New Zealand Dollar Rout Extends Amidst a Keen Market Focus on Yields

- Written by: James Skinner

- NZD falls against all G10 rivals as bond market dominates.

- Kiwi interest rates sit at record lows while rates rise elsewhere.

- Stragegists eye losses for the NZD relative to USD, GBP and AUD.

© Rafael Ben-Ari, Adobe Stock

The New Zealand Dollar fell broadly Tuesday as traders responded to the latest developments in global bond markets and, according to multiple strategists, the Kiwi currency could see these losses snowball even after the dust settles around Tuesday's price action.

The Pound-to-New Zealand Dollar exchange rate is trading at a five-week best at 1.9640 at the time of writing, thanks largely to the broadly weaker NZD which is easily the day's worst-performing currency.

Global interest rate dynamics are cited as being behind the move.

America's Dollar trades on the front foot thanks to a rise in U.S. bond yields which, now threatening to break above a key and pyschologically important level, could now fuel a further advance against the developed world currency basket.

US 10 year yields have risen steadily in 2018, from a low of 2.4% to nearly 3% Tuesday, due to an increase in the supply of American bonds and as markets continue to flirt with the idea that the Federal Reserve could look to increase the pace at which it raises interest rates in the months ahead.

This has been the primary driver behind currency market price action that saw the New Zealand Dollar cede ground to all of its developed world rivals Tuesday.

"The NZD continued to test lower as other commodity currencies wobbled overnight, yield differentials come back into focus and some positioning unwind continues. The NZD/USD has broken through some key levels recently and could well continue to test lower if US yields break higher," says Phil Borkin, a senior macro strategist at ANZ.

Above: NZD/USD exchange rate shown at weekly intervals.

After all, the Reserve Bank of New Zealand is widely expected to spend at least the next year sat on its hands while the U.S. Federal Reserve and other developed world central banks either continue to raise interest rates or take the initial steps toward winding down their post-crisis stimulus programs.

This could have profound implications for the Kiwi Dollar because traditionally, investors could earn a higher return by selling US Dollars or a range of other developed world currencies and buying the New Zealand unit in order to park their money in the Antipodean bond market.

Now the maths behind this idea no longer works as US 10 year bond yields are higher than their Kiwi counterparts, which is undermining a crucial source of support for the currency.

Above: 10 Year US Government Bond Yield.

Similar is true of the Kiwi relative to other developed world currencies in that this relative return metric is slowly but surely looking less attractive.

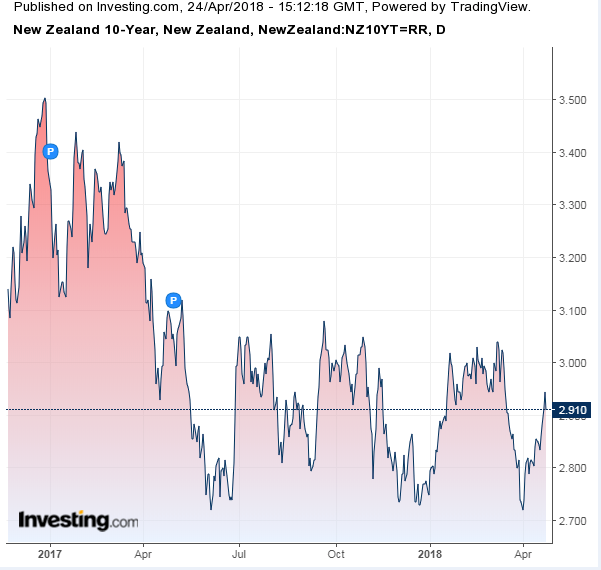

Above: 10 Year New Zealand Government Bond Yield

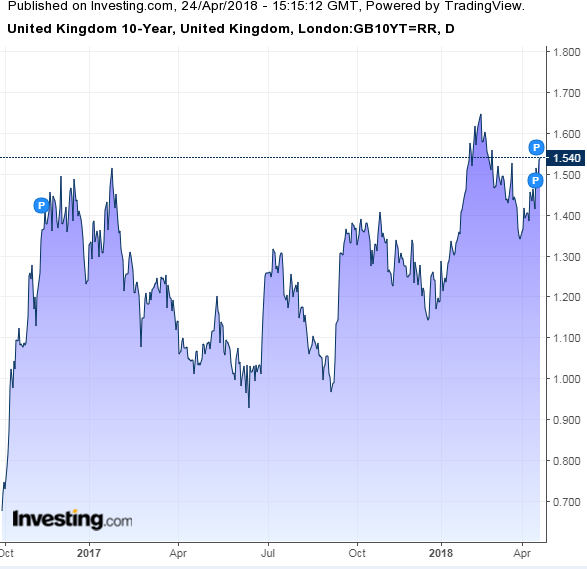

The Kiwi 10 year yield has fallen from 3.4% at the beginning of 2017 to just 2.9% in April 2018 while, during the same time period, UK yields have risen from 1.23% to 1.53% while Canadian yields have jumped from 1.65% to 2.35%.

Above: 10 Year UK Government Bond Yield.

Both UK and Canadian yields can be expected to continue rising, thus supporting both currencies, given the Bank of England and Bank of Canada are forecast to continue raising interest rates over the coming quarters.

Judging by economist forecasts, the best the Kiwi Dollar may be able to hope for is that New Zealand bond yields are able to avoid a further decline.

"Over 2018, we see scope for underperformance from NZD, though this is now more contingent on ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3, and perhaps on evidence that real assets (equities, housing) are threatened by late cycle growth dynamics and government intervention," says Sally Auld, head of Australia and New Zealand FX strategy at J.P. Morgan. "We expect NZD/USD to depreciate to USD0.67 by 1Q19."

Auld and the J.P. Morgan team are not alone in their bearish outlook for the Kiwi Dollar as many strategists have advocated betting against the currency in recent weeks. A fashionable way for speculators to profit from anticipated weakness in the New Zealand currency has been to bet on a rise in the AUD/NZD exchange rate, which had fallen as much as 5% in 2018 until little more than a week ago.

"AUDNZD broke its downward trend this week suggesting a near-term halt in further NZD strength. We remain long-term bears on NZD due to weak economic fundamentals," says Gek Teng Khoo, an FX strategist at Morgan Stanley.

A number of analysts, economists and strategists are still calling for the exchange rate to rise further, despite it having pared back its year to date loss to just -2.6% in the last seven days.

"The cross has bounced nicely off the uptrend support from the cycle low in April 2015, and we are looking for further upside with the RBNZ firmly on hold and the market underpricing the chances of an RBA hike this year," says Alvin Tan, a foreign exchange strategist at Societe Generale, referring to the AUD/NZD exchange rate.

Tan recommended a week ago that clients buy the AUD/NZD rate around 1.0550 and target a move up to 1.10, placing a stop loss at 1.0490. The ANZ Research team has also recommended betting on a rise on the AUD/NZD rate, targetting a move up to 1.08.

Above: AUD/NZD rate shown at weekly intervals.

"Over the past few months, the AUD/NZD has been facing renewed selling pressure, falling to 1.05, the lowest level since July 2017. This weakness occurred despite relative stability in our fair value estimate, which currently sits at 1.12," says Phil Borkin, a senior macro strategist at ANZ Research, in a recent note.

Borkin and the ANZ team say that prices of whole milk powder, New Zealand's largest export, are likely to dip lower over the coming months thanks to increasing supply from Europe and other global competitors. This would be bad for the Kiwi Dollar. In addition, they argue a weak first quarter inflation report has further soured the outlook for an RBNZ interest rate rise any time soon, which is also a headwind for the Kiwi currency.

ANZ Research is advocating that clients bet on the AUD/NZD exchange rate rising back to 1.08, from 1.0674 Tuesday, while Societe Generale is looking for a move up to 1.10. Strategists at Maybank in Singapore, who are also recommending a bet on the AUD/NZD rate, are targetting a recovery to the 1.0780 level.

The J.P. Morgan FX team forecast the NZD/USD rate will fall to 0.68 before year end and that the Pound-to-Dollar rate will rise to 1.44, which implies a Pound-to-New-Zealand-Dollar rate of 2.11 before 2018 draws to a close. This is implies an increase of nearly 8% from Tuesday's 1.9625 level before the year is out.

Above: Pound-to-New-Zealand-Dollar rate shown at weekly intervals.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.