Hedge Funds Backing Pound Sterling at Start of 2023: CME Group Data

Image © Adobe Images

Bilal Hafeez at Macro Hive has assessed the latest data from CME Group and finds hedge funds are betting on a rally in the Pound at the start of 2023, but he cautions conviction is lower than would be typically expected.

2023 has started with a bang. There have been sharp gyrations in the euro and yen against the dollar, with no clear trend yet discernible.

Meanwhile, commodity currencies have been on a tear partly due to China exiting its zero-COVID-19 policy.

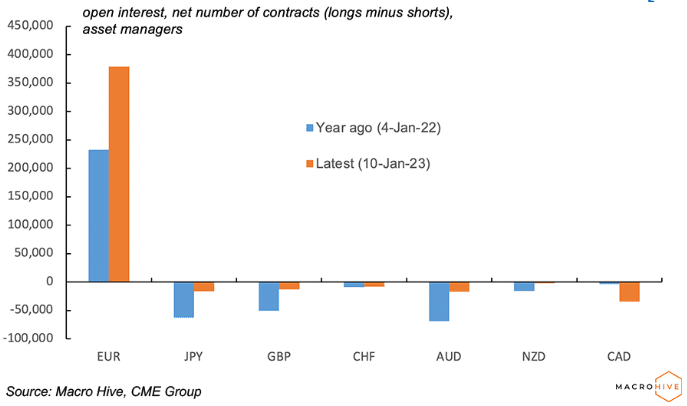

Investors have started the year with mostly smaller positions than the same time a year ago.

Hedge funds are short EUR, JPY, AUD, and CAD against USD:

Above: Hedge Funds Have Smaller Positions at Start of 2023 than in 2022.

However, they had much larger shorts in these currencies at the start of 2022 than today.

This decrease suggests lower confidence in these views.

The one big difference is that hedge funds are long GBP this year versus short a year ago.

Meanwhile, asset managers have even larger longs in EUR than a year ago:

Above: Asset Managers Have Larger EUR Positions at Start of 2023 Than in 2022.

This increase is one of only two (the other is short CAD). Elsewhere, asset managers are short all G10 FX against the dollar, though the position sizes are much smaller than a year ago.

Together, the CME Group positioning data suggests lower conviction in FX than in 2022.

A bullish dollar view appears to linger, both hedge funds and asset managers remain short most G10 FX against the dollar.

However, EUR/USD could be the most interesting currency as asset managers have large long EUR positions and hedge funds have significantly scaled back their EUR shorts from a year ago.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

This suggests investors expect a more positive euro year.

At Macro Hive we expect commodity currencies like the AUD to perform well on the China re-opening, so we disagree with investors’ shorts in these currencies.

We are more neutral on the euro as the market could be premature in pricing Fed cuts.

On the yen, we think there is a risk the BoJ could adjust its YCC policy again, so we could lean more positive on the currency.

Option Strikes

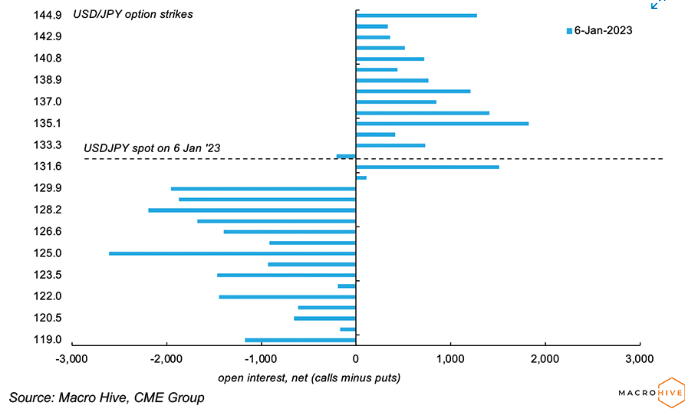

USD/JPY plunged lower in mid-December on the surprise BoJ yield curve control widening.

It traded lower at the very start of the year to 130.8 but has since bounced and appears to be in range.

CME Group positioning data suggests investors remain short JPY but less so than before. Meanwhile, CME Group data on option strikes reveals another perspective on investor bias.

Macro Hive finds the following:

There is notable net demand for USD/JPY calls around 135-136, but that demand fades at higher levels. This suggests tactical bullishness for a jump in USD/JPY:

Above: Open Interest in USD/JPY Option Strikes.

There appears to be more consistent net demand for USD/JPY puts below 130. This suggests investors expect greater risk of a sustained move lower in USD/JPY.

What to watch: outside U.S. data, there will be a big focus on the Fed and how it is interpreting more mixed data.

The next FOMC meeting is on February 1. A dovish bias would see USD/JPY lower. The other focus will be the BoJ.

Uncertainty persists as to whether the December 2022 YCC adjustment by the BoJ was a one-off or the beginning of further relaxation of the YCC policy.

The BoJ meeting on January 18 will therefore take on added significance.

FX Investor Risk Appetite

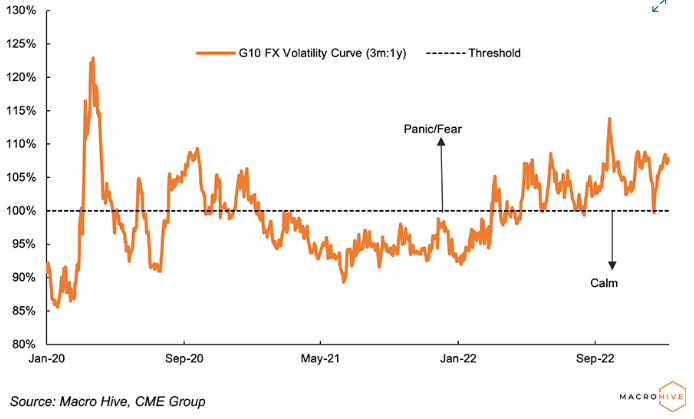

CME Group has a range of FX volatility data to help investors track the level of volatility.

We can also use FX volatility data to determine investor risk appetite.

We find the shape of the FX volatility curve useful in this regard. When shorter-dated FX implied volatility is higher than longer-dated volatility, this suggests investors are worried or in panic mode.

In contrast, when shorter-dated FX volatility is lower than longer-dated volatility, this suggests investors expect calm markets.

The latest data finds:

The FX volatility has started the year inverted. That is, shorter-term volatility is higher than longer-term volatility. Typically, this suggests investors are in “fear” mode:

We also find that CME Group’s CVOL volatility indices have been steadily rising since mid-December 2022. CME Group G5 aggregate FX index has risen to 10.4% from 8.2% in mid-December.

This tallies with the pessimistic take of the FX volatility curve.

Outside FX, both equity and rates volatility have been stable, suggesting more optimism among investors.

Overall, this suggests FX markets are nervous at the start of 2023.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes