Dollar-Yen Recovery Can Extend into Quarter-end

- Written by: Sam Coventry

Image © Adobe Images

The Dollar's recovery against the Yen could extend as month-end and quarter-end flows give it a fresh impetus.

The Dollar-Yen exchange rate bounced off the psychologically significant floor at 140 last week and could extend in the short term, according to analysts, although it is too soon to say the broader multi-week selloff is over.

The next few forex trading sessions could be volatile as month-end and quarter-end flows are set to dominate.

The end of the quarter and month are approaching, which will require global portfolio managers to make adjustments for recent FX market developments. The rebalancing can trigger significant short-term volatility.

"We have quarter end this week and that will likely start to drive FX in a bigger way tomorrow in the London morning and NY mornings," says Brad Bechtel, an analyst at Jefferies.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Dollar has fallen against most G10 counterparts in September, but the bigger and more relevant story for month-end flows is the sizeable rise in global equity markets.

"A turbulent Q3 for asset prices opens the door for significant rebalancing at quarter-end," says Robert Fullem, a Reuters market analyst.

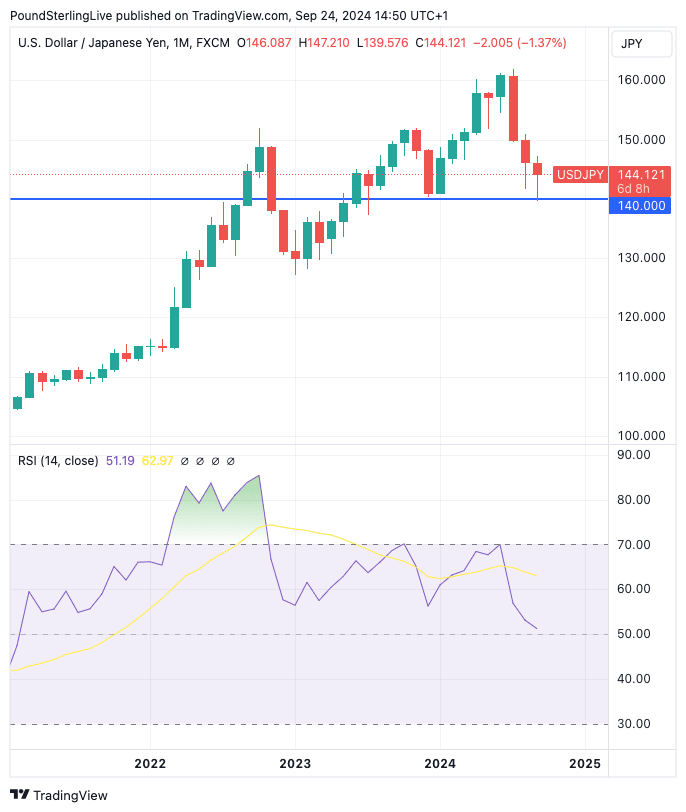

Above: USD/JPY at monthly intervals. Monthly momentum remains lower, but the 140 area is offering support (blue line).

Bechtel thinks the end of September and the third quarter of 2024 could be characterised by U.S. Dollar strength given the weakness seen over recent weeks.

"I would be surprised if we end up with enough USD selling for quarter-end to push us through 100 support in DXY, generally the quarter ends have been USD positive, so if anything, we are likely to grind back above 101 towards 102,"

A recovery in the U.S. Dollar index (DXY) - a measure of overall USD performance - would imply Dollar-Yen can potentially extend the current six-day trend of appreciation.

Looking into October, the Yen's recovery against the Greenback is not necessarily over and Fullem thinks a move in Dollar-Yen below 141.75 would put in play the year-to-date low of 139.58, whereas a close above 145.55 would target the September high of 147.20.

The Japanese Yen fell at the end of last week after the Bank of Japan (BoJ) appeared to waver on its commitment to raise interest rates further and bring an end to ultra-loose monetary policy.

The BoJ left its policy interest rate unchanged at 0.25%, and guidance showed an optimistic outlook for the economy and a commitment to deliver further interest rate hikes.

However, "what is striking is the lack of explicit forward guidance in today's statement. In July, it was stated that the BoJ would continue to raise interest rates if inflation evolved as expected. While the statement can still be read that way, it is no longer explicitly stated," says Volkmar Baur, FX Analyst at Commerzbank.

"This confirms our view that the situation in Japan is not quite as clear-cut as the Bank of Japan would sometimes like us to believe," he adds.

The market reaction suggests investors are in agreement, thinking the Bank of Japan might be softening its commitment to raising interest rates, which could deny the Yen a key source of support. As a result, the Japanese currency traded lower against all its G10 peers.