Pound-to-Dollar 5-Day Forecast: Break Above 200-day MA Seals Deal for Sterling Bulls

Image © Nomad Soul, Adobe Stock

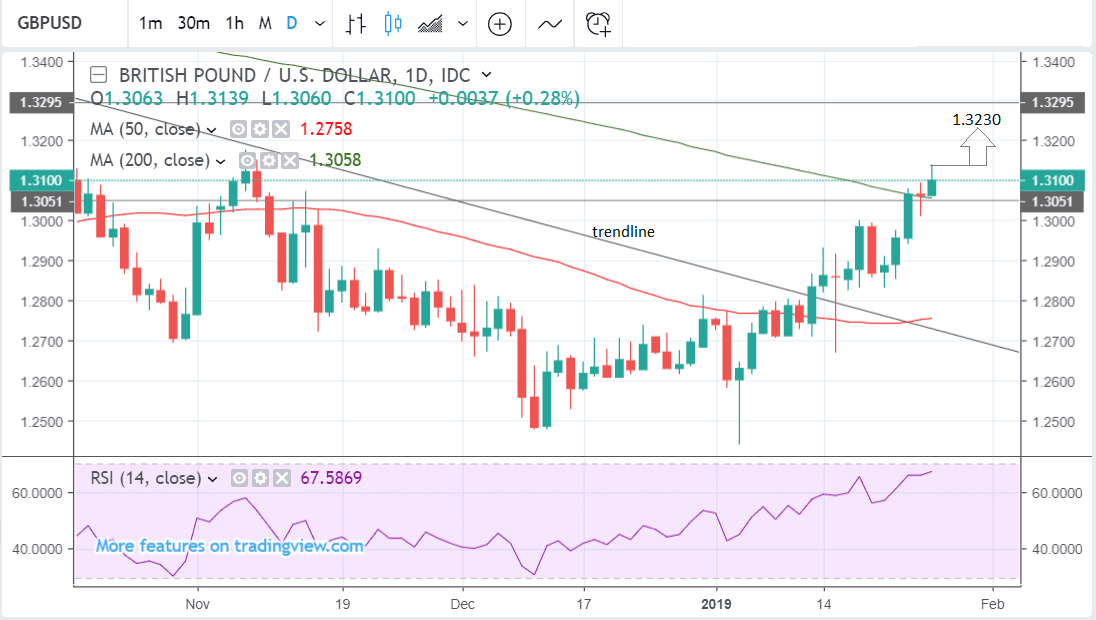

- Pair extends uptrend and breaches 200-day MA

- A close above would strongly bias more upside

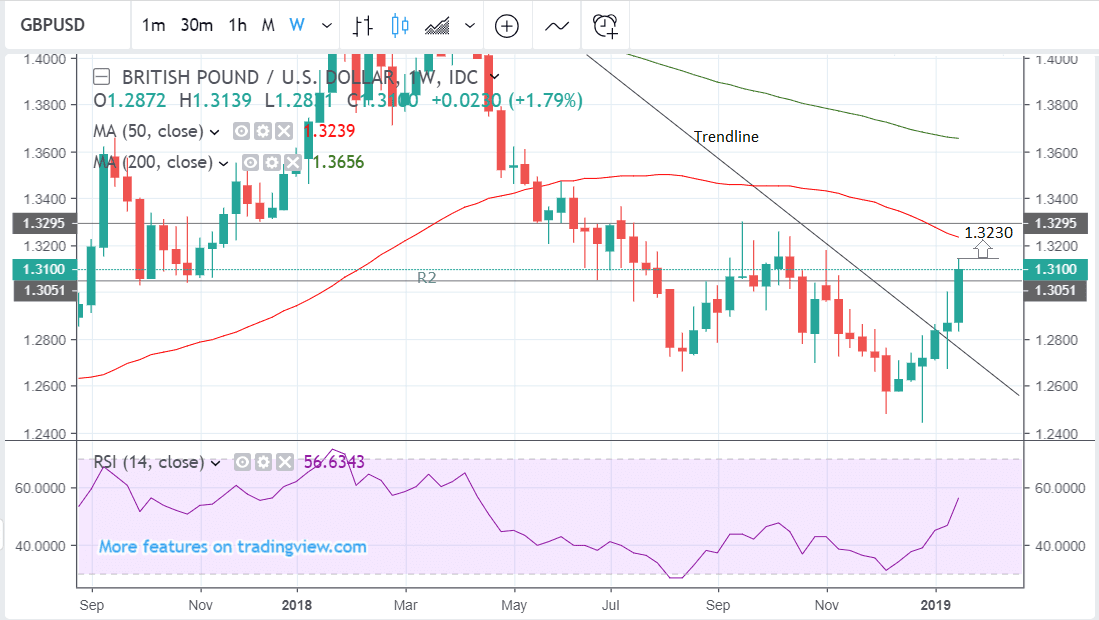

- Next target at the 50-week MA at 1.3230

The GBP/USD exchange rate is forecast to enjoy further upside momentum in the short-term suggest our technical studies while the highlight in the coming week for Sterling will be the outcome of a series of votes in the UK parliament on Tuesday which should dertermine the path forward on Brexit. In the U.S. the Federal Reserve policy meeting mid-week and employment data at the week's end should command attention.

