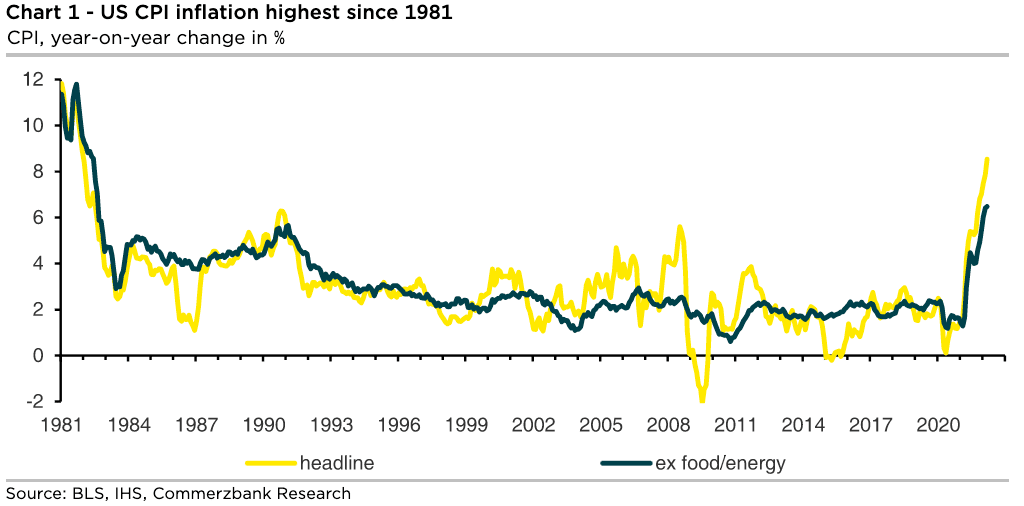

This week's key data release for the USD showed U.S. inflation grew 8.5% in March, but core CPI inflation rose 0.3% month-on-month in March, down on the 0.5% printed in February and underwhelming against the 0.5% the market was looking for.

"Despite wide-ranging price increases again in March, we believe this likely marks the peak in post-COVID inflation," says economist Sarah House at Wells Fargo. "Upcoming monthly gains will be set against the eye-popping inflation of last spring's reopening".

The Dollar fell in the wake of the inflation release in what is a potential sign inflation expectations and expectations for a more aggressive Federal Reserve rate hike path might be near maximum levels.

"The dollar pared gains after fresh U.S. inflation figures offered tentative hope that prices may be at or near a peak," says Joe Manimbo, Senior Currency Analyst at Western Union. "Dollar bulls might be disappointed by cooler than expected core inflation because if it’s sustained it could reduce pressure on the Fed to raise rates aggressively."

