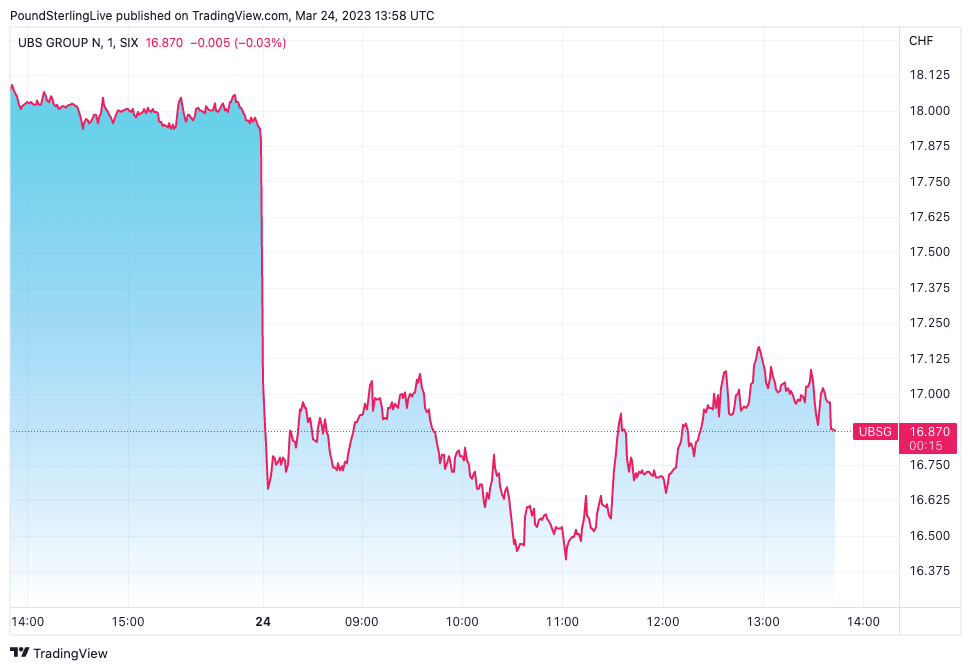

Deutsche Bank Shares Plunge by More than 12%, UBS Share Price Falls by more than 4%

ECB President, Christine Lagarde, stresses the banking sector remains resilient with strong capital positions.

Just as hopes had risen that contagion would be contained, banking stocks in Europe have been battered again by fears that fresh problems could be lurking.

More worries about the fragilities in the US banking sector emerged after US Treasury Secretary Janet Yellen said she was prepared to take more action to ensure deposits were safe.

Revelations that white knight UBS, which had ridden to the rescue of Credit Suisse, is being investigated by the US Department of Justice has shaken sentiment further.

The probe centres around allegations that staff helped Russian oligarchs evade sanctions.

Concerns are also deepening around Deutsche Bank after the cost of insuring against defaults on its debt spiked, with credit default swap prices soaring.

Worries about contagion are again rearing up even though more deposits appear to have been flowing into the German lender since the banking scare erupted, and it is thought to have capital reserves well in excess of regulatory requirements.

These fresh problems are bubbling up in a cauldron of worry about the implications of the rate rises we’ve seen over the past week, given that earlier hikes appear to have caused breakages in parts of the banking system.

There are worries that the fresh round of rate rises could make a precarious situation worse for some smaller banks, particularly those sitting on large bond holdings which have lost value as monetary conditions have been dramatically tightened.

Waves of bad news keep hitting the banking sector and the tide doesn’t look like it’s set to turn any time soon.

However, the European Central Bank has made it clear that it is standing by ready to deploy fresh tools to boost liquidity should the situation deteriorate and President, Christine Lagarde, has again reassured EU leaders in Brussels that the banking sector remains resilient with strong capital positions.

The message from the Bank of England has been on repeat over the past fortnight.

Although it’s monitoring the situation it’s stressing that there is still no systemic risk and that the UK banking system remains safe and sound.