New Zealand Dollar Forecast 2022: ING Bullish

- Written by: Gary Howes

- NZD tipped for "bullish" 2022

- But Sterling could yet outperform

- GBP/NZD could rise back towards 2.0

Image © Adobe Stock

An aggressive Reserve Bank of New Zealand (RBNZ), a strong domestic economy and steady trade dynamics are reasons to anticipate New Zealand Dollar appreciation in 2022 says a leading investment bank.

China is meanwhile considered to be the biggest downside risk to the Kiwi's outlook according to ING Bank, the Dutch based global financial services provider and lender.

"The currency should have the most attractive carry in G10 in the year ahead," says Chris Turner, Global Head of Markets at ING in London.

But against Pound Sterling gains will be harder to be realised, allowing the GBP/NZD exchange rate to push back towards the 2.0 level.

In a 2022 year-ahead research note ING tells clients they are bullish on the Kiwi as a strong domestic economy means the Reserve Bank of New Zealand (RBNZ) can proceed and 'out tighten' central banks of other developed economies.

Indeed, the RBNZ is a first mover in this regard, raising rates in November in response to official data that showed the economy was back above its pre-pandemic levels while employment was strong and wages growing.

The New Zealand Dollar has however weakened since the hike, suggesting the decision was well anticipated by the market which was also beginning to to fret about the emergence of the Omicron variant.

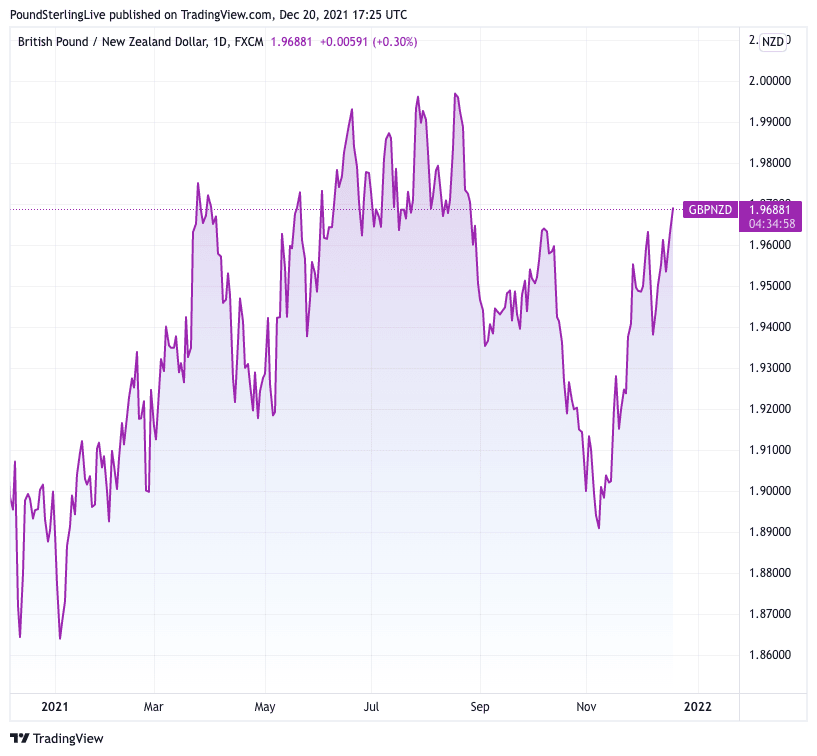

Above: GBP/NZD in 2022.

- GBP/NZD reference rates at publication:

Spot: 1.9660 - High street bank rates (indicative band): 1.8972-1.9110

- Payment specialist rates (indicative band): 1.9483-1.9562

- Find out about specialist rates, here

- Set up an exchange rate alert, here

From here, however, markets still anticipate the RBNZ to remain one of the most hawkish central banks in G10, pricing in around 175bp of tightening between now and the end of 2022.

"We think markets will have to scale down tightening expectations for 2022, but signs of persistent inflation throughout the year should fuel speculation that the tightening cycle will have to continue in 2023-24, and put a floor below NZD," says Turner.

Indeed, ING says hefty hawkish expectations held by the market are somewhat overdone and expect 125bp of tightening.

Nevertheless, "the currency should have the most attractive carry in G10 in the year ahead and should therefore benefit more than others from periods of low volatility a supported risk sentiment," adds Turner.

The reopening of New Zealand's borders in 2022 are expected by ING to boost the domestic economy while wage pressures should keep inflation at levels consistent with higher RBNZ interest rates.

New Zealand's commodity exports are meanwhile considered considerably higher than in the last five years, and even in case of a correction in 2022 "the exporting industry should continue to underpin the recovery," says Turner.

But, downside risks to the New Zealand must also be considered in the form of slowing Chinese economic activity says the analyst.

"A big downside risk for NZD in 2022 is, however, China-related sentiment, which remains quite uncertain amid government crackdowns on some sectors and a potential economic slowdown," says Turner.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Furthermore, positioning is a concern as ING finds the New Zealand Dollar to be "the most overbought currency in G10 and is facing some position-squaring-related downside risk in the near term."

ING forecasts The New Zealand Dollar to U.S. Dollar exchange rate "to rise gradually" to 0.74 in 2022 from current spot rates of around 0.6720.

The Kiwis is however tipped to lose value to the Pound over 2022.

ING describes Sterling as "unfashionably weak" and note the significant Brexit premium present in the currency since 2016 to have materially lessened since 2019.

ING holds a GBP/USD spot forecast of 1.34 for year-end 2022, this gives a cross rate forecast of 1.99 for the Pound to New Zealand Dollar exchange rate.

The exchange rate is currently at 1.9687.