Pound Sterling Outlook: The War in Ukraine Could Stall the UK Economy Later in 2022

- Written by: Gary Howes

- Sizeable indirect impact of Ukraine war looms for UK

- Consumer spending downturn forecast

- Could weigh on GBP

- Particularly against USD, AUD, CAD and NZD

- But seen better supported against EUR

Image credit: Rajatonvimma / VJ Group Random Doctors. Sourced: Flickr. Licensing: Creative Commons.

The British Pound will likely remain supported against the Euro and other European currencies as long as the conflict in Ukraine continues, but a significant hit to the UK economy is likely say economists and this could leave the currency vulnerable to the U.S. Dollar and commodity currencies.

The UK economy has little direct exposure to Russia and is therefore relatively immune to the sanctioning of Russian assets and associated economic decline, but the impact of rising commodity prices will be severe say economists.

European natural gas prices rose to a fresh all-time high, rising by more than 75% at one point on Monday with the European benchmark TTF goingg above €345 per MWh.

UK gas prices for April delivery opened the week at 610p/therm which Economist Simon French at Panmure Gordon says represents a thirteen standard deviation move.

"No economic modelling conducted in recent months will be capturing the rotation in spending power away from UK households," says French.

The AA and RAC reported UK forecourt fuel prices now average £1.55 a litre for petrol with the BBC reporting industry leades are ready for prices to head above £1.70.

Economists at ING Bank say UK inflation is set to stay above 6% for most of 2022, and that means consumer spending will struggle to avoid a downturn later this year.

"The Bank of England is still squarely focused on curtailing higher inflation, though we think policymakers will hold off on further hikes once the Bank Rate reaches 1% in May and growth risks build," says ING's Global Head of Macro, Carsten Brzeski.

This could result in a 'two-speed' Pound Sterling in 2022: one that advances against European currencies but struggles against safe havens and so-called commodity currencies.

"We see GBP as remaining moderately better positioned vs. the EUR in the coming months as long as the crisis deepens and Russia’s pariah status persists. The GBP, however, is likely to remain on the back foot vs. commodity currencies," says Jane Foley, Senior FX Straegist at Rabobank.

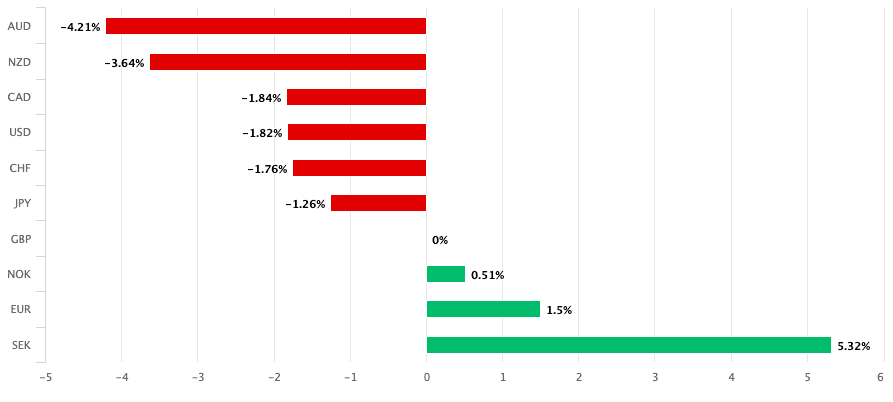

Above: GBP performance vs. G10 over past month. GBP is performing better than European currencies but lags safe havens and commodity currencies.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"The war in Ukraine and the associated spike in energy cost means a growing risk that the UK will enter a consumer spending downturn. It's early days, but we’ve revised downwards our forecasts, and quarterly growth rates are likely to hit zero later this year," says James Smith, Developed Markets Economist at ING.

Rising gas and oil prices are the greatest source of contagion from the war that the UK economy faces.

"We hiked our forecast for the peak rate of CPI inflation in April to 8.0%, from 7.7%, and our Q4 forecast to 6.7%, from 5.5%, due to the resulting surge in energy and food prices," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Russia and Ukraine are significant wheat exporters and the war will inevitably push up the price of this staple and food in the UK and globally.

