Surging Inflation Could Spell Trouble for the British Pound say Analysts

- Written by: Gary Howes

- UK inflation surges again

- GBP trades higher, initially

- But surging inflation to hit economic growth

- And could ultimately undermine GBP

- But inflation to fall sharply in 2023

Image © Adobe Images

Pound Sterling was supported following the release of excruciatingly hot inflation readings for the UK, but some currency analysts warn the economic hit posed by surging prices could weigh on the currency going forward.

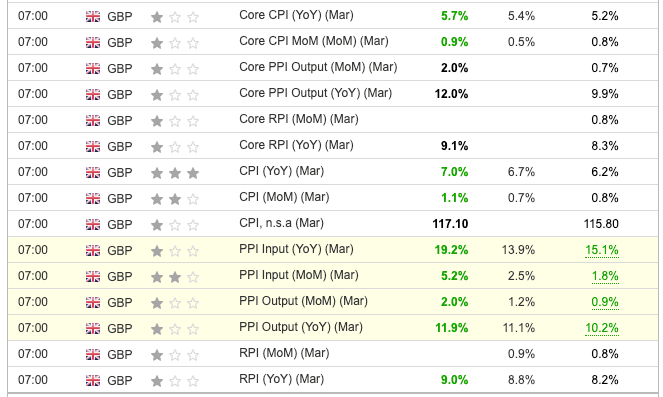

A series of inflation data released by the ONS on April 13 all beat expectations, offering a reflexive boost to Pound exchange rates on the age-old narrative that higher inflation is supportive of a G10 currency.

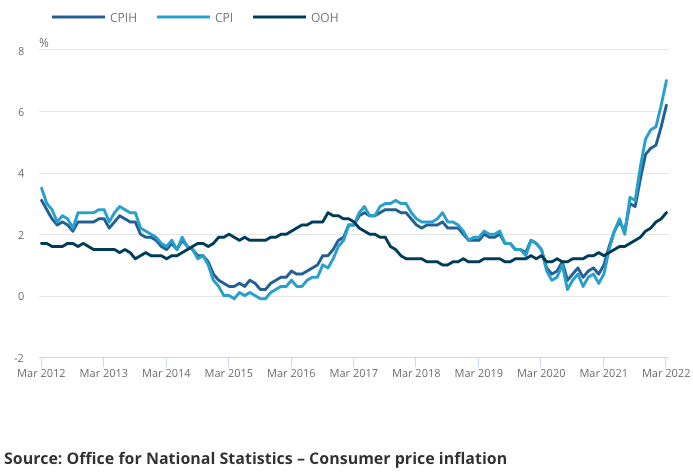

The headline CPI inflation figure rose a whopping 1.1% month-on-month in March, well ahead of the 0.7% expected by markets and beating an upwardly revised 10.2% print recorded in February.

"Today's broad-based upside surprise in March UK CPI looks set to keep aggressive Bank of England tightening expectations in place for a little longer and keep GBP supported," says Francesco Pesole, a foreign exchange strategist at ING.

The annual rate of increase came in at a 30-year high at 7.0%, exceeding the 6.7% expected by the consensus and the 6.2% figure from February.

Core inflation also beat expectations by growing 0.9% in March, suggesting domestic price pressures were intensifying, potentially denying the Bank of England the chance to dismiss the inflation problem as almost exclusively externally driven.

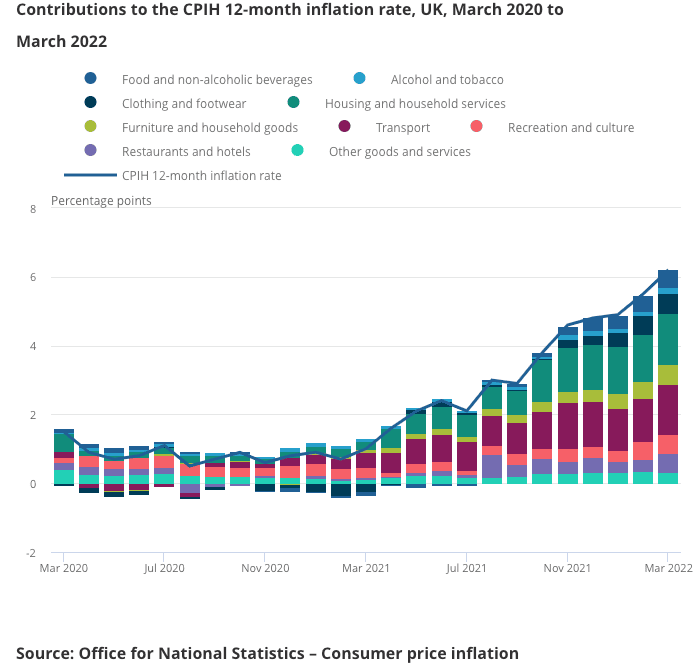

As can be seen in the below, inflation is widespread and accelerating at alarming levels:

Image courtesy of investing.com

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The initial currency market reaction has been to buy the Pound, as the data will boost expectations for further interest rate rises at the Bank of England.

There are 140 basis points of hikes now expected by the market in 2022.

