GBP/USD Rate Hits New 2022 Low Below 1.33

- Written by: Gary Howes

- BoE rate hike expectations drop

- Weighing on GBP

- As safe haven demand for USD surges

- But temporary moments of relief can help GBP/USD

Image © Adobe Images

The Pound to Dollar exchange rate has registered a new 2022 low as the Russian invasion of Ukraine pummels expectations for the number of Bank of England interest rate hikes that can be delivered in 2022.

The British Pound has been a laggard amongst its G10 peers as investors lower their expectations for hikes amidst a deterioration in the global economic growth outlook owing to Russia's invasion of Ukraine and associated repercussions.

Because expectations for Bank of England rate hikes were particularly elevated ahead of the invasion there is a greater scope for disappointment.

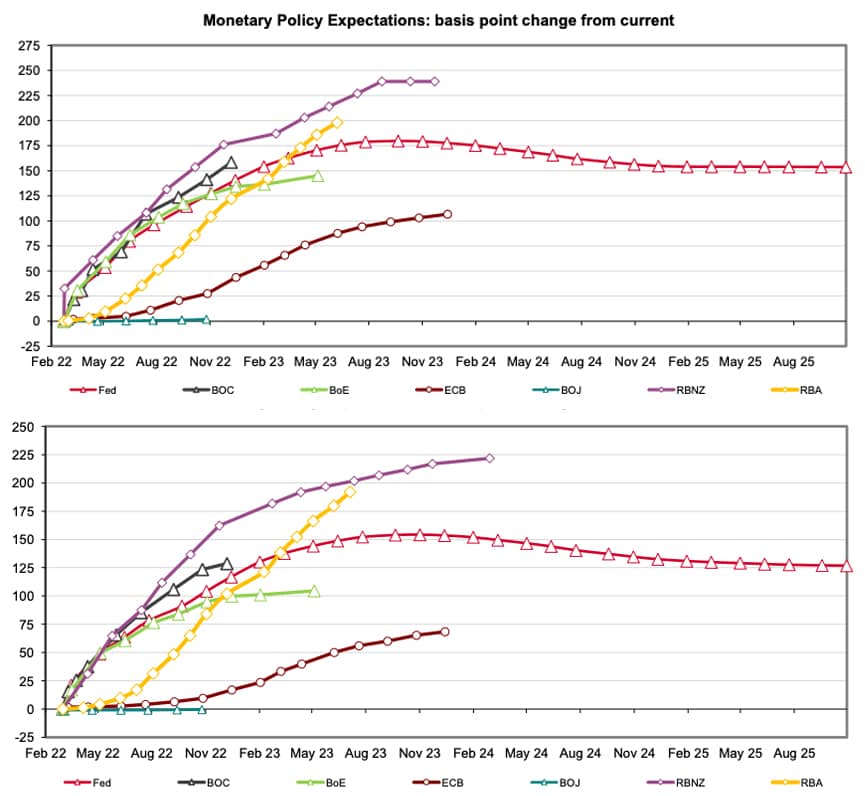

As of February 22 there were 134 basis points of Bank of England hikes priced for 2022 in OIS markets, a money market that serves as a gauge of investor expectations for future rate hikes.

But by the end of February those expectations had fallen to 126 basis points and as of March 02 there are just 100 basis points of hikes now expected for this year.

This represents a significant reappraisal of what is to come out of the Bank of England, depriving Sterling of what had been a substantive source of support until geopolitics gripped markets.

