Pound / Dollar Rate Outlook Constrained by BoE’s Ominous Warning

- Written by: James Skinner

- GBP/USD unwinds earlier gains & slips toward 1.31

- As BoE tips two-sided risks to future rate decisions

- Warns of risks associated with real income squeeze

- May obviate necessity for Bank Rate to rise further

- BoE outlook hinged on oil, gas price developments

- Substantial declines may lead to further rate hikes

- Continued elevation may see BoE stand pat in May

Image © Adobe Stock

The Pound to Dollar rate unwound earlier gains and slipped back toward 1.30 on Thursday after the Bank of England (BoE) delivered an ominous message to the markets alongside its latest interest rate decision, leaving a lot to be determined by future developments in oil and gas prices.

Sterling had been trading higher against many of its major counterparts including the greenback, which itself had fallen against many comparable currencies on Thursday, although the Pound-Dollar rate tumbled during the trading that followed the BoE’s March policy decision.

The BoE lifted Bank Rate back to its March 2020 level of 0.75% but warned of two-sided risks to future policy decisions and reminded financial markets of the impact that recent surges in oil and gas prices will have on household incomes and the broader economy.

“Based on its current assessment of the economic situation, the Committee judges that some further modest tightening in monetary policy may be appropriate in the coming months, but there are risks on both sides of that judgement depending on how medium-term prospects for inflation evolve,” the BoE said in a statement accompanying its decision.

“The MPC’s remit is clear that the inflation target applies at all times, reflecting the primacy of price stability in the UK monetary policy framework. The framework also recognises that there will be occasions when inflation will depart from the target as a result of shocks and disturbances. The economy has recently been subject to a succession of very large shocks. Russia’s invasion of Ukraine is another such shock,” the BoE also said.

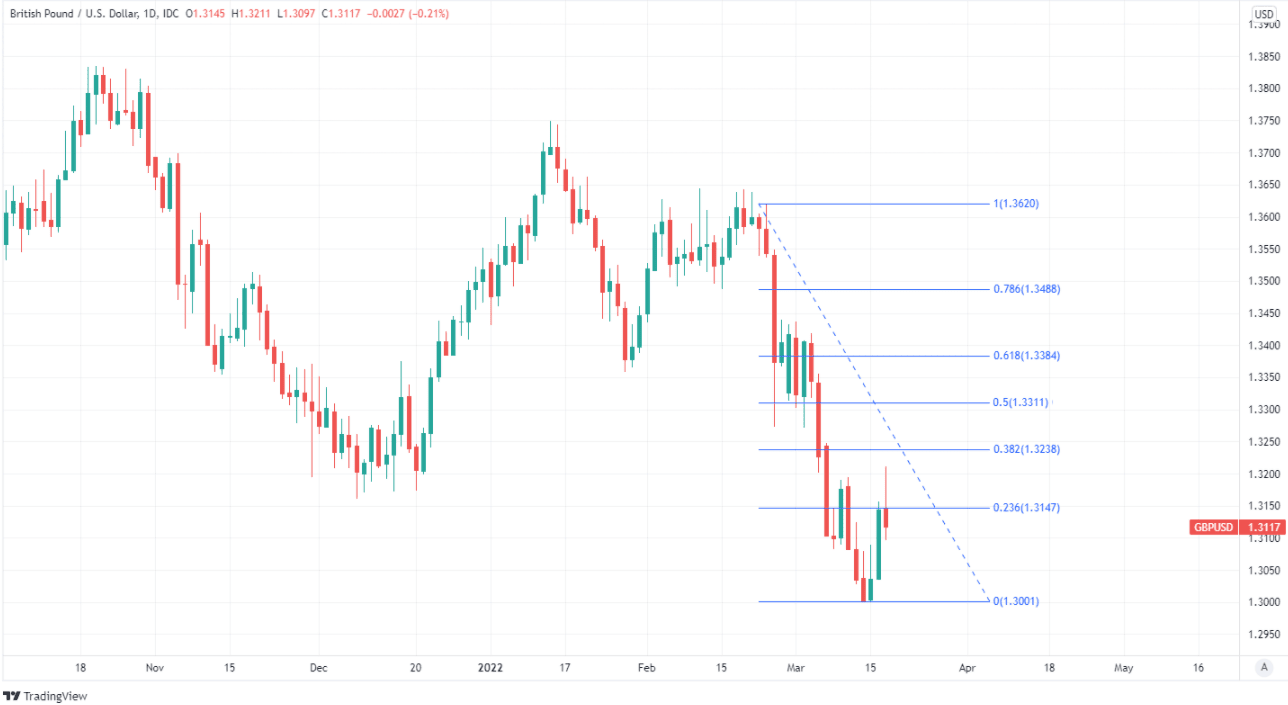

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of late February decline indicating possible areas of technical resistance to any recovery by Sterling.

