Pound Sterling Higher Tuesday, Volatility Now at Levels Last Seen in 2008 Thanks to Swinging EU Referendum Polls

- Written by: Gary Howes

Volatility in the British pound exchange rate complex is reaching levels last seen in the dark days of the 2008 financial crisis, and don't expect the markets to settle down anytime soon.

GBP is rising on the 7th of June thanks to fresh polling data confirming the Remain camp has retaken the advantage in the EU referendum.

Two polls, YouGov for The Times and ORB International for The Telegraph, say Remain have the advantage.

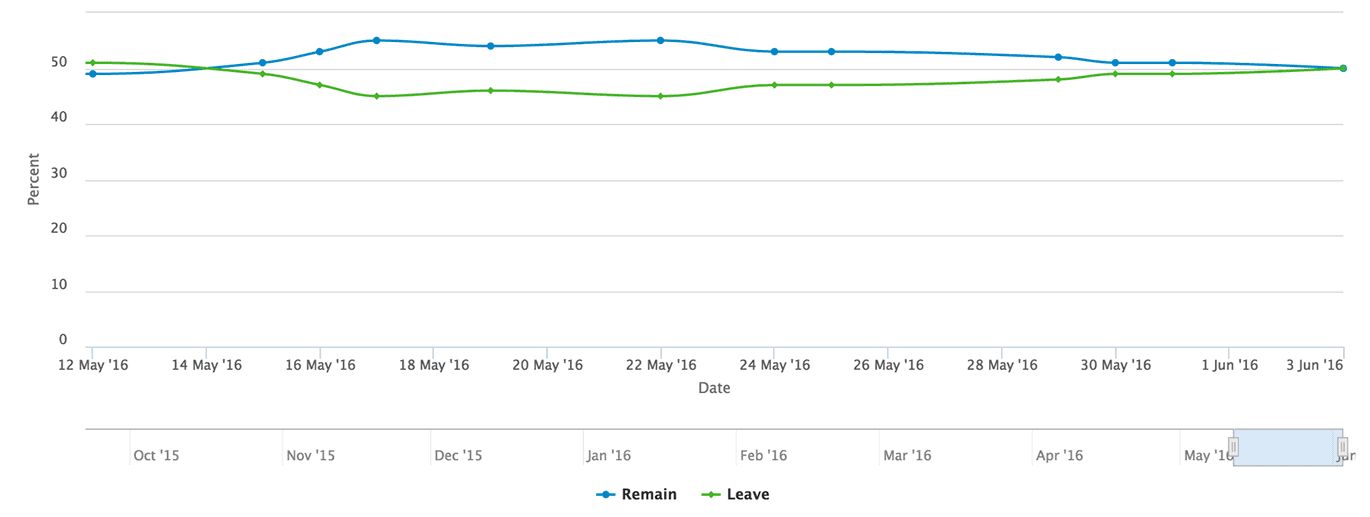

The polls arrest the recent swing we have seen towards Leave since the start of June and ensure the combined poll-of-poll readings remain on a knife edge with a 50/50 split.

In the wake of the releases, sterling rose over a percent against the USD to trade at 1.46 on the spot markets while against the euro the pound is trading a percent higher at 1.2838.

Those looking to buy euros with sterling will welcome the relief offered by the bounce as the rates on offer to them on the retail market now ranges between 1.2383 and 1.2717, depending on who was delivering the currency.

Our data suggests that the best rate on offer from independent providers at the present time will be in the 1.2717-/1.2627 vicinity, some 5% more advantageous than seen at banks and other big-name remit providers.

Volatility is the Only Winner

When it comes to the pound and the referendum, the only certainty is uncertainty, and markets hate uncertainty.

While we should allow for some spikes in sterling, the risks are squarely pointed lower in this environment and bounces will likely be sold into and ultimately capped.

"EUR/GBP 1-month implied volatility skyrocketed this week, being not far away from their all-time highs seen in the 2008 financial crisis – evidence of a very high degree of uncertainty and looming risks," says ING analyst Petr Krpata in a note to clients.

Krpata's confirms observations in the options underlying options market. We reported last week that the market was in turmoil, even if the spot market looked relatively calm.

Uncertainty is likely to continue to weigh on GBP and strength is expected to be short-lived.

