S&P 500 Must Rally if Sterling is to Trigger Fresh Highs

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1388 | GBP/USD: 1.3789

- Bank transfer rates: 1.1170 | 1.3495

- Specialist transfer rates: 1.1300 | 1.3685

- More about bank-beating exchange rates, here

The British Pound was treading water against the Euro, Dollar and other major currencies ahead of the weekend as investors called a pause to the currency's strong 2021 run, but should global stock markets rally then further advances will be possible.

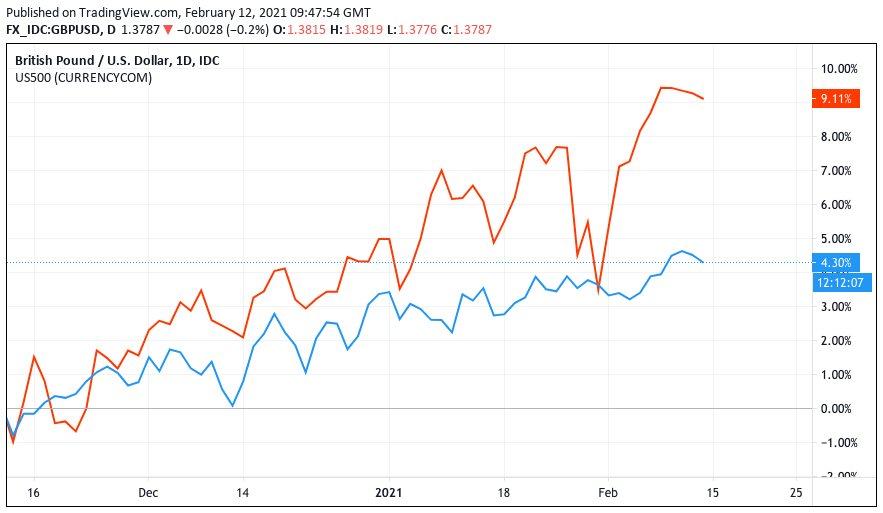

Global investor risk sentiment has become increasingly important to the post-Brexit Pound, with the U.S. S&P 500 stock market index proving to be a particularly usefule guide for the UK currency.

"The pound maintained upward momentum thanks to a correlation of 0.7 with the S&P and 0.6 with Brent," says Kenneth Broux, a strategist with Société Générale.

Above: The S&P 500 index (orange) and the GBP/USD exchange rate (blue).

"From here, further sterling gains against the euro are probably going to be determined by the overall risk mood," adds Broux's colleague at Soc Gen, Kit Juckes.

The Pound-to-Euro exchange rate is sitting on a 0.10% loss for the week, but the Pound-to-Dollar exchange rate is up 0.33%.

"The US dollar was moderately firmer overnight, following falls in recent trading sessions. The pound remains one of the strongest G10 currencies this year, although it has edged down to $1.38 after reaching $1.3850 earlier this week and it is slightly below €1.14," says Hann-Ju Ho, Economist at Lloyds Bank.

The Pound fell back from fresh 33-month highs against the Dollar and dipped back towards 1.14 against the Euro after a soft session in U.S. stock markets signalled a weakening in broader investor appetitive.

"The same old stimulus and vaccination stories appear well priced in by now, and investors seem to be searching for the next big theme that will drive sentiment. Wall Street futures are slightly negative on Friday, perhaps as traders take some profits and trim their risk exposure ahead of a long US weekend.," says Marios Hadjikyriacos, Investment Analyst at XM.com.

"It looks like this market is back searching for a reason to edge lower," says Chris Beauchamp, Chief Market Analyst at IG. "The overall tone of markets remains strong however, and we have seen traders step in to buy any kind of dip of late, with no expectation that this will change in the near-term."

Sterling is a middle-of-the-road journeyman, recording losses against the Franc, Aussie Dollar and Swedish Krona but gaining against the New Zealand and Canadian Dollars as well as the Yen.

With global stock markets being an important determinant of how Sterling trades foreign exchange markets will keep an eye on how broader sentiment is evolving.

"European stocks drifted lower shortly after the opening bell on Friday, following a mixed trading session across Asia, as market operators continue to weigh the latest dovish comments from the US Federal Reserve. Investors’ risk appetite is taking a pause for the end of the week amid rising uncertainties brought by the prospect of a negative impact a huge US stimulus package could have over inflation rates in the mid- to long-term," says Pierre Veyret, Technical analyst at ActivTrades.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Pound was broadly unchanged in the wake of the release of UK GDP data that showed the economy expanded at a faster rate than the market was expecting in December, even though the ONS confirmed 2020 saw the largest single annual drop in activity in the country's history.

For foreign exchange markets all eyes are focussed on the potential recovery that lies ahead now that covid infection rates are plummeting and 20% of the country's population has received a first dose of the vaccine.

The UK economy grew 1.0% in the final quarter of 2020, which double the 0.50% growth the market was expecting.

With the UK economy in a strict lockdown at the start of the new year the first quarter will likely result in negative growth.

But the positive growth in the final quarter of 2020 means that the technical definition of a recession - two successive quarters of decline - will be avoided.

Above: GDP grew by 1.2% in December 2020 after falling by 2.3% in November. Monthly index, January 2007 until December 2020, 2018 = 100. Source: Office for National Statistics - GDP monthly estimate.

"This means a technical double-dip recession will probably now be avoided. And even though the third COVID-19 lockdown means that the economy will almost certainly take another step down in January, GDP should rebound sharply in the second half of 2021," says Thomas Pugh, UK Economist at Capital Economics.

Capital Economics maintain an above consensus forecast that the economy will return to its pre-pandemic size in the first quarter of 2022, implying the Bank of England won’t need to loosen policy further and that the government won’t need to tighten fiscal policy.

The Pound rallied in the first week of February after the Bank of England effectively signalled that further interest rate cuts that would take the base rate into negative territory were now unlikely, given an expectation for a rebound in economic activity this year.

The spectre of negative interest rates has weighed on Sterling exchange rates over recent months, given an historical relationship that sees the currency decline when the Bank cuts rates.

The Bank of England's Chief Economist Andy Haldane has meanwhile underpinned a somewhat hawkish forward looking stance at the Bank by saying the economy resembled a "coiled spring" just waiting to bounce back.

Haldane told the Daily Mail the public are "desperate to get their lives back" and that the significant amount of money saved by households during the pandemic will be put to work when people are unlocked.

Haldane said a "decisive corner has been turned" thanks to the Covid-19 vaccine rollout – and families are ready to fuel a rapid return to prosperity with a multi-billion pound spending spree.

"The recovery should be one to remember, after a year to forget," he said. "A year from now, annual growth could be in double-digits."