The Pound-to-U.S. Dollar exchange rate rose an impressive 2.5% last week ensuring it will start the new week from 1.3199.

The pair has risen due to the Pound strengthening on diminishing ‘no-deal’ fears, whilst the Dollar has softened as global investor sentiment improves, thereby leading to diminished demand for the 'safety' of the Dollar. Additionally, markets are becoming increasingly convinced the U.S. Federal Reserve is becoming more cautious on further interest rate rises, a stance which tends to play Dollar-negative.

From a technical perspective the GBP/USD exchange rate is in an established short-term uptrend which is likely to continue as trends are said to have a greater tendency to extend rather than reverse.

The pair has broken above the 200-day moving average (MA) and if it can hold above it on a a daily closing basis it will be a strong continuation sign.

A break above the 1.3140 highs would provide additional confirmation for more upside, with the next target at 1.3230 where the 50-week moving average (MA) is located and widely considered an obstruction to further gains.

The RSI momentum indicator in the lower pane on both the daily and weekly charts, has risen in parallel with the exchange rate, furthering supporting the uptrend.

On the weekly chart, the RSI is actually at the same level it was at in April 2018 when the exchange rate was in the mid-1.30s, which is a sign bullish confidence is high and the pair is biased to continue rising.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The U.S. Dollar this Week

The US Dollar index - a measure of broader Dollar performance - closed down 0.8% last week as demand for the safety of the Dollar declined as investor sentiment improved.

The S&P500 closed the week up 0.9%, the U.S. Dollar fell, and U.S. bond yields rose.

We expect overall sentiment to remain a driver of Dollar performance over coming days; and it appears that the good mood might extend.

Sentiment has improved on news that the U.S. government shutdown would temporarily end.

U.S. President Trump and Congress leaders reached an agreement to reopen the government for three weeks, until 15 February, following a 35-day shutdown – the longest in U.S. history. Further talks would be held over Trump’s demands for financing to build a wall on the U.S.-Mexico border

Also weighing on the Dollar was a report the Federal Reserve was considering whether to slow down the reduction of its treasury bond holdings in line with a more cautious approach towards tightening monetary policy.

The highlight for the week ahead will be the Fed's policy decision, due on January 30 where it is all but certain to leave U.S. interest rates unchanged at a range of 2.25% to 2.50% after it increased them four times last year.

"The Fed has signalled patience and flexibility with policy as it takes stock of its series of rate increases over recent years and a weakening global backdrop that’s expected to put a headwind on the world’s biggest economy," says Joe Manimbo, a foreign exchange analyst with Western Union.

While the Fed next week may not sound overtly dovish, Manimbo expects a tone that might emphasise caution and thus do little to alter very low expectations for policymakers to raise rates this year.

The main data event to watch in the coming week will be the release of U.S. non-farm payroll numbers, due out on Friday, February 01.

Markets are looking for a reading of 165K for January, down on the previous month's 312K. Average hourly earnings could be important, markets are forecasting a reading of 3.2 year-on-year and 0.3% month-on-month.

Also out on Friday will be survey data in the form of the ISM Manufacturing PMI for January. This will give the most up-to-date indicator of how the U.S. economy is faring at the beginning of the year, and should also shed some light on what impact the recent government shutdown has had on activity.

A reading fo 54.1 is forecast.

The British Pound this Week

On Tuesday parliament votes on the government's 'plan B' on Brexit, which could give us a better steer on where the UK is headed and further cement expectations that a 'no deal' Brexit is becoming increasingly unlikely.

It is the growing expectation for this worst-case scenario to be avoided that has provided the fundamental fuel to the Pound's impressive start to 2019.

Prime Minister Theresa May is widely expected to say she will go back to Brussels to ask for further concessions required to make the Brexit deal more palatable to those in her party that voted against it earlier this month.

However, focus is likely to be on the amendments that will be tabled alongside the 'plan B' on Tuesday. The Cooper-Boles amendment is perhaps the

most significant as it gives Parliament the opportunity to force the government into requesting an extension to Brexit if parliament fails to approved a deal by February 26.

We believe the EU would consider such a request with Austrian Chancellor Sebastian Kurz saying last week any extension would likely only last three months.

While any delay only serves to extend the Brexit-induced uncertainty hanging over the UK economy, it does signal to the market that a worst-case scenario for Sterling - a 'no deal' Brexit - becomes increasingly unlikely.

On the data front, Friday February 01 sees the release of manufacturing PMI data, with markets expecting a reading of 53.5, down on the previous month's 54.2.

"While we expect only a moderate fall in January’s manufacturing PMI, recent weakness in the eurozone PMI means a larger drop cannot be ruled out," says Ruth Gregory, Senior UK Economist with Capital Economics.

We expect any impact on the Pound from data to be relatively short-lived owing to the all-encompassing importance of Brexit politics.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement