Dollar Back in Demand as "Ultimate Safe Haven" Asset Amidst Global Stock Market Rout

Image © Rawpixel.com, Adobe Images

- GBP/USD pressured by broad-based demand for dollars

- Technology stock rout compounded by rout of oil stocks

- But markets looking oversold, could recover into year-end

Stock markets have all but erased their 2018 gains as the sell-off in equities deepens which is in turn seen bidding up the value of the U.S. Dollar.

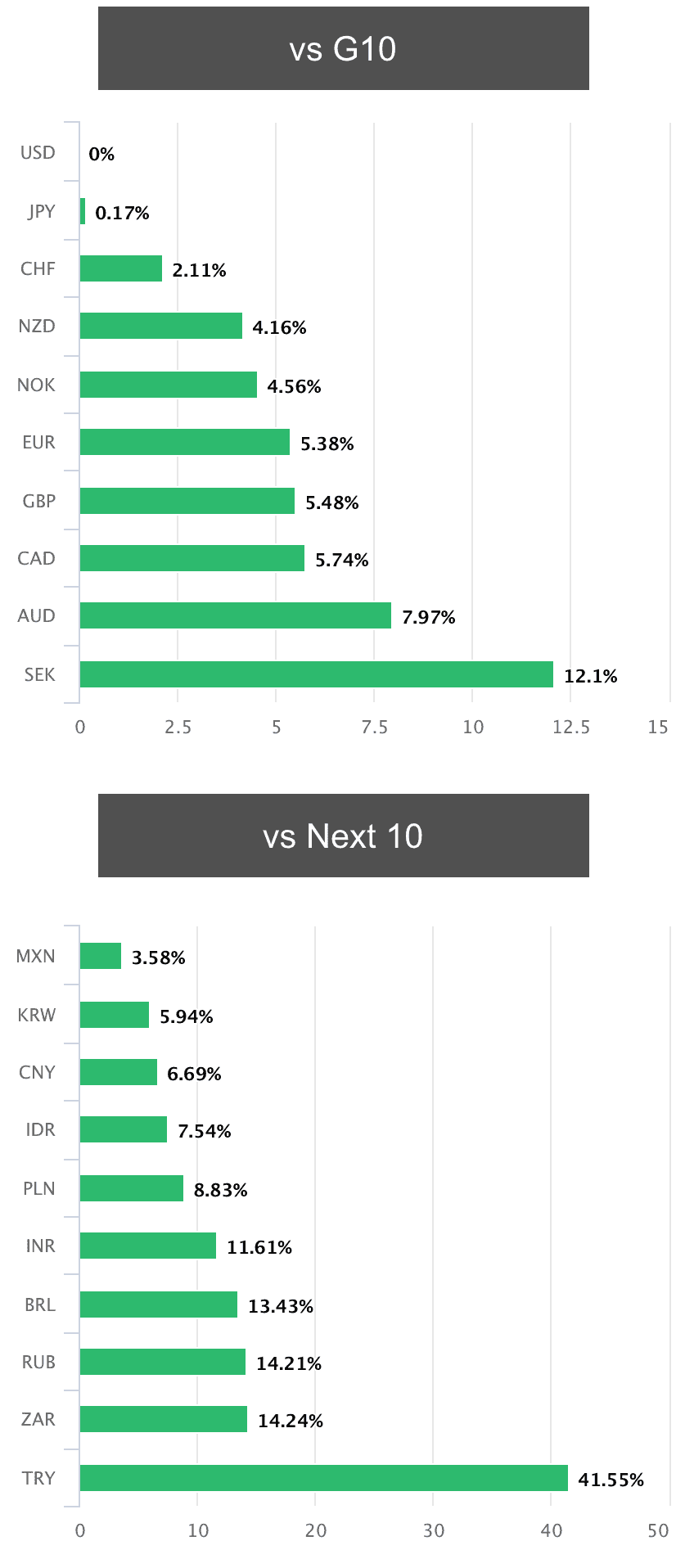

The U.S. Dollar is again cementing its position as top performer of 2018 having gaining 0.7% against major currencies over the past 24 hours on the back of safe-haven demand stemming from heightened risk aversion.

The Nasdaq remains in correction territory, down more than 14% from August peak, while the S&P closed just 4 points shy of a correction, defined as a 10% decline from an index’s most recent highs.

