Euro and Pound Back Under Pressure as Europe Enters Worst-case Scenario Phase of Gas Crisis

- Written by: Gary Howes

Image © Adobe Stock

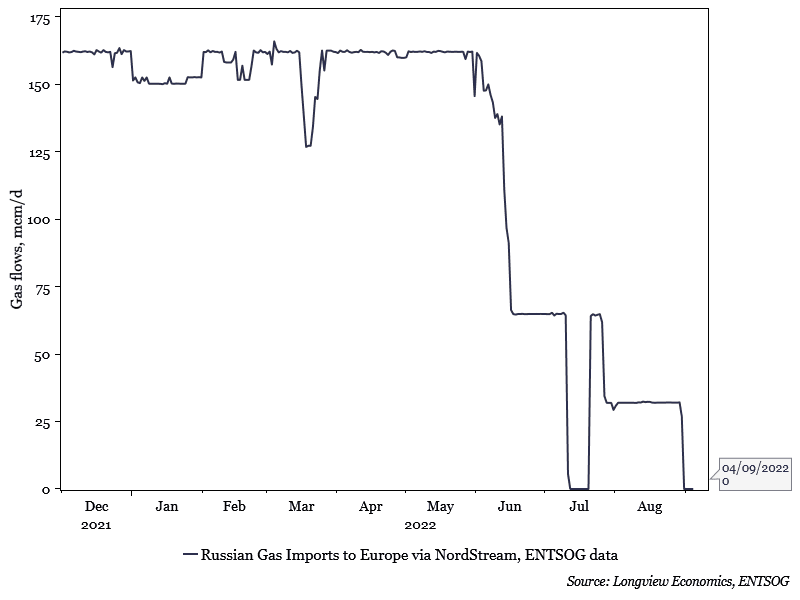

Gas prices rose Monday following Friday's announcement by Gazprom it would not restart the supply of Russian gas to European markets.

European gas benchmarks were up to 20% higher on Monday, as was the UK benchmark, but still well below recent highs.

The Euro fell to its lowest levels against the Dollar in 20 years, while the Pound fell to its lowest level since March 2020 as investors anticipated a negative hit to regional economic growth as a result of the price rises.

Gazprom had pre-announced a three day maintenance shutdown to Nordstream 1 for the end of August, but it announced Friday the shutdown would now be indefinite.

Above: The end of Russian gas has arrived. Image courtesy of @Lvieweconomics.

It cited technical issues for the decision but the reality is this is almost certainly Russian retribution for Europe's ongoing support of Ukraine.

The Gazprom decision followed closely a G7 announcement that they had reached agreement on capping Russian oil prices on a global scale.

"Europe's energy crisis has lurched into another critical phase after the indefinite shutdown of the Nord stream pipeline. These are the worst case scenario fears that European leaders had been bracing for," says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

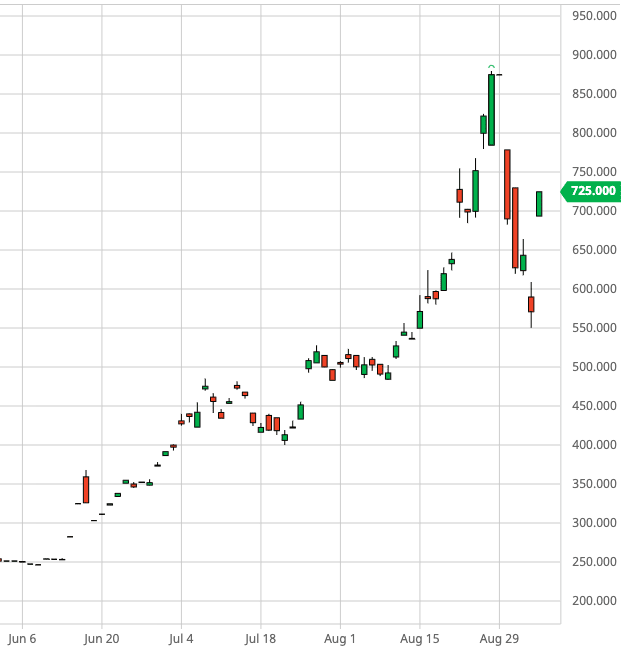

Above: UK natural gas prices for December delivery. Source: Barchart.

The Euro to Dollar exchange rate pierced 0.99 to test a low of 0.9878 before returning to 0.9913 at the time of writing. This takes euro payment exchange rates to around 0.9637 at major high street banks. Quotes at around 0.9885 are offered at independent payment specialists.

"The shortage and rising costs of crucial imports, above all energy and other raw materials, worsen the fundamental outlook for the euro," says David Alexander Meier, an economists at Julius Baer.

The Pound to Dollar exchange rate sunk to a low of 1.1442 before returning to 1.1475 at the time of writing. Banks are offering dollar payment rates at around 1.1246 and independent providers at 1.1440.

Nathan Piper, an oil and gas analyst at Investec, said he now expects record gas prices across UK/Europe this week as the impact of long-term restrictions of Russia gas supply is absorbed by the market following the indefinite shutdown.

But, gas prices did not spike back to their previous records, suggesting the worst-case scenario might already to a degree be factored into the market.

"TTF natural gas prices are not back to highs despite Russia shutting down Nord-Stream 1," says Andreas Steno Larsen, Director at Heimstaden. "The worst-case scenario is already priced in".

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Gas prices had shot to record highs this summer amidst frenzied demand by European states to fill gas storage facilities ahead of winter.

But these are now largely full, lessening the need for sovereign-backed buyers to buy gas at any quoted price.

The onset of Autumn meanwhile sees electricity demand for cooling fall back, just as wind flow increases across Europe, powering wind turbines.

If the worst-case has been realised, what is left to fuel the frenzied buying of recent weeks?

Although the peak in gas prices might have passed, the prospect of a period of elevated prices does however look set to endure, which could dent the Euro's recovery potential going forward.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks