Pound Falls Against Euro and Dollar on Stock Market Rout

- Written by: Gary Howes

Elon Musk's Tesla was a focus of an equity market selloff centred on doubts about AI. File image. Daniel Oberhaus.

Pound Sterling has retreated against the Euro and Dollar and extended gains against the Australian and New Zealand Dollars after the Nasdaq and S&P 500 had their worst single-day falls in percentage terms since 2022 after U.S. technology stocks sank.

The Pound to Euro exchange rate eased back to 1.1890 after some hot air was released from the AI market hype. The Pound to Dollar rate is now comfortably below 1.29 at 1.2884.

"Markets saw a massive slump yesterday, as the combination of weak earnings and poor data hit investor sentiment. That led to some very big losses, with the Magnificent 7 (-5.88%) posting its worst day since September 2022," says Henry Allen, a strategist at Deutsche Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The correlation between sentiment and the Pound reminds us that the UK currency is pro-cyclical and will tend to struggle against the Dollar, Yen, Franc and, to a lesser degree, the Euro when sentiment deteriorates. However, it tends to outperform high-beta currencies such as NOK, SEK, AUD and NZD.

"The British pound has fallen for three days on the trot versus the US dollar, has snapped a three-day winning streak against the euro and is being crushed by the rally of the Japanese yen – with GBP/JPY down a massive 5% in just 10 trading sessions. Sterling is trading stronger versus the Australian and New Zealand dollars though, in a sign that global risk aversion is gripping markets," says George Vessey, Lead FX Strategist at Convera.

Tech stocks are under pressure, led by Tesla, which saw stocks fall 12% after presenting mixed results for the year's second quarter.

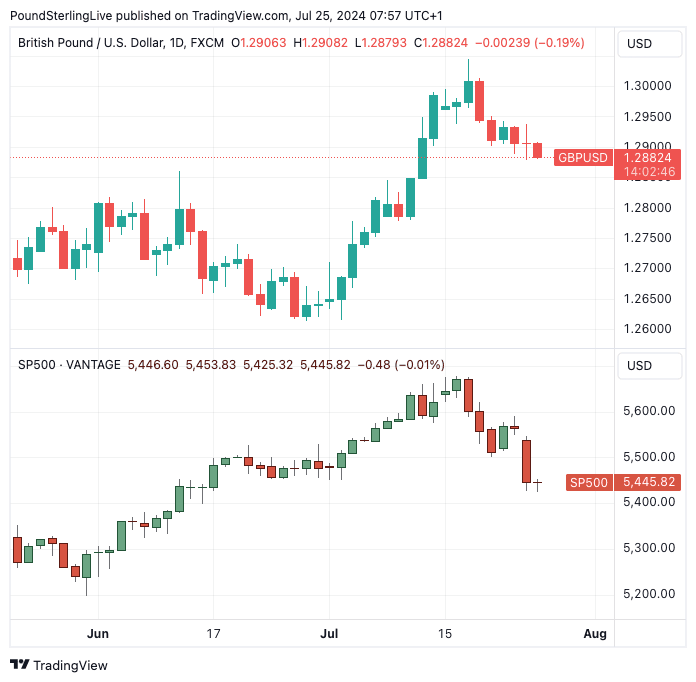

Above: GBPUSD (top) and the S&P 500.

"Equity markets were down across globe on Tuesday after results at two of the world’s largest tech stocks - Alphabet and Tesla - caused concerns that artificial intelligence isn’t yet sufficiently driving company earnings," says Shane Strowmatt, an analyst at LGT Private Banking.

The market selloff sparked in the U.S. found additional impetus in Asia after the People's Bank of China unexpectedly cut interest rates for a second time this week, causing investors to fret that authorities were aware of something the rest of us don't.

"An immediate interest rate cut would not be the normal case and would therefore create the impression that things are terribly urgent," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

This is the second time in two weeks that the Pound has been impacted by stock market jitters; last week, a combination of US-China trade concerns and a global IT shortage weighed.

China's second interest rate cut this week suggests the world's second-largest economy is struggling to deliver the growth Chinese authorities and investors expect.

The PBoC unexpectedly cut the one-year medium-term lending facility (MLF) rate by 20 basis points. The MLF cut, the biggest since April 2020, follows Monday's cuts in several benchmark rates.

"China announced an off-cycle monetary policy easing on Thursday, adding to Monday's surprise series of rate cuts, in a relatively drastic move that could counter-intuitively hurt investor sentiment," says Ewen Chew, a Reuters market analyst.

Given the strong trade ties between these countries, fears of further disappointments from China are likely to weigh on the New Zealand and Australian Dollars in particular.

We also discussed yesterday how the JPY rebound has particularly impacted NZD and AUD. This has caused the mighty 'carry trade' to unwind, which is particularly unhelpful for the Antipodean names.

The bigger question for the Pound's outlook is whether the stock market selloff is the start of a deeper downtrend or a typical counter-trend dip. After all, things would be amiss if selloffs didn't happen.

"We continue to expect the S&P 500 to recover and end the year higher at 5,900 versus the current 5,427. Easing monetary policy along with further build-out of AI infrastructure and applications should be supportive," says Mark Haefele, Chief Investment Officer at UBS Global Wealth Management.

Against this backdrop, UBS says investors should seize the opportunity from AI, seek quality growth, and position themselves for lower rates.