However, we caution that gains in Sterling might not last as it is clear the UK economy could come under intense pressure as inflation batters living standards and ultimately hits confidence and economic activity.

In fact, inflation could turn out to be an outright negative for the Pound according to one major investment bank.

"Upside inflation surprises are now inversely correlated with FX performance," says Paul Meggyesi, a FX strategist with JP Morgan. "Stagflationary tightening cycles are not straightforwardly currency-positive while growth downside continues to linger."

The Pound to Euro exchange rate is quoted at 1.2010 at the time of writing, the Pound to Dollar exchange rate is meanwhile at 1.3000. (Set your FX rate alert here).

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The problem for households is that inflation is likely to move above 8% YoY in April and stay there for several months. Our economists expect it to decelerate only modestly to 7.7% by year end. While wages growth has been healthy, it cannot completely offset price rises ahead," says Daragh Maher, Head of FX Strategy, U.S., at HSBC.

"Accumulated savings may help cushion the blow, but the economy is vulnerable, and GBP too," adds Maher.

Nevertheless, at the time of writing the Pound is up against all its major rivals, although gains are not entirely convincing.

"We expect data this week to show resilient growth, a tight labour market and rising inflation," says Eimar Daly, an analyst with Barclays. "Strong data that indicate a continued BoE hiking cycle is unavoidable will provide rate support to GBP.

Almost inevitably, the ONS reports the largest upside pressures to UK inflation came from electricity, gas and other fuels, a recognition of the acute pressures driving up global commodity prices.

But price rises are broad, with the ONS recognising no single sector offered any downside pull on inflationary pressures.

The ONS says contributions from 6 of the 12 divisions were the largest observed for over 10 years. Of these, 4 were the highest in the National Statistics series, which began in 2006.

The Bank of England will raise rates again in May, but economists are uncertain as to whether further rate hikes will be forthcoming.

A wideheld argument for a pause in raising interest rates is that inflation is being driven by an external energy shock and that there is very little that can be achieved by hiking interest rates.

An argument against this would be the widespread nature of inflation which suggests the Bank can indeed move the dial on prices by impacting domestic price dynamics.

"With high inflation feeding into price/wage decisions, we think the Bank of England will have to raise rates further than it expects, perhaps to at least 2.00% next year," says Ruth Gregory, Senior UK Economist at Capital Economics.

An argument for halting rate hikes would be that inflation will inevitably kill off the economic recovery by destroying demand, thereby doing the Bank of England's job for it.

"With inflation at 7%, households, families and small high street businesses are being hit for six. This obscene level of inflation is a double whammy for the family businesses that line the UK's high streets," says Dr Jackie Mulligan, a member of the Government’s High Streets Task Force and founder of the local shopping platform, Shopappy

The Bank would potentially not want to make an already difficult business outlook even worse by raising the cost of borrowing further.

"Inflation hitting 7% is catastrophic but we are determined to stay positive," says Natalie Lobel, founder at Manchester-based Grounded MCR, a small businesses selling coffee, tea and iced drinks from a trike. "Personally, we will cut back on everything to ensure a simple life and professionally we hope our regulars will still find money for an affordable luxury, namely a good brew. We will do everything we can not to put our prices up, however if we do, we will lower them again as soon as humanly possible."

The outlook for interest rates is therefore quite difficult to divine, and this could complicate the picture for the Pound.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Paul Craig, portfolio manager at Quilter Investors says with wages failing to keep up and pensions not rising by a similar amount, things are going to get tough for a lot of consumers.

The ONS said Tuesday that in real terms growth in total pay was 0.4% in February (this includes bonuses), but regular pay fell on the year at negative 1.0%.

"Alongside the Bank of England’s most recent interest rate hike came the prediction that inflation would hit 8% later this spring. The Bank has underestimated the extent of inflation in previous forecasts and given this month’s increase, there could be even worse to come than previously feared," says Craig.

Looking ahead, economist at Pantheon Macroeconomics now expect the headline rate of CPI inflation to leap to about 8.8% in April.

The 54% rise in Ofgem’s default tariff cap means that the contribution to the headline rate from electricity and natural gas prices will increase by 1.5pp, says Pantheon, while food and core goods CPI inflation will rise further over the coming months.

"We expect the headline rate to ease only to about 7.8% by the end of this year," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

But looking further ahead into 2023, there are signs inflation will come down sharply.

Pantheon Macroeconomics forecast inflation to fall below 2.0% "in the second half of next year, given that wages are showing little sign of responding to the current high inflation rate, and the downward-sloping futures curves for electricity and natural gas suggest that Ofgem will be able to reduce its price cap in April and October 2023".

Tombs notes global shipping costs have started to fall with the price of shipping a 40ft container from Shanghai to Northern Europe dropping 12% over the last month and now is 27% below its peak in September, according to Drewry Supply Chain Advisors.

"As a result, core goods inflation looks set to drop to a very low rate next year," says Tombs.

"The MPC, therefore, still has good grounds for arguing that a further substantial tightening of monetary policy would do little to restrain inflation in the near term but would run the necessary risk of pushing it substantially below the 2% target next year," he adds.