Wheat prices are now the highest they’ve been since the financial crisis.

"It is the sharp rise in commodity prices, both in terms of energy and softs such as wheat which are most visible and which will push up inflation. This could exacerbate the current cost of living pressure," says economist Ryan Djajasaputra at Investec.

- Reference rates at article's last update:

Pound to Euro: 1.2063 \ Pound to Dollar: 1.3124 - High street bank rates (indicative): 1.1825 \ 1.2857

- Payment specialist rates (indicative): 1.2000 \ 1.3060

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

Jane Foley, Senior FX Strategist at Rabobank says even though Russia’s energy sector have not directly been hit with sanctions, its exports are being shunned.

"This may be in part a reflection of difficulties with underwriting shipping in the region or the reluctance of banks to finance Russian trade flows. Either way the lack of demand for Russian energy and concerns about the provision of wheat and other agricultural outputs from the Black Sea region is equivalent to a supply shock given the increased interest in the output of other commodity producers," says Foley.

Pantheon Macroeconomics says the real disposable income of UK households now looks set to fall this year by around 2%, making for the largest fall since World War Two.

"This will slow the recovery in real consumption to a near-halt," says Tombs. Pantheon Macroeconomics revises down their forecast for year-over-year growth in GDP in 2022 to 3.6%, from 4.2% previously.

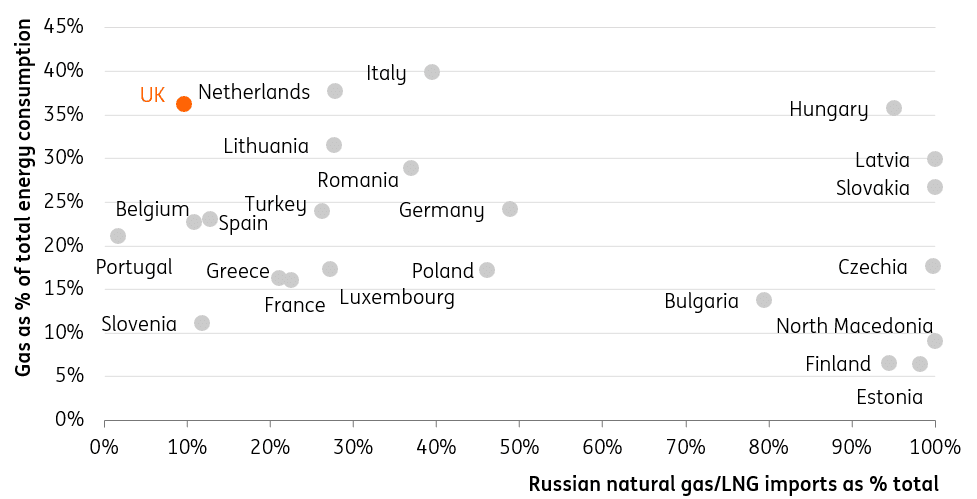

Above chart showing relative dependence on Russian gas. Source: ING.

Economists at Validus Risk Management warn that the situation might only be set to get worse before any relief in the commodity sector appears.

"While these rallies seem impressive coming on the heels of a commodity cycle that started nearly a year and half ago, in our view should the Ukrainian situation last, or unfortunately worsen (the most probable scenario in our view), then the rally we have seen might be just a small teaser of the massive spike higher which would be ahead of us," says Kambiz Kazemi, Chief Investment Officer at Validus Risk Management.

Validus says the markets are so far not considering the risk of a "super spike" scenario which will likely shock many investors and has tremendous implications on food and goods prices.

The downside risks to the UK economy are significant and how the Bank of England navigates an incredibly difficult situation that sees rising inflation but slowing growth will be instrumental.

The rule of thumb remains that were the Bank to step back from raising rates then Pound Sterling could struggle.

Expectations for the number of interest rate rises to come out of the Bank of England in 2022 have fallen notably over recent days, largely in line with the onset of intense geopolitical uncertainty caused by the war in Ukraine.