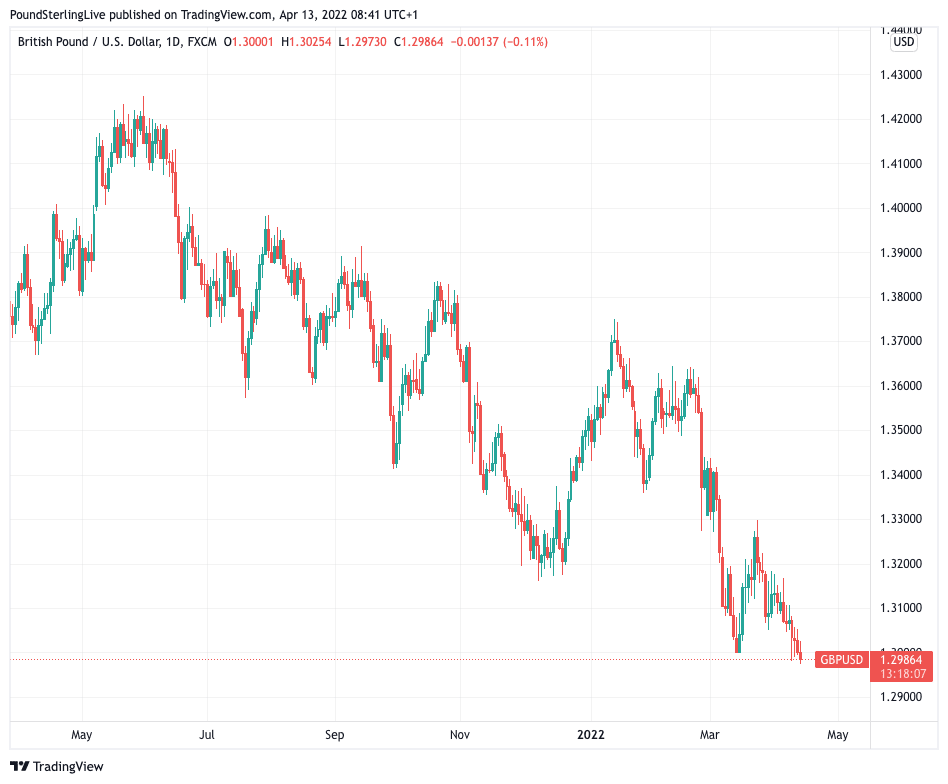

The Pound to Dollar exchange rate rose back above 1.30 in the wake of the data, but UK inflation figures out on Wednesday appear to have undone the gains and the exchange rate has slipped into the apper 1.29's again (Set your rate alert here).

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Economist Katherine Judge at CIBC Capital Markets say March will likely be the peak for inflation as the indices will be lapping some strong year-ago readings starting in April, while gasoline prices have eased off lately.

"Still, in order to achieve on-target inflation in 2023 in the face of a tightening labor market, the Fed will be inclined to raise rates by 50bps at the next FOMC, followed by a string of 25bps hikes at subsequent meetings, before pausing temporarily in Q4," she says.

Indeed, expectations for Federal Reserve rate hikes remain elevated with 200 basis points of hikes still expected for 2022.

However as of April 12 these expectations had fallen back somewhat, a potential confirmation that the peak in rate hike expectations could be near.

For the Dollar this matters as the currency's strong rally since early 2021 rests heavily on the expectation the Fed would be amongst the leaders in raising interest rates, thereby offering U.S. yields support.

Higher bond yields relative to elsewhere tends to support the U.S. currency, but were these yields to begin to see their advantage slip the Dollar's rally could be questioned.

"We think that the recent USD rally is less robust than it looks, as a large part is attributable to idiosyncratic moves in EUR and JPY," says a weekly currency briefing from Barclays.

"A large chunk of the Fed adjustment is now in the rear view mirror. As such, a key driver of dollar strength over the past year or so is increasingly fading in significance, currently and on a forward basis," adds the research note.

CitiFX’s head of FX analysis Ebrahim Rahbari expects U.S. interest rates to continue to rise, but he doesn’t think this necessarily translates into durable Dollar strength.

His analysis uses 1994 as a relevant reference point.

He suspects we may see some short-term upside in the Dollar, which continues to play out, but remains positive on "commodity carry" medium-term.

Above: GBP/USD daily chart shows ongoing weakness and little sign that the USD's trend of appreciation is at an end.

"Whether the inflation rate peaked in March depends above all on the further development of oil and gasoline prices. If the oil price remains at the current level of around $100 per barrel of Brent and does not rise again, March probably was the high in the inflation rate," says Christoph Balz, an economist at Commerzbank.

Commerzbank's foreign exchange strategists say two 50bp rate hikes are almost completely priced in for the coming two meetings by the market and for the rest of the year rate hikes of at least 25bp are expected per meeting.

"It is getting increasingly difficult to imagine that rate expectations could increase further," says You-Na Park-Heger, FX and EM Analyst at Commerzbank.

"If they really were to rise it would be questionable anyway whether this would provide further support for USD. Concerns are already emerging as to whether the Fed might react too aggressively and might cause a recession. For that reason, it might well be possible that even more aggressive rate expectations would not support USD but might even be detrimental to USD due to the risk of a recession," says Park-Heger.

Although inflation is high economists expect it won't come down fast and therefore rate hike expectations - a key prop to the Dollar's strength - could yet remain elevated.

"While the directional improvement will be welcomed, inflation remains a long way off from returning to the Fed's target. With inflation so far above target, we expect the Fed to expedite tightening and hike the fed funds rate by 50 bps at both the May and June FOMC meetings, in addition to beginning to wind-down the balance sheet in May," says House.

"Expect limited downside for the dollar from the data as inflation is not expected to fall towards the Fed’s 2% bullseye for a long time yet," says Western Union's Manimbo.