The Pound-to-New Zealand Dollar Outlook for the Week Ahead: Triangle Continues Unfolding

- GBP/NZD is consolidating between to major levels and is likely to continue sideways

- The pair may be forming a triangle pattern which could lead to a breakout higher

- Sterling is expected to be dominated by Brexit news whilst CPI data is expected to be the main release for NZD.

The Pound-to-New Zealand Dollar continues trading in a long-term sideways range between 1.98 and 1.87 as it has done since the beginning of the year.

The sideways move cannot last forever and the exchange rate may have formed the outline of a triangle pattern which suggests a break, probably higher, may be on the horizon.

Triangles are usually composed of a minimum of five waves, labeled a-e, so this triangle is only partially formed; the next move now will probably be a wave-e lower.

The trend prior to the formation of the triangle was bullish so this marginally increases the probability the pair will break up rather down.

A move above the b-wave highs at 1.9760 could confirm a breakout with a target at 2.0430, calculated from the height of the triangle at its widest point multiplied by the golden ratio of 0.618, the usual method used by technicians to establish minimum targets from pattern breakouts.

It is unfortunate that momentum is not stronger as that would indicate underlying strength within the set-up and increase the probabilities of a bullish break.

Another note of caution comes from the monthly chart which is showing the 50-month Moving Average (MA) capping price action at 1.9822 (see below).

The 50-month is likely to present a tough obstacle for bulls.

When prices touch large MAs they are usually rebutted; the effect is often magnified by short-term traders shorting the pair in anticipation of the decline.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

What to watch in the week ahead for the New Zealand Dollar

The main release in the week ahead for the New Zealand Dollar is inflation data for the second quarter, which is forecast to show a rise to 1.6% versus the 1.1% of the previous year, and a 0.5% rise quarter-on-quarter, the same as last quarter.

Inflation remains subdued, reflecting slower growth. if it data shows a higher-than-expected rise in Q2 it could lift the Kiwi. Higher interest rates tend to strengthen a currency, especially when they go hand in hand with stronger growth, because they attract more inflows of foreign capital.

"Our Q2 headline CPI tracking (incorporating June food prices of +0.5%/m) is +0.3%/q and 1.4%/y (RBNZ May estimate 1.5%/y)," says investment bank TD securities, who are less hawkish than the consensus.

"Larger contributions from House and utilities and Private transport (fuel jumped +5%/q) are expected to be offset a little by declines in House contents, Public Transport and Recreation (all seasonal declines)," says TD.

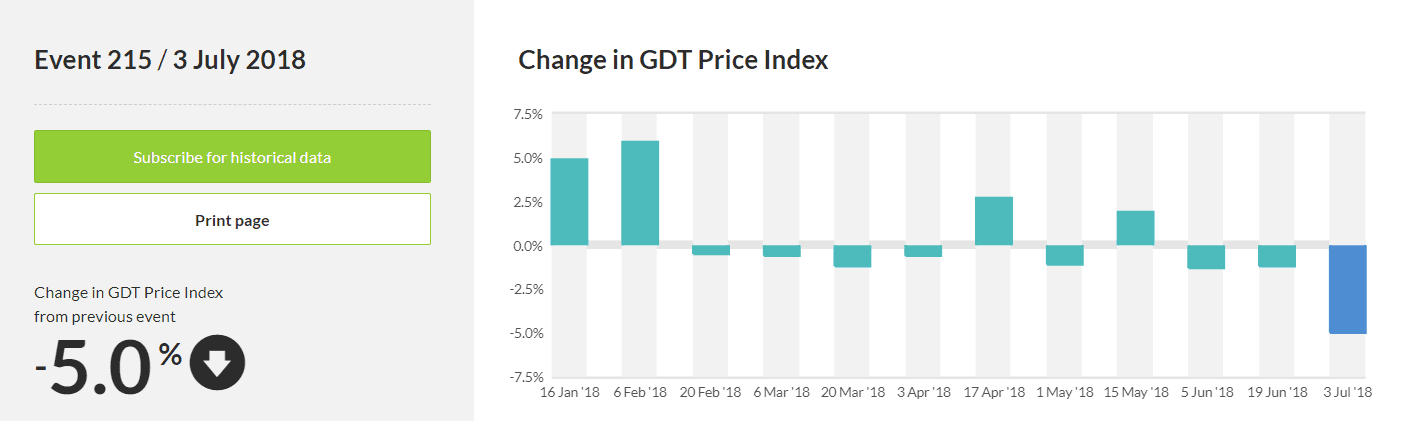

The other major release for the Kiwi is the Global Dairy Trade Price Index, which measures the average price of a basket of dairy goods sold at international, bi-weekly, auctions.

