Pound-Dollar Today: U.S. CPI Inflation Print Looms

- Written by: Gary Howes

U.S. inflation marks the main calendar focus for foreign exchange markets on Wednesday, with the 13:30 BST release likely to offer up some volatility.

A stronger-than-expected set of inflation data will confirm growing expectations amongst investors that the U.S. Federal Reserve will begin reducing its asset purchase programme in coming weeks, a process referred to as tapering.

Expectations for a 2021 taper and a series of interest rate rises in 2023 have fuelled demand for the Dollar over recent months, therefore a strong inflation beat on Wednesday would likely prove supportive of the currency.

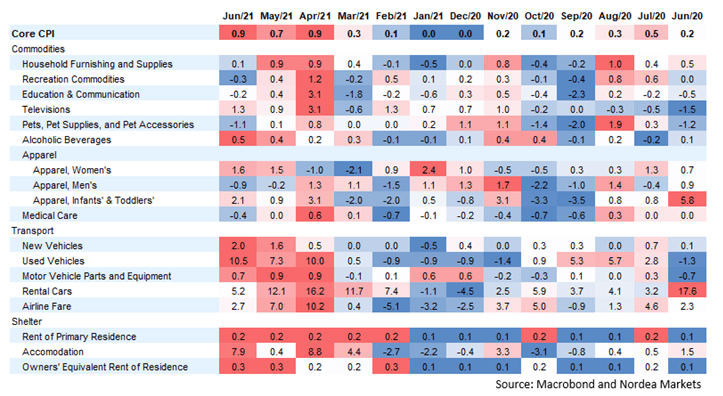

"The peak is yet to come" says Helene Østergaard, Analyst at Nordea Markets. "We expect core inflation around 4.8%, likely unhinging Powell and expediting the talk about talking about tapering as early as in September."

Above: MoM growth rates heat the core index says Nordea Markets.

"US inflation data will be the highlight for today’s currency traders. Speculation is that a stronger than forecasted number will boost the US dollar further despite its impressive run so far with the US dollar index rallying to 5-month highs," says Adam Ma, an analyst with Western Union.

"Today’s inflation data could help determine the recent trend or put a halt to bullish dollar traders,"he adds.

The market is looking for Core CPI to come in at 0.4% Month-on-Month in July, down on June's 0.9%. CPI is expected to come in at 0.5% Month-on-Month, down on the previous month's 0.9%.

The Year-on-Year reading is expected at 5.3%, putting it well ahead of the Fed's 2.0% target.

“Risks remain. While inflation data has so far not been a major market mover, Wednesday’s July consumer price index release has the potential to cause volatility, especially given expectations that inflation has passed the peak. Meanwhile, the reflation trade could still be challenged by setbacks in combating the COVID-19 pandemic," says Mark Haefele, Chief Investment Officer, UBS Global Wealth Management.

The Fed has said it views the current round of hot inflation readings to be transitory and therefore expect it to fade over coming months, therefore it is too soon to rush into a taper and interest rate rises.

Instead, the Fed wants to maintain loose monetary policy conditions in order to support economic growth and boost employment levels.

But with the economy adding jobs at a clip (+900K in July alone) and inflation running hot, some Fed members are now advocating for tapering to begin as soon as possible.

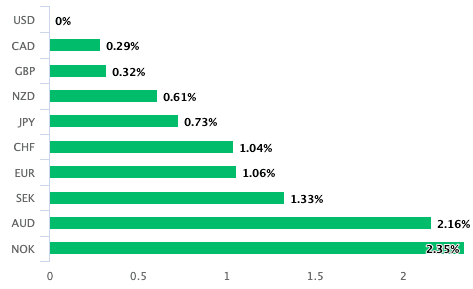

The dynamic has contributed to Dollar demand and now leaves the U.S. currency as the top performer of the past month amongst the world's largest currencies:

Above: USD performance over the past month.

"Any hint that inflation has not dropped back a little following reopening will be seen as a strong sign for both US yields and the US dollar. It may not look like it in developed markets – against the GBP, EUR, JPY for example – but the dollar is less than a per cent from its highest level of the year. A strong inflation number will be enough to see it break to those highs in the coming days," says Jeremy Thomson-Cook, Chief Economist at Equals Money.

The Pound-to-Dollar exchange rate is seen trading at 1.3823 at the time of writing, the Euro-to-Dollar at 1.1717.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}