Therefore, those with international payments should probably transact at current spot prices as they could rue any major reversals.

"I would not be at all surprised to see a 1.37/1.47 or 1.40/1.50 type range in the cable over the next few weeks. It won’t be about being right or wrong, but will be all about getting the market timing and position sizing absolutely perfect. In the very short-term. we should see support/resistance levels emerge at 1.4385/1.4585," says Sean Lee, a professional retail trader and founder of the Forextell service.

As a consequence Lee says were he to have a medium-term position, he’d prefer to be long EUR/GBP, "but I’m going to avoid the GBP unless I get some 90% trade set-ups."

We have seen sterling track the poll-of-polls (the average of all the polls conducted on voter intentions ahead of the EU referendum) over the past 8 weeks.

At the start of the new week we heard the Leave campaign are well ahead in the latest Observer/Opinium poll, something that has certainly jolted sterling.

The poll shows those in favour of Leaving now stand on 43% with 40% saying they will vote to Remain.

This is an about-turn on the previous Opinium poll - published May 21 - that showed remain four points ahead on 44%, with leave on 40% and 14% undecided.

Two weeks ago GBP was boosted on the observation that “remain now has a substantial lead among Conservative voters with 48% of Tory backers saying they want to stay in the EU, compared with 41% who want to leave.”

On Monday the 6th we saw two more polls that have cemented the swing.

A YouGov online poll of 3,495 people for ITV's Good Morning Britain showed 45 percent would opt to leave the EU while 41 percent would opt to stay while 11 percent of voters were undecided.

A TNS online poll of 1,213 people showed 43 percent would vote to leave, 41 percent would vote to stay and 16 percent were undecided.

Why did the swing reported in Sunday's poll happen? 41% of those in the most recent poll cite immigration as one of their two most important issues when deciding how to vote.

Over recent weeks immigration has shot up the news agenda with a surge of crossings being made from Africa to the European Union. When David Cameron announced the June 23rd date for the poll he did so knowing this would be the earliest possible date available ahead of an expected summer surge in Mediterranean crossings.

Pound Has its Work Cut Out

The pound was the worst performing currency in the G10 arena, coming in just behind the US dollar which also saw a rapid turn in fortunes following a positive May.

The best performer in G10 was the New Zealand dollar which enjoys the highest basic interest rate yield of its peers confirming global money has started to hunt out high yielding currencies again.

With regards to the British pound’s outlook for the week ahead, we could say that economic data will not matter as there is only one game in town for sterling, and that is sentiment regarding the EU referendum.

The pound is simply not reacting to economic data at present, rather when the prospect of a Remain vote grows the pound rises.

When the prospect of a Leave vote grows, the pound falls. This is a binary world for the GBP and this means predicting future movements is particularly difficult.

Thus, we will be keeping an eagle eye on upcoming polls to gauge the mood of what appears to be an undecided British public.

Finely Positioned

Ahead of the latest Opinium/Observer poll, the average of the last six polls, conducted between the 20th of May and 3rd of June shows a clear split between Remain and Leave. It is a dead heat.

The problem for GBP bulls is that momentum currently favours the Leave vote with the Remain’s strong lead, noted in May, being erased over the past week.

When sterling was soaring higher in a strong recovery move back on May 22nd, Remain enjoyed a 55% to 45% advantage.

The question now is whether or not Leave can break into the lead.

Importantly Though, Bookies Still Give Remain the Edge

While the polls have been shifting in one direction, bookmakers continue to reflect a Remain victory.

These odds are important as many see them as being more accurate than the polls, which were completely discredited in 2015 by failing to predict the Conservative victory in the general election.

At present Bet 365 assigns a mere 28.6% chance the UK will vote to leave the European Union. Betfair see a 29.41% chance, as do William Hill. Ladbrokes are slightly higher at 30.77%.

For us the big signal to a Leave vote will come when bookies shift closer towards the 50% mark, but we reckon this will only be reflected by a sharp move in favour of Leave in the polls, which to be fair, looks unlikely at present.

Therefore sterling should ultimately not experience the same agressive sell-off that we saw in the January-March period, however, the outcome of the various polls over coming days will still be critical for movement in sterling over the near-term.

Pound Sterling Live will be keeping a finger on the pulse of polling outcomes this week and assessing the UK currency’s reactions.