Market Dip Blunts Pound Sterling's Advance, Outlook Still Constructive

- GBP sensitive to stock market moves

- But weakness seen as limited near-term

- Intesa Sanpaolo say staying positive on GBP outlook

- Issue latest GBP/EUR and GBP/USD forecasts

Image © Adobe Stock

- Pound-to-Euro spot: 1.1413 | Pound-to-Dollar spot: 1.3845

- Bank transfer rates: 1.1194 | 1.3550

- Specialist transfer rates: 1.1334 | 1.3748

- More about bank-beating exchange rates, here

A dip in financial markets over the course of the past 24 hours has blunted the British Pound's advance against the Euro, Dollar, Yen and Franc.

The UK currency nevertheless remains well supported against nearly all its peers in the short-term and retains its position as 2021's top performing G10 currency, given this momentum any weakness is likely to be viewed as temporary in nature at the current time.

The Pound fell back from fresh 33-month highs against the Dollar and dipped back towards 1.14 against the Euro after a soft session in U.S. stock markets signalled a weakening in broader investor appetitive.

"It looks like this market is back searching for a reason to edge lower," says Chris Beauchamp, Chief Market Analyst at IG. "The overall tone of markets remains strong however, and we have seen traders step in to buy any kind of dip of late, with no expectation that this will change in the near-term."

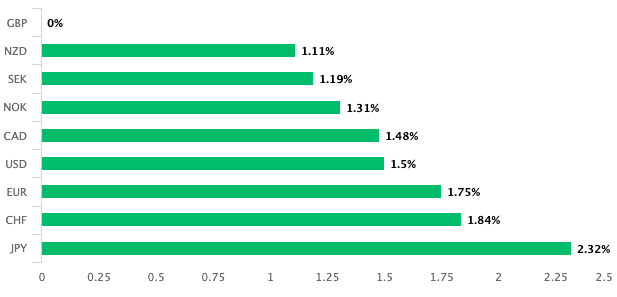

Above: The Pound is the best performing major currency of the past month.

"GBP/USD might be due a pullback but the upside target of $1.40 is still on the radar. GBP/EUR remains afloat the €1.14 handle after piercing through key moving averages last week," says George Vessey, UK Currency Strategist at Western Union. "GBP/USD keeps hitting new 34-month highs nearer the $1.39 mark and could re-test that zone today. GBP/EUR upside potential remains in place so long as the €1.14 handle acts as a strong support."

Since the EU and UK signed a post-Brexit trade agreement foreign exchange markets have been left to consider factors other than Brexit when trading the Pound.

A tighter correlation with broader risk sentiment has since established, meaning what happens to global markets is important.

"GBP has traded like a 'risk on' currency," says Dominic Bunning, Head of European FX Research at HSBC.

A 'risk on' currency is one that rises alongside the world's major stock markets but falls when they decline.

"GBP is vulnerable to reversal when risk sentiment wanes or when markets focus on domestic drivers again," adds Bunning.

But broader market sentiment is not the only game in town for the Pound as analysts say the currency is also finding support from the country's rapid vaccine rollout and the dawning realisation that the Bank of England will not cut interest rates into negative territory in the foreseeable future.

Given these additional factors in play, both of which are likely to remain supportive for the foreseeable future, softer global equity markets will likely only deliver limited damage to the currency's value in the near-term.

"The underlying trend of the Pound should be positive, with a further strengthening supported by the favourable post-Brexit trade agreement reached with the EU, waning expectations for an interest rate cut into negative territory, and the good progress being made by the vaccination campaign in the United Kingdom," says Asmara Jamaleh, Economist at Intesa Sanpaolo.

Above: Waning expectations for a rate cut into negative territory have aided GBP upside, image courtesy of Intesa Sanpaolo.

Intesa Sanpaolo's latest forecast projections for the pound against the dollar are 1.35, 1.37, 1.40, 1.42 and 1.44 on a 1m, 3m, 6m, 12m, 24m horizon.

For the Euro-to-Pound exchange rate the forecast projections are 0.88, 0.86, 0.85, 0.84 and 0.84 on a 1m, 3m, 6m, 12m and 24m time horizon.

This translates into a Pound-to-Euro forecast profile of 1.1364, 1.1627, 1.1765 and 1.19.

The above forecast profiles confirm Intesa Sanpaolo's belief that the UK currency could suffer some near-term tremors that lead to weakness over coming days and weeks ahead of a more sustained rally into year end and beyond.

But this expectation of near-term weakness is not shared by their colleagues at NatWest Markets who see the opposite playing out, i.e. that the Pound can be expected to strengthen in the near-term but weaken in the longer-term.

In a research briefing note to clients, NatWest Markets say a "quicker pace of vaccine roll-out will likely lend support to Sterling," noting a clear divergence in the speed of vaccinations between Europe on the one hand and the U.S. and UK on the other. "Wth downside risks for Sterling more fully priced, we see scope for further Sterling strength in the near term amid quicker vaccine roll-out".

But any gains in Sterling against the Franc and Euro are expected by NatWest Markets to be front-loaded in 2021, meaning the peak in the currency's value will likely be in the first half of the year.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

One reason for this view is that the positive impact of the vaccination programme will ultimately wear off and the negative impacts of Brexit will be left exposed.

"Sterling’s recovery could fade later in the year as it becomes more apparent that the agreed deal is weighing on trend growth. Softer productivity trends, deep economic scarring and deteriorating sustainable current account deficit position are expected to impact negatively," says Robson.

RBS economist Ross Walker said in a research note in November 2020 that Brexit is likely to exert a longer-term, incremental drag on UK productivity and economic growth as a result of reduced investment and restricted labour mobility.

"Trade deals with non-EU countries will bring a dose of sobering reality – far from taking back control, the UK will be taking whatever it can get from larger trading counterparts less in need of a speedy deal," says Walker.

NatWest Markets forecast the Pound-to-Euro exchange rate to be at 1.14 by the end of March 2021, ahead of an easing back to 1.12 by mid-year and 1.11 by year-end.

The Pound-to-Franc exchange rate is forecast at 1.2610 by the end of March 2021, 1.247 by mid-year and 1.222 by year-end.

"The short-term outlook is arguably more constructive before long-term concerns start to dominate once more," says Robson.