Pound Sterling in Central Bank Bid as Peoples' Bank of China Eyes Win-Win Cooperation

- Written by: James Skinner

- GBP/USD, GBP/EUR eyes 1.43 &.1.17, aided by PBoC.

- FX market flows eye win-win cooperation on EUR TWI.

- After FX disrupts economic stabilisers in EU, CN et al.

- PBoC diversification, FX market's dysfunction key now.

Image © Adobe Images

- GBP/EUR: spot rate at time of writing: 1.1392

- Bank transfer rate (indicative guide): 1.1098-1.1178

- FX specialist providers (indicative guide): 1.1226-1.1317

- More information on FX specialist rates here

The Pound remained the outperformer for 2021 Thursday, after being aided by the People's Bank of China (PBoC), which may need to lift GBP/USD to 1.43 and GBP/EUR to 1.17 in February or just after if it's activities are to be conducive to the win-win cooperation Chinese diplomats are renowned for.

Chinese foreign exchange reserves managers may be indicating great consideration for the inflation-targeting objectives of their contemporaries, and much more so than many other FX investors, which has been observed by the author over the course of the past week.

Price action in Chinese exchange rates has at all times been consistent with a desire among reserves managers to ease the upward pressure on the Eurozone's trade-weighted index (TWI) measure of exchange rates. Not at any point in this period has Pound Sterling Live observed an instance where USD/CNH has done anything that would adversely prejudice the trade-weighted Euro, while in many, it has moved to offset adverse impacts coming from elsewhere in Europe's exchange rate complex.

The implication is that, despite its already large rally thus far, Pound Sterling could have further to run this month and if-not then, soon after. This is likely in part because there's little enthusiasm in the market for the Dollar, amid an ongoing depreciation that some analysts say will include a PBoC reserve diversification away from it, although any further rise in the short-term would also be one half because the Bank of England (BoE) has upside risks to its inflation target at the long end of its forecast horizon.

Above: GBP/USD, EUR/USD (orange), GBP/EUR (blue), EUR/CNH (yellow) and USD/CNH (purple).

Shows: Euros sold for Dollars, and Dollars sold for Pounds while Dollars are also sold for Yuan; lifting GBP/EUR while bearing down on EUR/USD and EUR/CNH.

The above graph is very cluttered and many readers won't necessarily understand what it shows, but it is the case that when the exchange rates pictured behave as they have over the period in which they have, and with the systematic consistency that they have; the chart becomes near-photographic evidence of either the author's argument, or a market bid that indicates an form of automatic stabiliser seeking to keep the trade-weighted exchange rate from extinguishing the Eurozone's inflation pulse.

An acceleration in the Pound-to-Euro rate would give Governor Andrew Bailey and colleagues insurance against any move above the inflation target over a one-to-two year horizon because it would take place for Sterling against the currency of its largest import provider, while Europe's unit would fall against that of its third largest market. This would lift the cost of imported goods and may have an upward impact on inflation over the same period, helping the European Central Bank (ECB) in an ongoing battle.

"Responding to a shock of this scale has led to debate around what it means to be an independent policymaker. This debate is misplaced – the focus must be and always is on the inflation target, the outcome,” Governor Bailey said in conclusion to LSE’s German Symposium last Friday, after earlier remarking: “The challenge for monetary policy in many countries has shifted from one of getting inflation down to target, to one of getting it up to target. This has been less marked for the UK, in part because in a more open economy exchange rates have tended to raise inflation...expectations in the UK have not become de-anchored or more volatile, despite the greater economic volatility. But this shift has required central banks to be somewhat more flexible in the way we go about seeking to hit the inflation target, and the tools we use to do this".

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Recent price action comes after the Yuan's relationship and beta to the Euro began to wane in following a warning from ECB President Christine Lagarde, who said on January 13 that she and other policymakers are "extremely attentive" to EUR/USD. This was as the exchange rate traded up to 1.2250 and its highest since 2018, but also following a growing number of other attempts by Frankfurt to discourage the market from bidding the Euro higher too quickly.

