Better Performance for British Pound v Euro + Dollar but More Work to Do v Commodity Currencies

- Written by: Gary Howes

Pound Sterling pulled itself higher against the Euro and US Dollar during the course of the week 12-16 June.

The gains against the Euro were particularly welcome as those hoping for a better exchange rate witnessed the currency fall for six weeks in a row.

However, the UK unit saw disappointment against the commodity-linked currencies - the New Zealand, Canadian and Australian Dollars.

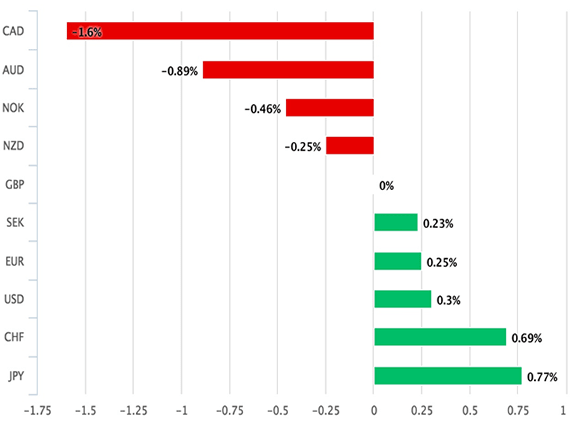

Above: Comparative performance data for the past five trading days shows Sterling has outperformed those currencies with low central bank interest rates.

Ahead of the new week the Pound to Euro exchange rate is quoted at 1.1408, the Pound to Dollar rate at 1.2776, the Pound to Aussie Dollar at 1.6754, the Pound to Canadian Dollar at 1.6877 and the Pound to NZ Dollar at 1.7607.

Pound’s Respite Could be Short-Lived

In truth, the Pound is lucky to have got away with a gain against the Dollar and Euro we believe.

It was shown that inflation is moving higher with core CPI rising to 2.6% in May, from 2.4%. that contrasts with a slowdown in wage growth, down to 1.7% excluding bonuses and signalling a worsen ing real wage squeeze.

No wonder then that retail sales, in volume terms and excluding auto fuel only rose 0.6% in the year to May, down from 4.5% the previous month.

Recent seasonal volatility distorts the figures, but the first 5 months of this year saw sales up by 2.7% vs. last year, a rate that has slowed from 6% in late 2016.

The Pound was saved by the Bank of England which left rates on hold but voted 5-3, with Ian McCafferty and Michael Saunders joining Kristin Forbes in voting for a hike.

“Ms Forbes leave next month and with a Sarah Hogg's seat to be filled also, this may turn into a 7-2 vote rather than getting any closer, but it nevertheless reflects a difference of views about the inflation threat facing the UK,” says analyst Kit Juckes at Societe Generale.

Some analysts have suggested the vote represents an important shift for the better for Pound Sterling.

“We are now on a much more neutral footing toward Sterling,” says Richard Kelly, Global Head of FX Strategy at TD Securities. “The downside is constrained by the BoE’s nascent hawkishness, hopes for a softer Brexit, and our broader view that the era of USD strength may be complete.”

Others are not convinced saying interest rates are going to remain on hold for the foreseeable future amidst political uncertainty and will therefore not help the Pound.

Manuel Oliveri at Credit Agricole is not optimistic on the Pound's chances of rallying as "intact political uncertainty is likely to prevent the GBP from facing more sustained upside in the short-term."

This is especially true as speculative positioning is broadly balanced.

"Hence, fresh buying interest is needed in order to trigger a sustained trend higher. Unless rate and/or growth expectations rise from here, demand for the currency is likely to stay muted," says Oliveri.

Canadian, New Zealand and Australian Dollars Outperform

“So your best trade this week would have been to buy the Canadian dollar against either the Rouble or the Icelandic Krona. This might mean markets are returning to business as usual. Bank of Canada Governor Stephen Poloz and Senior Deputy Governor Carolyn Wilkins both made statements this week referring to the prospect for higher rates and triggered a sharp market re-think about when that would happen,” says Juckes in reference to the CAD’s strong run.

Oil has had a bad week, but the CAD's had a good one.

The AUD has meanwhile been helped by good employment data, and at least iron ore prices have held up reasonably well, “but it's the though of the RBA making a similar communication move that is propelling it and the NZD higher,” says Juckes.

No surprise then, that the softest currencies in G10 are the negative rates one - CHF, JPY and EUR.

So interest rates are key - those countries that command higher interest rates at their central banks are tending to benefit.

We would expect this pattern to continue next week.

Key Events to Watch

Following Thursday's surprisingly hawkish MPC debate, where 3 members voted for a 25bps hike in rates and where the minutes took a hawkish tone, "markets will be on the lookout for any comments from BoE officials. Note that Governor Carney’s postponed Mansion House speech will be rescheduled," says Victoria Clarke at Investec.

The week will likely be dominated by politics once again, particularly so given that the economic data calendar is very quiet.

The domestic focus will be on whether the Conservative Party reaches a final deal with the DUP over a confidence and supply agreement, which would provide the government with a narrow majority in the House of Commons.

Reports this week have suggested that a deal between the two parties was close, but that due to the tragic fire at Grenfell Tower a conclusion would be delayed until next week.

Also due next week is the Queen’s Speech which has been rescheduled to Wednesday, whilst formal Brexit negotiations are also set to begin.

For the Euro, Sunday will see the second round of the French National Assembly elections.

The first round saw strong support for Emmanuel Macron’s party, Le République En Marche, which looks set to win an overall majority in the 577 seat National Assembly come Sunday.

June’s Composite PMI will be the key number of the week. May’s outturn represented a six year high at 56.8 and we expect June’s survey will maintain that pace of economic activity. PMI figures will also be due from Germany and France, whilst final Q1 GDP estimates are due for the latter.

In the United States, it is a similarly quiet week, with the main data releases being housing market focused with existing and new home sales due, as well as FHFA house prices.

After this week’s Federal Reserve and Bank of England policy decisions, the only major policy announcements over the next seven days are due from the Reserve Bank of New Zealand and the Norges Bank.

The RBNZ is expected to maintain the Official Cash rate at 1.75%, whilst the Norges Bank is also expected to keep policy rates steady at 0.50%.