As of February 22 there were 134 basis points of Bank of England hikes priced for 2022 in OIS markets, a money market that serves as a gauge of investor expectations for future rate hikes.

But as of the end of February those expectations had fallen to 126 basis points and as of the first of March they had fallen yet further to 111.

"Another ramification of the ongoing conflict was that investors continued to price out the more aggressive reaction functions from central banks they’d been expecting before the invasion," says Jim Reid, an analyst with Deutsche Bank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

But it was a near-consensus opinion amongst foreign exchange strategists that the hefty amount of rate hikes expected by investors was an achilles heal to the Pound's outlook: most saw little realistic chance that the Bank could ever meet such expectations.

Indeed, members of the Bank's Monetary Policy Committee said that based on the elevated market pricing inflation would fall below the 2.0% target over the course of the forecast horizon (two years) while unemployment would rise.

The reduction in rate hike expectations could therefore remove some of this overcooked pricing, offering a little more clear air ahead for Sterling bulls.

That the Pound to Euro exchange rate has risen to its highest levels since October 2016 while also losing this rich rate hike pricing is supportive of further upside for this pair in particular.

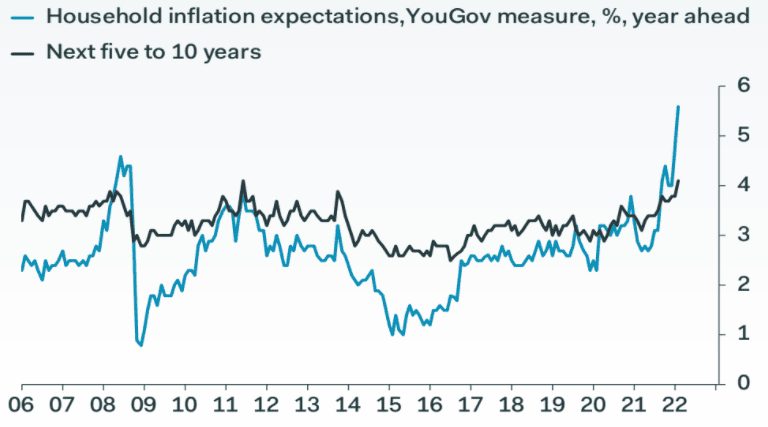

Above: UK inflation expectations leapt in February - Pantheon Macroeconomics.

The Pound however looks vulnerable against the Australian and New Zealand Dollars.

As noted here, New Zealand and Australia don't appear to be as at risk of stagflationary conditions as do the UK and Eurozone. As such, their yield curves are sloping higher in a supportive direction for their currencies.

The U.S. Dollar meanwhile remains supported by its safe-haven status and could keep Pound-Dollar at bay for as long as global geopolitics remain uncertain.

But the Pound-Euro rate could remain supported.

ING's Foley says the Pound is neither a safe haven nor as exposed to the ramifications of the conflict as the Euro or the Krona.

"We see GBP as remaining moderately better positioned vs. the EUR in the coming months as long as the crisis deepens and Russia’s pariah status persists. The GBP, however, is likely to remain on the back foot vs. commodity currencies in the current environment," says Foley.

Analysis from ING Bank N.V. finds the war in Ukraine could dampen the pace of the recovery in the eurozone, while inflation is likely to be close to 4% for the year.

As a result economists say the European Central Bank will have more trouble navigating through the storm, though they still expect an end to quantitative easing in the third quarter and a first rate hike towards the end of the year.

"It is hard to see the ECB wanting to start normalising monetary policy at such a moment of high uncertainty," says Brzeski.

These developments pose further downside risks to the Euro.

"War in Europe has understandably taken its toll on currencies in the region and the implementation of Russian sanctions now questions the rouble’s deliverability. Pressure is building for a sizeable break in EUR/USD below 1.10 this spring," says Brzeski.

Money markets show investors are reconsidering the prospects for rate rises at the European Central Bank this year.

"Having previously priced in the prospect of rate hikes in Q3 and Q4, which we had already believed to be too aggressive, markets are now only factoring in around 30bps of tightening by the end of the year as opposed to 50bps previously," says Investec's Djajasaputra.