Pound Sterling Struggling Amidst Equity Market Pullback

- Written by: Gary Howes

Image © Adobe Images

Falling stock markets are weighing on the British Pound with analysts saying an ongoing debate over U.S. interest rates appears to be behind the moves.

Global stock markets fell following comments from two prominent members of the Federal Reserve that suggested interest rates in the U.S. would stay higher than many investors have been expecting of late.

This implies further difficulties for businesses not just in the U.S. but across the world and is therefore largely supportive of the 'safe haven' U.S. Dollar.

The Pound meanwhile has a high beta to global investor sentiment - meaning it is highly responsive to broader market developments - and is therefore losing value in tandem with a down day for equities.

U.S. stock markets set the tone for Europe losses after the Fed's Raphael Bostic and Mary Daly said U.S. interest rates are likely to move above 5% and stay there.

This suggests higher interest rates over a longer period and is not currently priced by a market which still anticipates rate cuts in the second half of this year.

Relief from falling interest rates is still a distant prospect. "Weaker equity markets and mixed rhetoric from the Fed has helped to put a floor under the USD for now," says Daragh Maher, Head of FX Strategy for the U.S. at HSBC.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

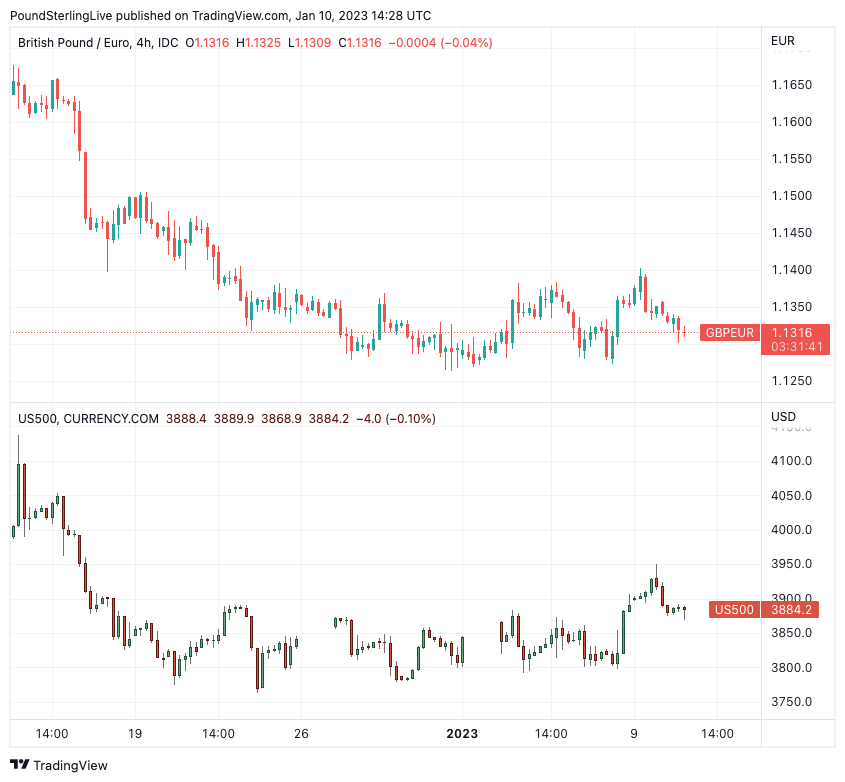

Amidst a pullback in global equities the Pound to Euro exchange rate retreated to 1.1314 having been as high as 1.1361 earlier in the day.

The Pound to Dollar exchange rate fell back to 1.2126 having been as high as 1.21975 earlier.

"It seems that the evidence of slowing wage growth and softness in the services sector is not yet enough to dissuade the Fed from pushing rates at least 75bp higher this year, even if we get there in 25bp steps from now on," says Maher.

The Dollar fell and the Pound surged higher on Friday after U.S. labour market statistics revealed softer-than-expected wage pressures in December. A survey of the U.S. service sector meanwhile plummeted and suggested the economy might now be entering a recession.

Above: GBP/EUR (top) and the S&P 500 index, highlighting the Pound's relationship with global risk sentiment. Consider setting a free FX rate alert here to better time your payment requirements.

The data was interpreted by traders as being confirmation the Fed can now afford to step back from its rate hiking cycle and even consider cutting rates in the future.

But the Federal Reserve will be cautious of not validating such expectations as it would prompt an easing in financial conditions in the economy as markets price in a future downshift in Federal Reserve interest rates.

The Fed wants to tighten monetary conditions in order to bring domestically generated inflation pressures under control, therefore a strident tone from members of the Fed's policy board should be expected until they are sure such a trend is underway.

The developments also confirm that it is events in the U.S. that are holding sway over British Pound exchange rates in the early stages of 2023.

Equity strategists at JP Morgan say in new research that a lot of the positive stories that have underpinned global markets of late (pro-GBP, USD-negative) are now already 'in the price'.

"We think the current rally will end up faded as we move through Q1. We advise taking some profits, to tactically reduce equity exposure," says Mislav Matejka, Head of Global and European Equity Strategy at JP Morgan.

Recent positive drivers include falling European gas prices, a peak in U.S. inflation and the reopening of China.

"A lot has repriced, and the market focus could turn to earnings, which are likely to be weaker, and that could contribute to market consolidation ahead," says Matejka.

If this prediction is correct, the Pound could be set to struggle against both the Dollar and Euro.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)