Pound-to-Dollar Rate Forecast Back Below 1.30 by Year-end at Scotiabank

Image © Adobe Images

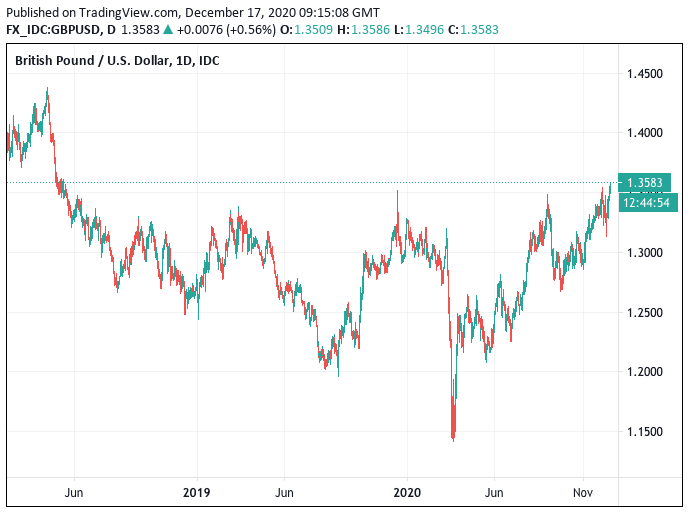

- GBP/USD spot rate at publication: 1.3580

- Bank transfer rate (indicative guide): 1.3205-1.3300

- FX specialist providers (indicative guide): 1.402-1.3485

- More information on FX specialist rates here

Foreign exchange analysts at Scotiabank are warning Pound Sterling risks a decline back below 1.30 as the EU and UK will ultimately fail to reach agreement.

New research into the foreign exchange markets conducted by the Canada based global financial services provider warns that even were a deal to be struck, upside would be limited.

The findings are the latest in a body of research that suggests the Pound could see a limited rally in the event of a deal, with Pound Sterling Live reporting today on research conducted by Capital Economics that suggests the upside limit for GBP/USD is at 1.35 in the event of a deal.

The Pound-to-Dollar exchange rate (GBP/USD) scaled fresh two-year highs on Thursday Dec. 17 amidst ongoing expectations for EU and UK negotiators to reach a post-Brexit trade agreement and an environment of broad-based Dollar weakness.

Rising stock and commodity markets betray an environment of investor confidence, which tends to correlate with a weaker Dollar owing to the currency's status as a 'safe haven'.

But broader Dollar weakness won't protect the GBP/USD rate from a sharp decline in the event of a 'no deal' says Scotiabank, in a monthly foreign exchange forecast report.

"We believe the GBP is gearing up for a sharp decline toward or below the 1.30 mark upon a final announcement that trade discussions have concluded without a deal; upside remains limited (1.36) given the still-low odds of a deal," says Juan Manuel Herrera, a foreign exchange strategist with Scotibank.

A GBP/USD decline to just below 1.30 nevertheless marks a notable departure from the worst-case scenarios that were being predicted by many analysts earlier this year, with some saying declines to below 1.20 would be assured.

Scotiabank maintain a view that trade talks will not result in a deal being reached,

"A fully-fledged trade compact with Europe and a settlement on the status of Northern Ireland are likely to remain pending agenda items into 2021 even if initial deals are concluded before the holidays. With trade, the devil is always in the details," says Herrera.

Beyond Brexit, the UK Government's response to the covid-19 pandemic is another red mark on Sterling's prospects.

"This dim view of the UK’s prospects is compounded by Westminster’s uneven response to the COVID-19 pandemic," says Herrera.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Scotiabank forecast the UK economy will suffered a severe 11.1% year on year decline in economic output during 2020, deeper than that of the U.S., Eurozone and the majority of major economies.

While some economists say the sharp decline in 2021 will result in a sharper recovery than that of most peers in 2021, Scotiabank see further underperformance.

The UK is leading the world with a covid-19 vaccine rollout - having reached over 130 000 people in just a week - but this won't be of consequence to the UK economy says Scotiabank who have this month downgraded 2021 forecasts from 5.9% year-on-year to 5.2% year-on-year.

This is a reflection of Scotiabank's view that that underlying potential of the economy has taken a deeper hit than they previously expected from the Brexit saga and the pandemic.

Looking at the bank's GBP/USD forecasts, 1.29 is pencilled in for year-end, 1.30 for the end of March 2021, 1.31 for the end of June 2021, 1.32 for the end of September and 1.33 for the end of 2021.