New Zealand Dollar Rally Leaves GBP/NZD Vulnerable Near 15-month Lows

- Written by: James Skinner

- GBP/NZD eroding major support at 1.9090

- As NZD/USD looks for break above 0.6900

- Commodity price outlook supportive of NZD

- While BoE policy uncertainty constrains GBP

Image © Adobe Stock

The Pound to New Zealand Dollar rate was retesting a notable level on the charts while under pressure close to 15-month lows in the final session of the week as NZD/USD closed in on 2022 highs and Sterling remained soft following the March Bank of England (BoE) monetary policy update.

New Zealand’s Dollar advanced against most major counterparts on Friday as commodity currencies outperformed ahead of the weekend, lifting NZD/USD to within inches of 2022 highs while pushing GBP/NZD back beneath the 1.91 level.

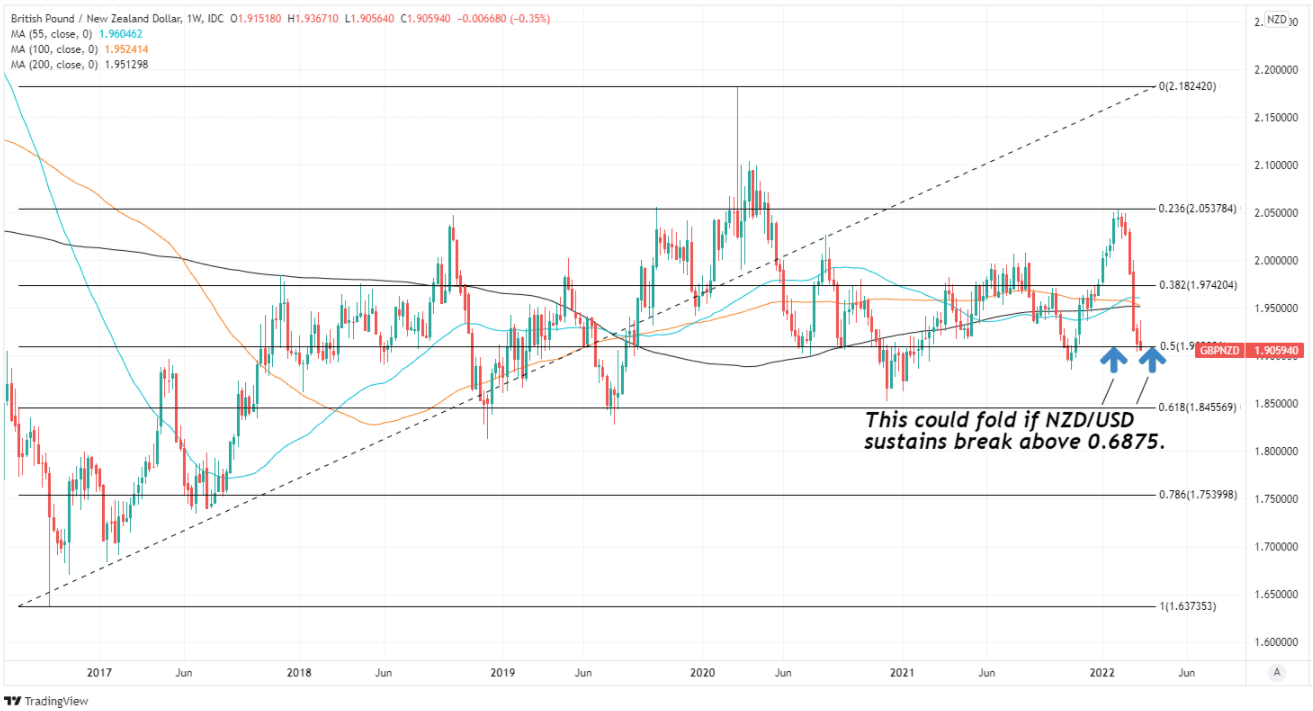

The Pound to New Zealand Dollar exchange rate was retesting the 50% Fibonacci retracement of its post-referendum recovery trend around 1.9090 in the final session of the week after being weighed down by the buoyant Kiwi and declines in the main Sterling exchange rate, GBP/USD.

“The NZD has performed well this week as risk appetite has improved (US equities have had their best 3-day run since November) and as commodity prices have rebounded. But the risk of a hard landing remains,and Omicron is clearly impacting consumer behaviour; against a backdrop of mixed signals, volatility is likely to continue to trump directionality in currency markets,” says David Croy, a strategist at ANZ.