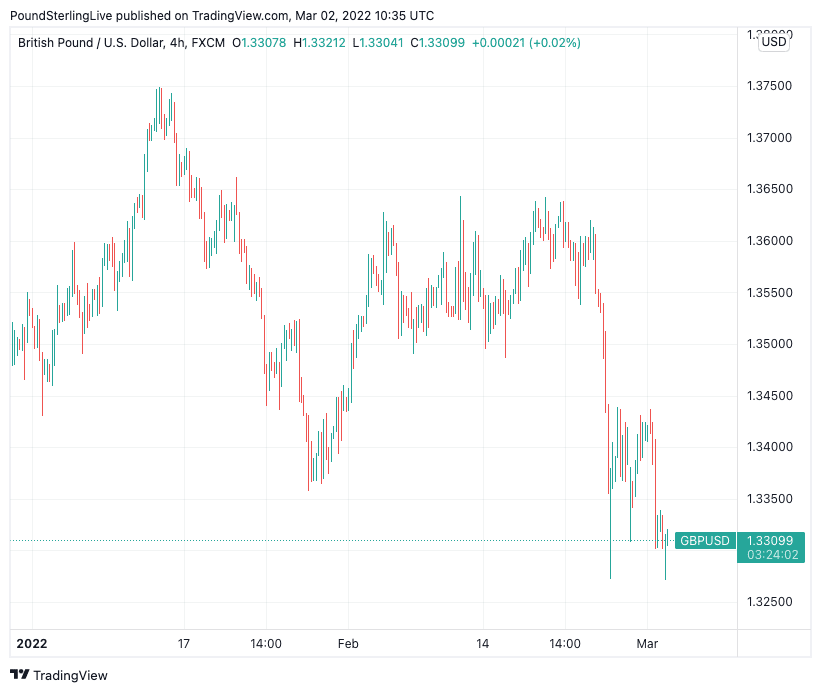

Above: GBP/USD at four hour intervals showing 2022 trade.

- GBP/USD reference rates at publication:

Spot: 1.3311 - High street bank rates (indicative band): 1.2945-1.3038

- Payment specialist rates (indicative band): 1.3192-1.3244

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The Pound to Dollar exchange rate peaked at 1.3749 on January 13 and has since fallen back to 1.3305 at the time of writing, the day's low is at 1.3272.

"Another ramification of the ongoing conflict was that investors continued to price out the more aggressive reaction functions from central banks they’d been expecting before the invasion," says Jim Reid, an analyst with Deutsche Bank.

The amount of Federal Reserve hikes priced for 2022 has also fallen substantially: as of February 22 there were 140 hikes priced, but as of March 02 this had fallen right down to 117.

But despite the rapid reappraisal of Fed hikes the Dollar tends to benefit during times of heightened geopolitical fear as the currency's significant liquidity makes acts as a safe haven asset.

Falling global stock markets and a resultant demand for cash inevitably tends to benefit the highly liquid Dollar.

Above: The shift lower in global central bank rate hike expectations: top = as of June 22, bottom = March 02. Source: Westpac.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

For those watching foreign currency markets in the near-term the question remains how far this broader rate expectation adjustment continues, which is invariably linked to news out of Ukraine.

Any easing of tensions would potentially deny the Dollar its safe haven status while also exposing the rapid decline in rate hike expectations at the Fed.

The Pound-Dollar exchange rate would be an obvious candidate for a rebound under any easing of tensions.

"Just as sterling has depreciated significantly from the Russia-Ukraine situation, it has significant room to appreciate as markets increasingly see this conflict as localised and global risk has begun to rebound," says Marek Raczko, a currency analyst at Barclays.

"A calmer global risk backdrop and a central bank that has clarified its reaction function to the Ukraine could lead the GBP to outperform other G10 FX in the coming week," he adds.

One potential source of near-term relief could be a second round of talks between Russia and Ukraine, aimed at ending the conflict.

Belarus said on Wednesday authorities are ready "to do everything they can" to ensure further Russia-Ukraine negotiations on a settlement of the Ukrainian crisis, according to Interfax, quoting Belarusian Foreign Ministry press secretary Anatoly Glaz.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"We have said repeatedly we are ready to do everything we can and organize a meeting any time," Glaz is quoted as saying.

"The final preparations are being made. Belarus is ready for any turn of events. Most importantly, the delegations should come to terms," he added.

However the starting positions of the two sides suggests any resolution in the near-term is highly unlikely.

The first round of talks saw Ukraine demand the complete withdrawal of Russia from Ukraine, Crimea and other contested Ukrainian territories.

Russia meanwhile demanded regime change in Kyiv and the control required to ensure Ukraine can never join NATO.

Intense fighting continues at the time of writing.