- GBP/USD reference rates at publication:

Spot: 1.3111 - High street bank rates (indicative band): 1.2652-1.2744

- Payment specialist rates (indicative band): 1.2990-1.3050

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The BoE said that elevated energy prices and the resulting squeeze on incomes is likely to put significant downward pressure on domestically generated inflation during the period ahead, which could ultimately be significant enough to serve as a substitute for any further increases in Bank Rate.

That placed the currency and interest rate markets into a bind on Thursday because many investors and traders had been wagering increasingly that Bank Rate could rise to 2% or more later this year, and had the effect of provoking a modest sell-off in Sterling exchange rates including GBP/USD.

“The minutes are irreconcilable with the rapid rate hikes anticipated by markets,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics, who’s long expressed scepticism of the assumptions implied by prices in certain financial markets.

“Today’s minutes leave us more confident in our view that the rate hiking cycle will stall after the Committee increases Bank Rate to 1.00%, most likely at the next meeting in May,” Tombs and colleagues said in a note to clients on Thursday.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The BoE’s statement leaves much about forthcoming interest rate decisions to be determined by intervening developments in oil and gas prices, as these will also potentially have a meaningful impact on the degree to which financial conditions within the economy do or don’t tighten.

“Their comments painted a more balanced picture going forward, with one member voting for unchanged rates, moving sterling lower and gilts higher. The yield curve remains inverse from 3 years out, albeit at elevated levels, showing that the balancing act will continue to require some serious acrobatic finesse,” says Chris Wilgoss, head of global markets treasury at Crown Agents Bank.

Oil, gas and other commodity prices are often volatile although many have seen almost unprecedented increases since the Russian military began its invasion of Ukraine in late February, and these have added further to the already-significant gains notched up last year.

These price changes will impact the levels of inflation in the UK for some time to come, with the BoE warning on Thursday that some of the impact won’t be fully felt until October when the Office of Gas and Electricity Markets (OFGEM) raises the government’s ‘energy price cap,’ which was already expected to be lifted by 54% as of April 01.

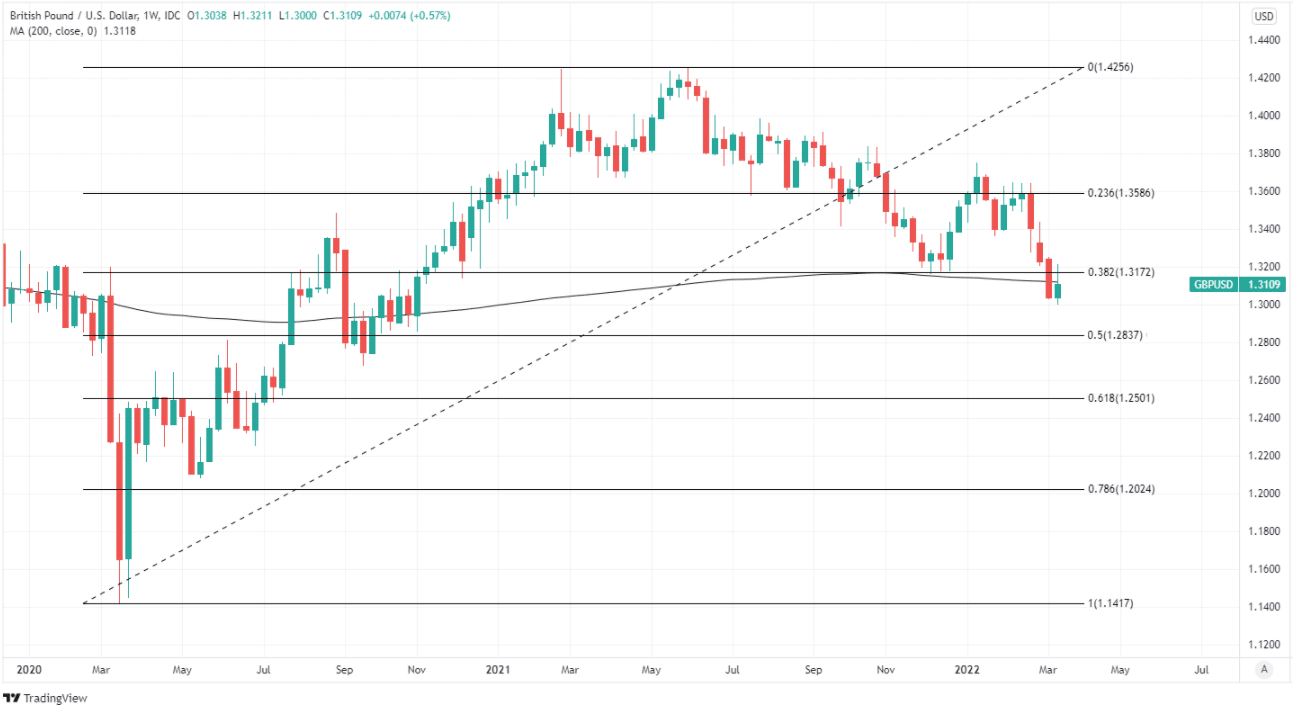

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating possible areas of medium-term technical support for Sterling. Shown alongside GBP/USD’s 200-week moving-average.