Australian Dollar's 12-month Outlook Boosted by RBA Stance

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar is tipped to outperform in the coming months, helped by a 'hawkish' Reserve Bank of Australia (RBA) say analysts.

The RBA might have cut interest rates, but it hasn't necessarily started a rate cutting cycle, say economists in reaction to Tuesday's events.

The RBA cut rates by 25 basis points, but Governor Michelle Bullock clearly pushed back against expecting further cuts, suggesting the move was a reversal of an "insurance" hike conducted last November.

"Bullock's comments were purposely hawkish and pushed CIO Forecast back directly on more aggressive market pricing of rate cuts. We believe the RBA will cut just once more in 2025 (May or August), for a total of 50 basis points," says Wayne Gordon, Strategist at UBS.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Gordon says current levels in the Australian Dollar reflect the more dovish rate pricing environment alongside elevated risks of a deeper trade conflict between the U.S. and China.

"As we see fewer cuts and potential for upside surprises to Australian and Chinese growth prospects vs consensus, this should drive the AUDUSD higher over the next 12 months," he explains.

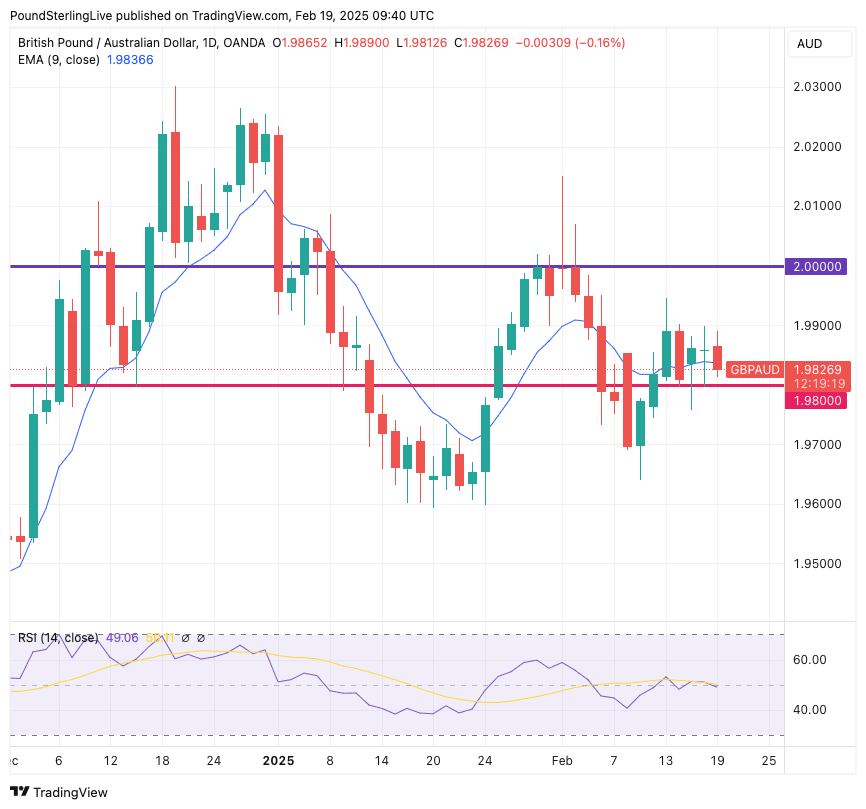

Following the RBA's decision, the Australian Dollar-U.S. Dollar rate rose to 0.6360, and the Pound-to-Australian Dollar exchange rate retreated to support located at 1.98.

"We cannot declare victory on inflation yet," said Bullock. "Recent labour market data have been unexpectedly strong, suggesting that the labour market may be somewhat tighter than previously thought."

Above: GBPAUD at daily intervals. If support at 1.98 gives way then a move to the 1.97 and then the 1.96 round figures becomes likely.

"More hawkish-than-expected rhetoric from the RBA helped the support the Aussie. The AUD/USD pair strengthened in Aussie's favour later in the session after weakening through most of the day following the announcement of a rate cut. The pair finished at 0.6353 cents," says Illiana Jain, an Economist at Westpac.

The RBA said the decision represents a "cautious cut" as it pushed back against market pricing for a more forceful cutting cycle.

Market expectations for lower rates, in turn, pressure Australian funding costs, which can be inflationary. By pushing back against these expectations, the RBA prevents more loosening in conditions.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

For the Australian Dollar, this is, all else equal, supportive.

The RBA's new forecasts have the trimmed mean inflation measure as being revised down to 2.7% through the forecast period, which is lower in the near term but above the midpoint of the inflation target band.

Economists at Standard Chartered downgraded the number of cuts they had pencilled in for Australia following clear guidance from Bullock that markets must keep expectations low.

"Bullock pushed back against market pricing of RBA rate cuts – with swaps at the time of the press conference pricing in another c.50bps in cuts by the December meeting," says Nicholas Chia, FX and Macro Strategist at Standard Chartered.