The Untold Story of Pound Sterling's Steamrolling Rally

- Written by: James Skinner

- To a more multilateral reserves basket & one impeded by ECB et al.

- Fears about FX effect on inflation requires dance around EUR TWI.

- Bigger share & big bid for undervalued GBP offers a viable solution.

- As UK recovery prospects stand out, BoE indicates City's door open.

- Toscafund forecasts 1.60 Vs USD & 1.30 Vs EUR this year for GBP.

Image © Adobe Images

- GBP/EUR: spot rate at time of writing: 1.1580

- Bank transfer rate (indicative guide): 1.1276-1.1357

- FX specialist providers (indicative guide): 1.1407-1.1500

- More information on FX specialist rates here

The Pound has confounded expectations with sharp gains over all major rivals until Thursday, leading to much head-scratching in some parts and prompting Pound Sterling Live to draw on the buy-side expertise of Toscafund Asset Management to tell the untold story of the steamrolling 2021 rally.

Pound Sterling was lower against most currencies including the Euro on Thursday and following a partial dissipation of another surge that took place during the early hours of Wednesday morning in Asia.

Meanwhile, Euro-Dollar was back above 1.22 for the first time since January while trading higher against all other major rivals also, which is even more noteworthy in light of Sterling's recent surge and for reasons explained below.

"As you say, the PBOC are navigating expertly under the radar," says Dr Savvas Savouri, chief economist and partner at Toscafund Asset Management, responding to questions from Pound Sterling Live. "Still plenty of time for sterling to reach at least 1.30 euros before 2022 and at the very worst; 1.60 for cable."

The Pound had rallied from around 1.4140 against the Dollar to nearly 1.4250 and a fresh three-year high, solidifying at the time the Pound-to-Euro exchange rate's move above 1.16 and almost enabling it to reach the 1.17 handle and Pound Sterling Live's own once-weekly "armchair" projection.

Many attempts have been made to explain the above moves but underappreciated as a driver of the rally - and a key reason why many seemingly more attractive currencies have struggled to keep the Pound suppressed in 2021 - is the role likely played by central bank reserve managers and notably those at the People's Bank of China (PBoC).

Above: GBP/USD at 4-hour intervals with GBP/EUR (red), GBP/CNH (orange) and CNH/USD (green).

The PBoC's desire, if-not need to diversify out of the U.S. Dollar is widely understood in the market and a frequently-held assumption. It's prominence here doesn't preclude the possibility of other central bank flows from either reserve accumulation or recycling having influence on Sterling, which has been noted by analysts this year, although not all central banks are created equal and there are reasons for why China specifically might be making some changes.

Included here is the legacy of Washington's use of the U.S. settlement system as a foreign policy tool, which has damaged the Dollar's standing in some facets of life as a dominant reserve currency, along with the trade war and not to mention the longstanding economic plans of China's government.

These are all part of why Toscafund, a London based multi-asset hedge fund with around $4 bn under management, has been looking for the Pound and UK's share in the PBoC's basket to increase. However, for Sterling this was always if anything going to be a 2021 story, given that until January it had been weighed down by Brexit-related market fears, even if it is possible that the PBoC has been a seller of Dollars and a buyer of Euros for a while now.

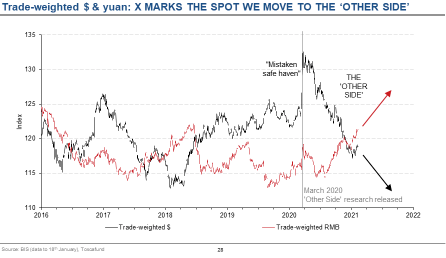

"Beijing has after all been systematically disintermediating the dollar from its commercial and financial system. It has: signed currency swap arrangements all over the world; run down its Treasury holdings, by spending them on assets around the world and adapted its yuan management from a strict bilateral approach relative to the dollar, to a multi-currency one," Savouri told investors in December. "We are FAST approaching the moment the trade weighted levels for the dollar and the yuan CROSS (the X-in Chart 1), doing as Beijing opts to finally focus on the purchasing powers of its own population rather than those of the export markets it hitherto relied upon."