The index showed a relatively large -5.0% drop in prices at the previous event on the 3rd of July and unless the index can recover at the next auction on Tuesday, the Kiwi could weaken.

Dairy products are New Zealand's largest export sector and the higher the price of these goods the more NZD's must be purchased by foreign importers of dairy products, increasing demand for the currency and its value.

What to watch in the week ahead for the Pound

There is a considerable bundle of data and events in the week ahead for Sterling, which suggests it could be a highly volatile time for the currency.

On the political front there will be votes on amendments to the Trade and Customs Bill, which help form the basis of the government's new 'softer' Brexit proposal. These are expected to take place on Monday 16 and Tuesday 17.

They could be critical in gauging whether the plan has a likelihood of success and implementation.

"Another legislative showdown takes place in the UK House of Commons as the Trade and Customs Bills are voted on. Amendments to the bill have come from 'hard' Brexiteers (trying to undo the white paper) and Remainers (trying to bind the UK to a customs union). Some of these votes could come down to the wire, and have significant implications for Brexit negotiations," says Actionforex.com in their week ahead analysis.

Sterling may catch a bid if Brexit supporters in the Conservative party fail in their upcoming attempt to harden the UK government's plan on leaving the EU, as failure should increase the GBP-positive probability of a relatively soft Brexit.

We note a string of opinion polls out over recent days that shows support for the Convervatives has fallen below that of Labour with a good proportion of voters flocking back to UKIP having judged that May will not deliver the Brexit they desire.

This will remind Convervative lawmakers that bringing down the government will likely throw their party onto the opposition benches. It does also however offer the potential to sharpen the determination of Brexiteers who believe their electoral success will lie with delivering a clean 'hard' Brexit.

From a 'hard' data perspective the week has three major, potentially market moving, releases too: labour market data on Tuesday, CPI on Wednesday and retail sales on Thursday - all are at 9.30 UK time (8.30 GMT).

Their significance is further heightened by the fact that they may impact on the decision-making of the Bank of England (BOE) when it has its pivotal meeting in August. Because the probabilities of a hike or not, are so evenly balanced, next week's data could prove critical in swinging the vote one way or another.

Labour market data for May, is expected to show continued improvement with a 150K rise in employment on a three-month-on-three-month basis.

The more important wage data component of the release, which is more of an influence on inflation and therefore Bank of England decision-making, is expected to show only modest rises of 2.6% for headline and 2.8% (including bonuses).

Stronger wage rises are necessary to increase the chances of a rate hike and a disappointment could weigh heavily on Sterling.

CPI inflation data in June, out on Wednesday, is likely to show a rise due to the temporary influence of higher oil prices, however, if the main driver is in fact only fuel prices, it is unlikely to have much impact on the Bank of England who are more likely to look through inflation from temporary factors.

Therefore we believe the core CPI reading will be of more interest to the Bank of England as it shows the underlying inflationary pressures present in the economy.

Core CPI is forecast to read at 2.1% (month-on-month) while headline CPI is forecast to read at 0.2% month-on-month and 2.6% year-on-year.

"We suspect that CPI inflation edged up to 2.6% in June, owing to a rise in energy prices. But this should not mark the start of a sustained rise," says Andrew Wishart, UK economist at Capital Economics.

Retail sales for June are set for release on Thursday but the "evidence on strength," says Capital Economic's Wishart, "has been decidedly mixed."

On the one hand, the strong data in April and May will be a hard act to follow in June, yet on the other hand factors such as the good weather and the World Cup could support a rise.

"More sunshine, warm weather, and World Cup should be supportive. Our base case 0.4% forecast leaves a very strong trend for Q2 sales, and a solid hand-off to Q3," says TD securities in their note on data in the week ahead.

Markets are forecasting a reading of 0.4% on a month-on-month basis and 3.9% annualised.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here