Brexit Deal Relief for Pound Sterling to be Short-lived says Rabobank

- Skeletal trade deal not enough to prompt GBP surge

- Domestic political headwinds to blow strong in 2021

- GBP/EUR to remain anchored around current levels show forecasts

- GBP/USD could be at 1.34 in one-year

Image © Adobe Images

- Market rates: GBP/EUR: 1.1090 | GBP/USD: 1.3123

- Bank transfer rates: 1.0880 | 1.2856

- Specialist transfer rates: 1.0990 | 1.3000

- Learn more about market beating exchange rates, here

- Lock in today's rate for use at a future point in coming months, here.

Analysis from investment bank Rabobank shows the outlook for the British Pound will remain clouded into 2021 even in the event of a post-Brexit trade deal being reached between the UK and EU this year, a finding that will disappoint market participants looking for a sizeable rally on the sealing of a deal.

The Pound has been one of the better performing major currencies since September as investors began to increase expectations that a post-Brexit trade deal would be reached with the EU before the year-end cut-off for the transition period.

"Since its peak in mid-September EUR/GBP has been trending lower. Optimism that the EU and the UK will sign a trade deal in November is providing the pound with some support," says Jane Foley, Head of FX Strategy for Rabobank in London.

EU and UK negotiators are currently locked in intensive talks with a view to securing a breakthrough in negotiations by November 19, when EU leaders are due meet for one of their regular summits.

While outstanding issues over fishing rights and level playing fields remain, political commentators say that ultimately the two sides can see the route to a deal. This is a view apparently shared by the market as Sterling had earlier this week rallied to fresh two-month highs against the Euro and Dollar.

Yet, charts will confirm the major exchange rate pairs have merely bounced off their lows and Sterling's purchasing power is still less than it was at the beginning of the year.

Above: GBP/EUR in 2020. Set your ideal exchange rate with a limit order, ensuring when the market is hit your rate is delivered automatically. Learn more here.

An assumption amongst many readers who make contact with our editorial team is that the Pound will go markedly higher in the event of a deal being signed; an article we published covering the views of one analyst at a money transfer broker was particularly popular owing to the broker's view that GBP/EUR could go as high as 1.25 in the event of a deal.

The view that the Pound can go higher is certainly shared by many in the analyst community, but what is noticeable is that consensus is of the opinion gains will likely be limited.

Indeed, the Bank of England in their November Monetary Policy Report out on Thursday observed that the skew in the options market for future volatility in the Pound suggested there was ample scope for a sizeable move lower, but very little enthusiasm amongst investors for a sizeable move higher.

Analysis from Rabobank concurs with this view, showing that there remains a stew of negatives - economic, political and medical - that could prevent a significant rally in Sterling on the signing of a deal.

Foley says that any deal that is eventually signed will be a skeletal one that could fail to comprehensively cover many business, particularly in the services sector is likely to be limited and potentially short-lived.

"While many Brexit-weary investors will be looking forward to an end to the UK political wrangling next year, these hopes may prove premature," says Foley.

Politics are likely to prove to be a headwind that contains enthusiasm towards the Pound. Foley says PM Johnson’s popularity among his own party faithful is at a low ebb after a series of policy U-turns this year and on the back of criticism over his handling of the Covid-19 crisis.

"Additionally opinion polls are suggesting that Labour’s standing has risen above that of the Tory party in national polls. Despite winning an 80 seat majority in the House of Commons less than a year ago, speculation is appearing that Johnson may be removed as party leader well before the next election in 4 years’ time," says Foley.

Foley says a new source of concern for investors over the longer-term relates to Scotland and the potential break up of the United Kingdom.

"The state of the union in the UK is again in the spotlight after an opinion poll indicated that Scotland is favouring independence. Not only did Scotland vote to remain in the EU in the 2016 referendum but First Minister and Leader of the SNP Sturgeon is seen as having performed better than Johnson through the Covid-19 crisis. The SNP is expected to perform well in the May 2021 Scottish Parliament election and this could increase pressure on the Westminster government to allow another vote of Scottish independence," says Foley.

The issue gained prominence on October 14 after polling company Ipsos MORI revealed support for independence in Scotland had reached its highest level on record, with a whopping 58% of Scots who are likely to vote saying they are inclined to take their country out of the UK if they were asked to vote today.

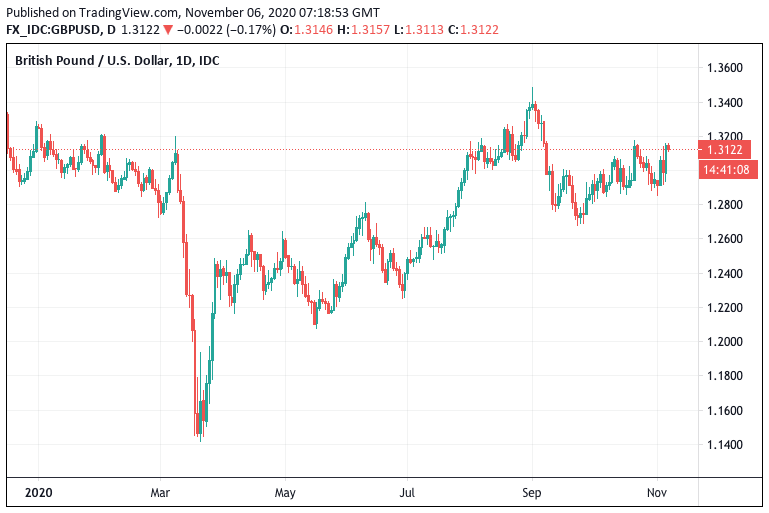

Above: GBP/USD in 2020. Lock in today's exchange rate for use over coming months, thereby protecting your international payments budget, more information can be found here.

Scottish independence matters for the Pound, with the 2014 referendum resulting in the Pound falling as it absorbed a risk-premium in anticipation of a potential vote for independence, with declines accelerating in response to some polls that suggested the outcome would be close.

The currency recovered following a result in favour of the status quo.

Economics are also unfavourable given England has this week entered a second lockdown and joins the other nations of the UK in having significant restrictions on movement, which economists say will knock the economy into contraction once more.

Granted, with other European nations and the U.S. facing second waves of covid-19, the relative damage of the lockdown is mitigated. However, data does show the UK to have already been the second-most negatively impacted economy in Europe from the first lockdown.

"The four week lockdown announced by the PM from November 5 has pulled the rug away from hopes of a UK recovery in the final quarter of the year. In turn this has injected fresh life into speculation about the prospects of a negative interest rate from the BoE. This too is likely to cloud the outlook for the pound going forward," says Foley.

Rabobank are forecasting the Pound-to-Dollar exchange rate to trade at 1.30 in three months, 1.29 in six months and 1.34 at this point in 2021.

The Pound-to-Euro exchange rate is forecast at 1.12 in six months, 1.13 in six months and 1.14 in one year.