Source: Toscafund Asset Management. Click for a closer inspection.

Irrespective of that however, and in a world where the European Central Bank (ECB) is citing a 10% Euro-Dollar rally in the year to January as the foremost factor that keeps it up at night, China was always going to struggle to buy any more Euros without buying a bucketload of Pounds first.

This is in part because on almost all other sides of the trade-weighted Euro there is a central bank that has been complaining about increases in its exchange rates and the impact they could have on inflation targets which if not ever-elusive, have almost all become harder to reach in recent years.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

They, just like the ECB, have been pushing back against currency strength and all while Sterling traded near to historic lows against many major counterparts.

"When Beijing shocks the dollar down against the yuan, it is very likely that it ensures the yuan moves up far more slowly against the other constituents of the weighted basket it is now managed against. It will act in this way to mute the yuan’s overall trade-weighted appreciation. To achieve this I have no doubt the PBOC will actively buy the currencies it wishes to temper the yuan’s ascent against, and accumulate them as foreign reserves," Savouri wrote.

Source: Toscafund Asset Management. Changing composition of PBoC reserve basket. Click for a closer inspection.

The PBoC would be compelled to buy Euros in order to achieve any diversification at all, and not just because of the Titanic sizes of the European and U.S. currencies: The central bank conundrum elsewhere in the major currency space also prevents it from buying much of anything else without buying Euros too. Mathematically, the only solution to this is one that creates headroom for EUR/USD to rise without lifting the trade-weighted Euro at a pace or to an extent that's an issue for the ECB.

The Yuan was 17% of the trade-weighted Euro and the Dollar some 20% while the undervalued British currency was 15% as recently as 2018. Meanwhile, the European and U.S. currencies are significant components of China's own trade-weighted basket, while Sterling is only a low single digit share.

These factors mean the PBoC, which had $3.2 trillion of reserves in January according to the State Administration of Foreign Exchange, was always going to struggle to buy much from last month without first picking up a bucketload of Sterling. The Pound's large share of the trade-weighted Euro combined with its Brexit-related undervaluation mean that increasing its share in the reserve basket is a real solution to potentially big problems.

"I have never doubted how foreign exchange markets, or rather those active in them, are highly risk averse and so stubbornly reactionary. This accepted those involved in speculative FX trading are soon sure to witness a considerable uplift in real transactional demand for sterling," Savouri said in December. "When FX markets are shocked, as they inevitably will be, by the weight of this arriving capital, it will force them to react by reappraising the price of sterling. In short, either the pound quickly becomes unstuck, or foreign exchange traders will."

Source: European Central Bank. Click for a closer inspection.

Pound Sterling Live believes a PBoC bid is exactly what it's witnessed, and increasingly since February 04 when the Bank of England (BOE) as-good-as said that the City of London's doors are open in this regard.

"The unleashing of - what when the time comes to unlock, will amount to at least – c. £300bn savings, is the cornerstone for my confidence in a swift UK economic recovery, as measured by GDP and reflected in a rapid and widespread labour market rebound," Savouri says. "As well as reflating the price of goods and services, enforced savings will be deployed into lifting asset prices, not merely UK properties but equities too. Households and investors will not however have it all their own way in this regard. Rather than enjoying monopsonist power, we will find that our properties and equities will become highly sought targets by those overseas."

{wbamp-hide start}

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

Recovery prospects, their impact on the interest rate outlook and the BoE's steady hand in the face of rising exchange rates are all part of the 2021 picture for Sterling, and big factors in Savouri and Toscafund's forecasts for the Pound-Dollar rate to rise to 1.60 and the Pound-Euro rate to 1.30.

"I believe the MPC will vote sooner than the consensus expects to lift the base rate," Savouri writes in a February note. "I am writing here of a shift up to say 0.25%, before then 0.5% and ahead of the end of 2022 back up to its pre crisis 0.75%. Such calculated moves should not however be viewed as cause for concern, but rather a vote of confidence in the health of the UK economy."

