Pound / Dollar Steadies Above Recent Floors, Powell and Risk Improvement Cited

- Written by: Gary Howes

- Powell testimony hints at steady path for U.S. rate hikes

- 50 bp rate hike unlikely this month

- Investor sentiment improves

- Aiding GBP

File image of Chair Jerome Powell, image supplied by the Federal Reserve.

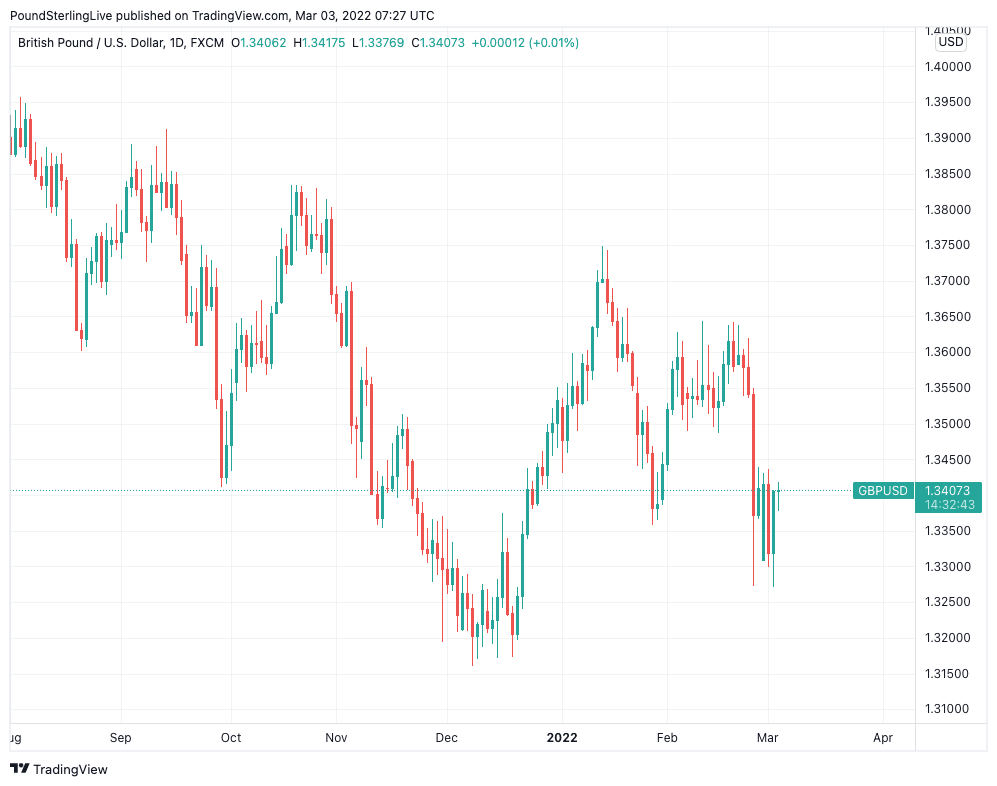

The Pound to Dollar exchange rate has recovered from 2022 lows amidst improved investor sentiment concerning the Russia-Ukraine war and signs the Federal Reserve will adopt a 'moderate' stance to raising interest rates.

In a scheduled testimony before U.S. lawmakers Federal Reserve Chairman Jerome Powell said interest rates would rise in March but he insisted there remained two-way risks to the outlook and the Fed must adopt a nimble approach to rate hikes.

"With inflation well above 2 percent and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month," said Powell in a prepared statement.

The Pound to Dollar exchange rate had been as low as 1.3272 ahead of the Powell testimony but has since recovered back to 1.3406.

"The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain. Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook," added Powell.

This was by no means a resolutely hawkish statement that would have nudged the market into pricing in further interest rate hikes for 2022 and 2023 and was therefore unable to offer the Dollar bulls much sustenance.

Above: GBP/USD at daily intervals.

- GBP/USD reference rates at publication:

Spot: 1.3404 - High street bank rates (indicative band): 1.3035-1.3129

- Payment specialist rates (indicative band): 1.3283-1.3337

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

For sure, the prospect of a bold 50 basis point hike - another potential trigger to Dollar upside - now looks even more remote.

"With the possibility of a 50bp hike in March largely priced out, we continue to assume a ‘moderate’ hiking path," says Marko Kolanovic, an economist with JP Morgan.

While the Dollar is by no means a laggard in the current environment - owing to market anxiety related to the Ukraine-Russia war - Powell's commentary coincided with an improvement in risk and a broader pullback by the Dollar from recent highs against the likes of the Pound and Euro.

"We have changed our call from a 50bp hike to a 25bp hike," says strategist Kim Mundy at CBA.

"We had acknowledged a number of times that our conviction on our call was fading in the aftermath of the Ukraine war. Indeed, Powell said that there was heightened uncertainty because of the war and that as a result, the FOMC needed to be nimble," she adds.

Peter Chatwell, Head of Multi-Asset Strategy at Mizuho, says the global economic outlook is likely one of rising inflation and slowing growth, i.e. stagflation.

"Regarding monetary policy, stagflation will likely mean a more gradual tightening. Powell’s support towards a 25bp hike in March aligns well with this more prudent monetary path outlook," says Chatwell.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

While rate hike expectations remain an important driver of the Dollar, soo too does broader investor sentiment.

The significant hit to sentiment from Russia's invasion of Ukraine and the subsequent sanctions placed on Russia by the international community triggered a significant liquidation in investor holdings of stocks, boosting demand for the Dollar.

"The war in Ukraine is a global challenge. It is more severe for European countries, including the UK, than it is for the US. The USD acts as a safe haven in such agitated times, and it is no surprise that GBP has given up some of the gains it achieved in January and February," says Thomas Flury, Strategist, at UBS.

The U.S. currency will therefore be exposed to weakness during episodes of improved sentiment.

Newswires reported over recent hours that Russian negotiators had said a ceasefire was indeed on the agenda at talks with Ukraine.

The Russian delegation on Wednesday made itself available for a second round of Russian-Ukrainian talks, the Belarusian state-run news agency BelTA said on Wednesday.

Ukraine confirmed a second round of talks were indeed happening, but the venue was not yet decided.

Should sentiment improve then the Dollar might find itself giving back some recent gains.

The war in Ukraine does however remain a key risk and will keep a lid on any relief rallies and ensure Dollar downside is limited.

Mizuho's Chatwell says even if Ukraine were to fade as a risk concern for global markets, the high inflation low growth outlook might in itself deliver volatility.

"The backdrop continues to look grim for risk assets. Stagflation makes a safe haven extremely hard to find, applies pressure on corporates to deleverage, and generally pushes all financial risk premia higher. This is something that market participants with most experience in the post-GFC regime may have difficulty navigating, hence the likely continued rise in volatility across asset classes," says Chatwell.