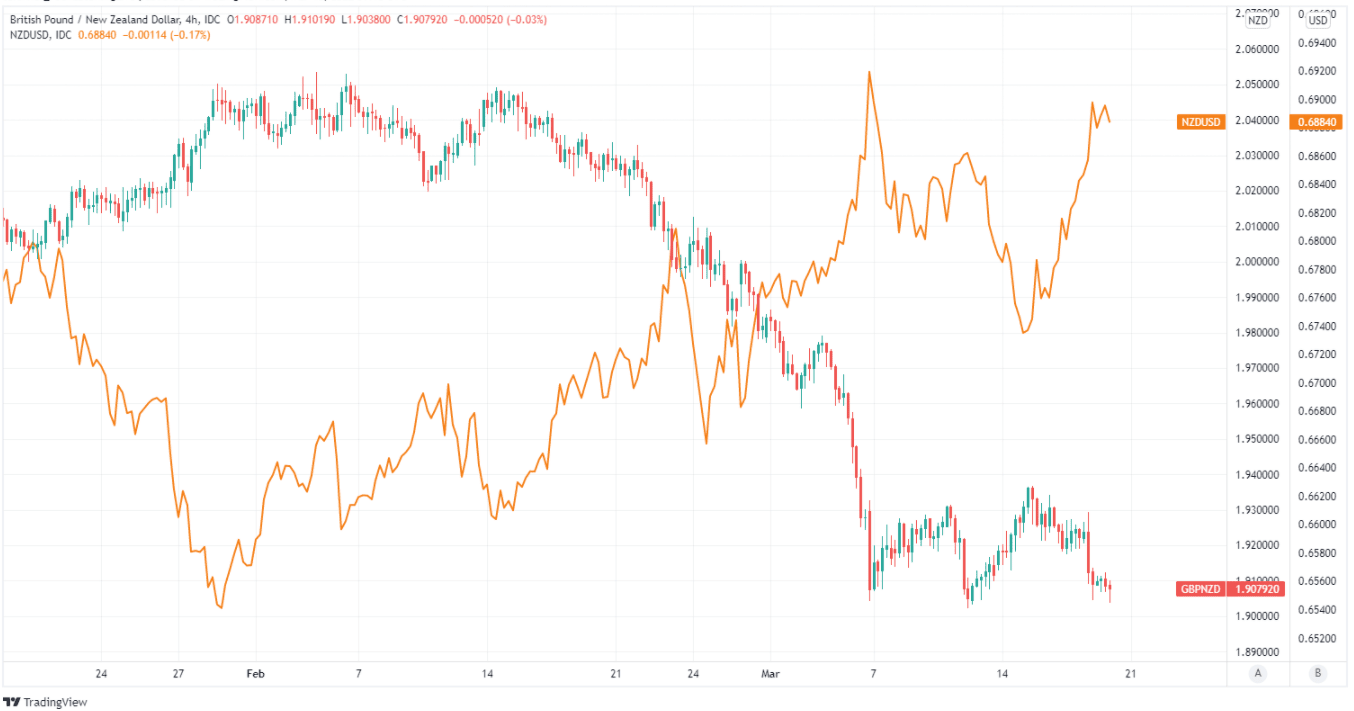

Above: Pound to New Zealand Dollar rate shown at daily intervals alongside NZD/USD.

- GBP/NZD reference rates at publication:

Spot: 1.9084 - High street bank rates (indicative band): 1.8416-1.8550

- Payment specialist rates (indicative band): 1.8910-1.8950

- Find out about specialist rates, here

- Set up an exchange rate alert, here

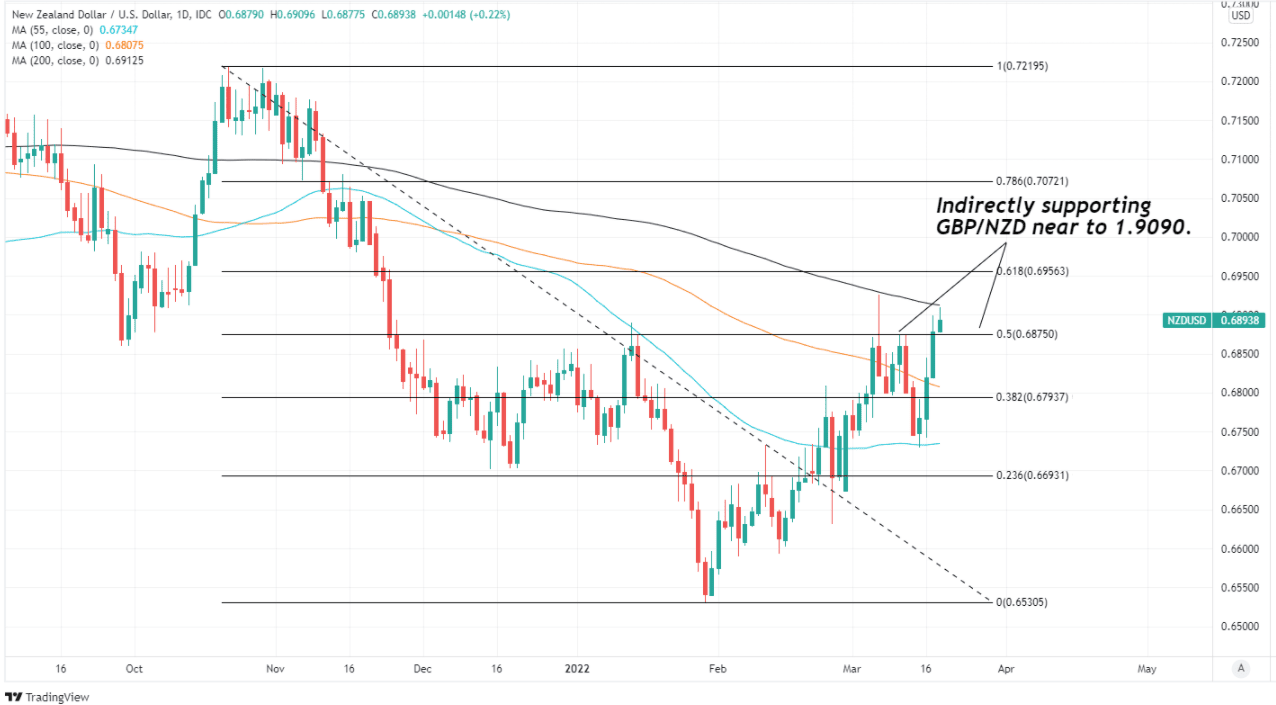

GBP/NZD’s decline was in part the result of this week’s rally in NZD/USD, which rose back above 0.69 for the first time since early March on Friday and briefly brought the New Zealand Dollar into contact with its 200-day moving-average around 0.6912.

“The next upside target is 0.6925. Risk sentiment has improved further, despite mixed reports from Ukraine/Russia, and commodity prices have risen further. Longer term, we target 0.7100+ by year end,” says Imre Speizer, head of NZ strategy at Westpac, in reference to NZD/USD.

The New Zealand Dollar extended earlier gains from Wednesday as the U.S. Dollar declined broadly in the wake of the March Federal Reserve (Fed) interest rate decision and after final quarter GDP data showed the Kiwi economy growing faster than had been assumed by the Reserve Bank of New Zealand (RBNZ) in February’s forecasts, although some local economists are increasingly cautious about the New Zealand economic outlook.

“The partial rebound in GDP over Q4 may be the only good news we get on the activity front for some time. It’s increasingly looking like the vicious combination of Omicron disruption and surging inflation will make it difficult for the economy to post strong growth numbers over 2022. There’s a bit more rebound to come, but looking through the noise, 2022 is shaping up to be a softer year,” says Miles Workman, an economist at ANZ.

Above: NZD/USD shown at daily intervals with Fibonacci retracements of November decline indicating possible areas of technical resistance to any recovery by the Kiwi, and shown alongside selected-moving-averages.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Much about the short-term outlook for GBP/NZD depends heavily on whether NZD/USD sustains or otherwise builds further on this week’s gains over the U.S. Dollar, given that GBP/NZD tends to closely reflect the relative performance of Sterling and the Kiwi when measured against the U.S. Dollar.

The rub for Sterling is that some analysts see the U.S. Dollar as being likely to remain on its front foot against European currencies while commodity counterparts like the Kiwi continue to outperform, which is a recipe for further declines in GBP/NZD.

“There is a camp arguing that the dollar typically sells off in the first six months of a Fed tightening cycle - presumably on the 'buy-the-rumour, sell-the-fact' mentality of a well-telegraphed tightening cycle. What is different this time, in our opinion, is the aggressive front-loaded tightening about to be undertaken by the Fed and events in Ukraine which have damaged European growth prospects and will weigh on currencies in the region,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

“In short, we suspect the dollar will stay bid on dips against European FX and the JPY, while the commodity-exporting currencies can continue to outperform,” Turner and colleagues wrote in a Friday research briefing.

Above: Pound to New Zealand Dollar rate shown at weekly intervals with Fibonacci retracements of post-referendum recovery indicating medium-term technical support for Sterling around 1.9090 and at 1.8455.

The Pound to New Zealand Dollar rate would be likely to remain below the 1.9090 support level over the coming days if NZD/USD continues to test or even rise above its nearby 200-day moving-average unless in the interim the main Sterling exchange rate, GBP/USD, was to stage a recovery.

This latter outcome could be unlikely, however, given the ongoing Russian invasion of Ukraine and uncertainty about the Bank of England interest rate outlook thrown up by the potentially ominous warning contained in this Thursday’s monetary policy statement.

“The Bank of England raised its cash rate by 25bps overnight, to 0.75%, in an 8:1 vote (Deputy Governor Cunliffe voted to keep rates on hold). However, the tone of the statement was more cautious than markets were expecting,” says Jason Wong, a strategist at BNZ.

“UK rates have fallen by as much as 12bps at the short end of the curve, while the GBP is the standout underperformer in the FX market overnight,” Wong and colleagues wrote in a Friday research note.