Since then the main Chinese exchange rate has moved in a manner that is indicative of a strengthening relationship between the Yuan and Pound. The Pound is the top performing major currency of 2021 in part due to earlier Brexit-inspired underperformance and now expectations of an economic recovery that comes sooner than in Europe or elsewhere, largely because of a faster rollout of coronavirus vaccinations. However, last week and earlier in January Sterling looked to have gotten a new admirer.

Thursday was somewhat an exception and it's possible the PBoC's bid will now be less evident in the week ahead - the Lunar New Year holiday in China - although there's at least two compelling arguments for why the bank would be on a shopping spree in the City of London and likely to remain so in the coming weeks. First and foremost, China's desire, if-not need to diversify out of the Dollar and into other currencies is a widely held assumption in the market.

Above: The Euro inflation trade using GBP/USD & GBP/EUR as automatic stabilisers. EUR/USD shown in orange.

China had $3.2 trillion of foreign exchange reserves this January, according to the State Administration of Foreign Exchange. With the Yuan aside, the Euro is the largest rival to the Dollar and so may already have benefited alongside many other currencies from a diversification, although to the extent that it is yet to; that might not be possible in light of the recent if-not current level of the Euro relative to major trade partners' currencies. Especially those it imports from.

The level of the currency has made overseas goods cheaper to buy already and may incentivise GDP-negative imports, all the while threatening to see falling consumer prices undermine the ECB's effort to lift inflation to its target of "close to, but below 2%". The ECB has long struggled to reach that but with the global economy weaker as a result of the pandemic, it could now find the going more difficult, even without the impact of rallying exchange rates kicked up by an over-enthusiastic market.

A rallying Euro is the result of a falling Dollar and both are a problem for the ECB, PBoC and many other central banks. This is where the Chinese approach of seeking "win-win cooperation" and the diversification into Sterling marry well into the second argument. With a 15% weighting in the TWI, Sterling is significant enough for a GBP/EUR rally to create scope for the PBoC and the market at large to buy more EUR/USD, but not significant enough for this to happen without a decent sized rally.

Curiously, there is a precedent for this happening when EUR/USD rallies are objected to by the ECB. Each is now as predictable as the other, evidenced when Pound Sterling Live foretold the ECB's most recent bout of concerns on August 14, weeks before the bank itself actually spoke. That makes this both a recurring vulnerability, in addition to an opportunity for those bullish on the Euro, or bearish on the Dollar.

Forecasters and speculative investors frequently disregard the challenges faced by the ECB and other policymakers around the world to kick up currency trends that run counter to central bank objectives. The author suspects that a possible coordinated attempt to rehabilitate the market could be a major theme in 2021. Europe's economic ailments mean the Euro is unable to appreciate sustainably over anything less than a marathon, but it mostly rallies in what are effectively sprints, while the market inevitably disregards the ECB's expressions of concern just the same as with other central banks.

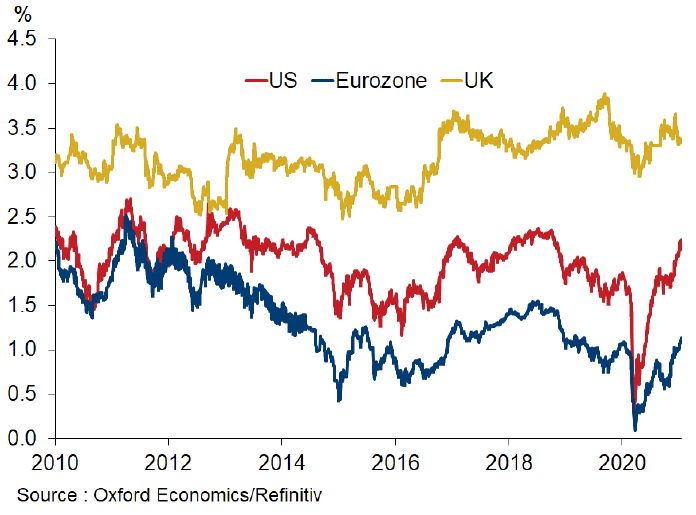

Above: Oxford Economics graph shows 5-year inflation swaps. Shows excess inflation pressures in UK and GBP, on target pressures in U.S. and USD, against inadequate inflation supply in Eurozone and EUR.