The recent declines erase the year-to-date gains for both the Dow and S&P 500, while the Nasdaq now clings to a 0.1% gain on the year.

Month-to-date, the Nasdaq has fallen 5.4%, the S&P and Dow have retreated 2.6% in November.

"Tech shares again sold off yesterday in the U.S., leading to big declines for the major indices. Not quite carnage just yet, but with the markets giving up their 2018 gains we are seeing clear signs that this selloff is building some momentum of its own," says Neil Wilson, Chief Market Analyst with Markets.com.

Markets.com say we might see more downward pressure than upwards for a little while yet. The negative market conditions are ripe for a stronger Dollar.

"The Dollar proved its status as the ultimate “safe haven” currency, outdoing even CHF and JPY, the usual refuges for nervous investors. People buy CHF and JPY when they’re nervous, USD when they’re scared," says Marshall Gittler, a foreign exchange strategist with ACLS Global.

Above: The Dollar in 2018. Image (C) Pound Sterling Live.

The Pound-to-Dollar exchange rate trades at 1.2818 at the time of writing, having been as high as 1.2829 and as low as 1.2777 already this week. Brexit remains a key consideration for Sterling; however we believe the Pound is likely to consolidate near-term as the Brexit process progresses leaving the GBP/USD at the whims of the broader Dollar story.

Technology stocks are one particular area of weakness for the markets, with the likes of Apple rolling back production in the face of a slowing global demand.

But, developments in oil markets are also having an impact on energy listings.

A plunge in oil prices is hurting oil stocks with prices reversing nearly 30% from four-year highs reached a mere seven weeks ago.

"The oil sector led the US stock market lower, while inflation breakevens fell as a result too. Expectations of lower inflation should in theory be bad for the the Dollar, since it also implies less need for the Fed to tighten, so the dollar’s rise was all the more remarkable in that context," says Gittler.

The safe-have bid for the Dollar does however work against a negative narrative that comes in the form of a potential slowdown in the pace of interest rate hikes at the U.S. Federal Reserve.

The Dollar struggled in the week prior as a number of Fed speakers hinted that the end of the current rate hike cycle is appearing on the horizon; keep in mind that the Dollar's current long-term rally is largely built on the Federal Reserve's policy of raising interest rates while the rest of the world sit on unchanged rates.

"The Fed may have to moderate its position, particularly if equity market weakness does start to impact the real economy as it will," says Wilson.

So while the Fed could soon work against the Dollar, for now the safe-haven bid looks to be supportive.

And, broader global sentiment has been hurt overnight by the latest developments in the U.S.-China trade dispute.

U.S. Trade Representative Robert Lighthizer presented a 53-page document accusing China

of having continued its intellectual property rights theft, only 10 days prior to the Xi Jinping-Trump G20 meeting

"Contributing to the risk-aversion environment was perhaps the US Trade Representative report that showed that China has not sufficiently addressed concerns about the theft of US intellectual property. The report comes as the two largest economies prepare for discussions scheduled later this month to try to resolve the ongoing trade dispute. Strained relations are likely to delay a speedy resolution on the matter; this would fuel global-growth concerns," says Mpho Tsebe, an analyst with RMB in Johannesburg.

White House Economic Advisor Larry Kudlow has meanwhile said that Trump "believes that China would like to have a deal".

If correct and the U.S.-China trade headache dissipates, markets could be in for a strong end to the year and we would expect those currencies that thrive in a positive investor environment to do well; notably the Australian and New Zealand Dollars.

Markets.com's Wilson adds that the market sell-off is now looking overdone.

"There are signs that the market is looking oversold, although dip buyers have been burnt a couple of times already this year and may not want to get hit a third time just yet," says Wilson

The U.S. Dollar could see its safe-haven bid dissipate, and if this coincides with further expectations for a moderation in U.S. Fed interest rate hikes, the Greenback could end the year on a softer footing.

Strategists at Morgan Stanley are meanwhile saying we are already close to peak Dollar, and they are looking for the currency to weaken into 2019.

"Instead of strong inward foreign direct investment or other long-term flows, we see evidence that flows to the U.S. have been into money market funds and are carry trade motivated. We expect these carry trade flows to reverse and flow out of the U.S. as U.S. growth slows," says Hans Redeker, head of currency strategy at Morgan Stanley, in a recent note to clients.

Advertisement

Bank-beating GBP/USD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here