Oil and Gold Prices in a 'Stormy' Session

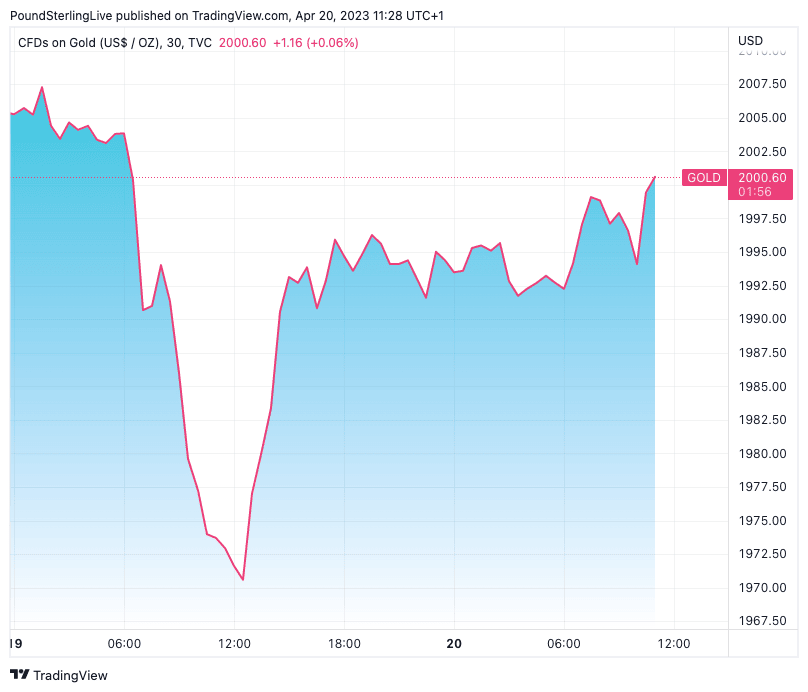

Gold had a particularly stormy session as it initially sliced below the crucial $1980 region, dragged down by a stronger US dollar and rising real yields, before bouncing back to reclaim that territory as both the dollar and yields cooled off.

Volatility in gold might persist as opposing forces remain in play.

Concerns of an imminent recession have eased, helping yields to recover after a slew of stronger data releases saw investors unwind bets of Fed, ECB, and BoE rate cuts.

Yet central banks in China, Russia, and Turkey remain net-buyers of gold, countering some of the negative pressure from rising yields and establishing a soft floor under bullion prices.

Above: Gold price action at 30-minute intervals.

For gold to resume its uptrend and make another attempt towards record highs, recession concerns would likely need to resurface, which puts the emphasis on incoming economic data starting with tomorrow’s business surveys from the major economies.

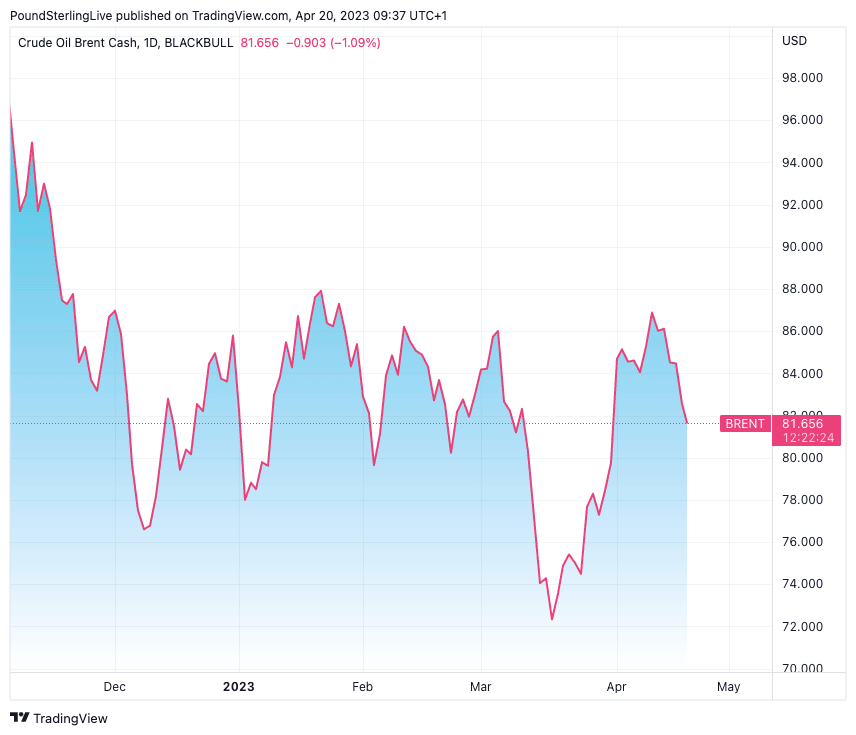

Oil prices fell victim to heavy selling this week and have started to fill the price gap from earlier this month after OPEC announced production cuts.

There was no clear trigger behind this sudden shift. If anything, the recent news flow was bullish for energy prices following upbeat Chinese growth numbers and a larger-than-expected drawdown in US crude stockpiles this week.

In classic fashion, the drop in oil prices inflicted collateral damage on the Canadian dollar, which is linked to energy markets through the export channel.

Looking at the charts, there isn’t much support for WTI crude until the OPEC-induced gap is filled near the $75/barrel zone, which suggests the weakness in both oil and the loonie could persist for now, especially if the mood in equity markets continues to sour.

Above: Brent crude oil prices latest.

Stock markets indeed appear to be losing steam. Futures point to a lower open on Wall Street today after Tesla reported a dismal quarter, with an 80% decline in free cash flow from last year pushing its share price down almost 8% in premarket trading today.

Adding insult to injury, CEO Elon Musk said he is willing to sacrifice profits to gain market share in the near term, effectively warning of an escalation in the ongoing electric vehicle price war.

Overall, the expansion in central bank balance sheets and the associated liquidity injections have helped markets stage a mighty comeback this year, but this rally has only made valuations more expensive in a regime of falling corporate earnings, posing the risk that reality might come knocking soon.

As for today, inflation data from New Zealand has already been released and fell short of forecasts, dealing a blow to the local currency as bets of further rate increases were dialled back.

The spotlight will now turn to a trio of Fed speakers that includes Waller (16:00 GMT), Mester (16:20 GMT), and Logan (19:00 GMT).

This will be one of their final chances to shape market expectations before the Fed’s blackout period begins on Saturday ahead of the next rate decision.

Finally, Japan’s inflation data for March will be released early on Friday.

With traders still speculating on whether any policy changes are on the table for next week’s Bank of Japan meeting, this inflation update could attract special attention.

Marios Hadjikyriacos is Senior Investment Analyst at XM.com. An original version of this article can be found here.