At the heart of all of this is a somewhat dysfunctional and recurring misallocation of inflation, a resource that despite recent headlines is really of almost a systemic scarcity, through the trajectory of exchange rate trends. Currencies like the Pound and U.S. Dollar, which are underwriting economies where inflation pressures are not in major deficit or subject to erosive exchange rate trends, are often sold further into an inflationary depreciation while the likes of the Euro continue to receive disinflationary tailwinds. For a market that purports to want higher interest rates and yields it sure doesn't always look like that.

In this instance that makes it difficult for the PBoC to buy more Euros without increasing its allocation to the Pound first, and likewise with the broader FX market, because doing so would exacerbate upward pressure on the Eurozone's overall exchange rate without an offsetting reaction in a suitably sized other part of it. However, it might also be the option which appeals because sending flows in the direction of Sterling enables it to continue diversifying without upsetting contemporaries. It wouldn't be prejudicing a public policy objective, as it was in Europe. This might be a commonly extended courtesy, if-not rule of the road in reserve management, and then it might not be. Pound Sterling Live has entertained the idea that when President Lagarde said she was "extremely attentive" to EUR/USD, she might've been politely asking the PBoC to go away!

On that note, and at risk of taking it out of context, Governor Bailey of the BoE had the following to say this week; "The UK’s financial markets and its financial system are therefore open for trade to all who will abide by our laws and act consistent with our public policy objectives."

If so EUR/USD may be a frustratingly boring place for traders to be spending their time over the coming weeks, while there's a bit of a party in Sterling. This would be necessary for another reason too; ensuring automatic stabilisers (exchange rates) of major economies are able to function while the popular view of a further Dollar depreciation is played out. The Euro and correlates need to rise if the Dollar is to fall meaningfully, given their sizes, yet this isn't possible without further upside for Sterling.

Around 22:00 in London, on Sunday 31, January, which is the beginning of the FX week in Asia, the automatic stabilisers of both Chinese and Eurozone economies appeared to malfunction until an apparent intervention corrected the problem. This was both the Titanic Euro's inability to appreciate at all in trade-weighted terms, combined with misplaced bearishness on Sterling, which was keeping GBP/EUR suppressed and sabotaging the EUR/USD rally that many of the Sterling bears have also been flogging. Like a postmortem horse.

Above: GBP/USD, EUR/USD (orange), GBP/EUR (blue), EUR/CNH (yellow) & USD/CNH (purple). Stabilisers malfunction.

Previous patterns of price action suggest it's not a good idea to be looking for the Pound to do little while the Euro rallies against the Dollar at a time when the ECB's complaints are becoming louder and more frequent. There aren't many other currencies that can deflate the trade-weighted Euro, and there aren't any others of those which have lagged the Euro to the degree that Sterling has during recent years, which might make it a natural if-not good candidate for appreciation anyway.

Europe's nominal effective exchange rate (EER), a benchmark of all the Euro rates, fell by around 1.2% from 122.92 to 121.63 between January 06 and February 08, thanks largely to declines against the Dollar, Pound and Yuan. But this still leaves the EER around levels that prevailed in September when the ECB first began to make its objections known, and the Euro had crept higher against the Dollar, Yuan and Sterling between February 08 and Thursday, albeit that it hadn't returned to earlier highs.

Sterling could give the Euro 1% worth of headroom in its trade-weighted index and the Euro-Dollar rate upside to as far as 1.2780 later in the year, although it would need to rise more than 6% to around 1.20 in order to do so and that could take some time. However, the author suspects that a 1.15-to-1.17 range is achievable this month. Even with EUR/USD near 1.22, Sterling would test 1.15 as GBP/USD crosses the nearby 1.40 level and would achieve 1.1740 upon any GBP/USD contact with 1.43.

A further short-term rally in Sterling is ointment for the problems of many central bankers not limited to the PBoC, ECB and BoE. It's the only way the EUR/USD rally can continue and for the ECB to avoid upsetting U.S. Treasury Secretary Janet Yellen. Meanwhile, if the Euro remains on its feet, the Dollar could rise against other smaller currencies and help to counter unhelpful currency market trends burdening central banks in other parts of the world.

Above: The Euro inflation trade using GBP/USD & GBP/EUR as automatic stabilisers. EUR/USD shown in orange.