A GBP/EUR recovery to 1.30 from around 1.12 in January would create nearly 2% worth of headroom in the trade-weighted Euro. This would be enough to enable EUR/USD to rise 5% from 1.21 to 1.27 and for the Euro to also appreciate against other smaller European counterparts, thus aiding a broader collection of central banks. EUR/USD is 20% of the Euro TWI.

Source: Toscafund Asset Management. Covered rate parity fair values for GBP Vs EUR, USD. Click for a closer inspection.

The UK has had less trouble than others in generating the 2% annual inflation coveted by many central banks in the developed world, as was noted by BoE Governor Andrew Bailey in a February speech to LSE's German Symposium, and market-based measures of inflation expectations are pointing to 2% at the other end of the forecast horizon.

Some of Governor Andrew Bailey's latest words on the subject offer insight that may be highly pertinent here, given that rising exchange rates give insurance at the other end of the forecast horizon by cheapening imports, while helping the ECB in an ongoing battle by raising at the margins, the cost of goods coming from its third largest market.

"Responding to a shock of this scale has led to debate around what it means to be an independent policymaker. This debate is misplaced – the focus must be and always is on the inflation target, the outcome,” Governor Bailey said, after remarking: “The challenge for monetary policy in many countries has shifted from one of getting inflation down to target, to one of getting it up to target. This has been less marked for the UK, in part because in a more open economy exchange rates have tended to raise inflation...expectations in the UK have not become de-anchored or more volatile, despite the greater economic volatility. But this shift has required central banks to be somewhat more flexible in the way we go about seeking to hit the inflation target, and the tools we use to do this".

Many analysts have become attuned to this since February 04 and some have even gone as far as to bet on further outperformance by the Pound, but none went as far as to suggest that a lift in GBP/USD to 1.43 and GBP/EUR to 1.17 would be seen by the end of February or soon after.

Pound Sterling Live did however, and explained why in it a speculative op-ed on February 12 after observing what it perceived to be the PBoC's activities from January 31. These numbers had at their foundations the assumption the PBoC needed to create scope for EUR/USD to rise this year without lifting the trade-weighted Euro too far or too fast for the ECB.

Above: The Euro inflation trade using GBP/USD & GBP/EUR as automatic stabilisers. EUR/USD shown in orange.

This would require GBP/EUR to rise to within a 1.17-to-1.20 range imminently, ahead of further gains later this year, although a more important implication at this stage is that rather than the EUR/USD rate being over and done with for 2021, the single currency could actually have scope to rally from here. But this would also mean that playing out alongside the connected UK vaccination campaign and the improving BoE outlook is almost certainly the story of an FX reserve diversification away from the U.S. Dollar.

This means, among other things, that it may not be coincidence that with the rally in Sterling aside the top story in all things financial of late has been the ongoing sell-off in the U.S. bond market and associated surge in yields. Some have worried about the impact rising yields could have on global stock markets.

"I believe the dollar is on the cusp of losing its exorbitant privilege as the world’s foremost reserve currency." Savouri says. "Without the need to keep the yuan artificially weak against the US dollar, Beijing will no longer need to accumulate and hold dollar paper. The consequence is chillingly simple enough to foresee; a rout in the Treasury market. Whilst this will have unwelcome consequences to parts of the world holding Treasury’s, the most dramatic impact will be felt within a United States where, for the first time in a very long time, the Federal Government will have to live within its own fiscal means, rather than rely on being handed the world’s wealth to save.”

It will be six months before the relevant data for the first quarter is made available, and even then the figures are aggregate global data rather than individual country numbers, but the Composition of Official Foreign Exchange Reserves (COFER) report published by the International Monetary Fund (IMF) will eventually provide clues as to whether Savouri was right last year and if Pound Sterling Live is correct in its observations this year.

At the last update in December, covering the third quarter of 2020, Sterling saw little increase beyond that explainable by valuation while China's $3 trillion reserves were equal in January to roughly 25% of the global basket reported previously. Pound Sterling Live suspects the 2021 reports will attract a lot of attention. Data published thus far and in future is found here.

Source: Composition of Official Foreign Exchange Reserves (COFER) report, the International Monetary Fund (IMF).