Pound Sterling Tipped to Stay Defensive vs. Euro and Dollar if Bank of England Boosts Quantitative Easing Programme this Week

- GBP outlook weighed by Bank of England quantitative easing

- JP Morgan stay 'short' Sterling

- GBP could gain if market sentiment improves this week

- Brexit deadline to also weigh

Image © lazyllama, Adobe Stock

![]() - Spot GBP/EUR rate at time of writing: 1.1428

- Spot GBP/EUR rate at time of writing: 1.1428

- Bank transfer rates (indicative): 1.1128-1.1208

- FX specialist rates (indicative): 1.1194-1.1325 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2464

- Spot GBP/USD rate at time of writing: 1.2464

- Bank transfer rates (indicative): 1.2128-1.2215

- FX specialist rates (indicative): 1.2210-1.2352 >> More information

The British Pound is tipped to retain a defensive tone over coming days, and even months, amidst a combination of Bank of England policy actions, subdued market sentiment and rising Brexit threats.

The immediate concern for the UK currency this week is Thursday's Bank of England policy decision, where opinion is divided amongst market participants as to whether or not policy makers will announce fresh measures to aid the economy, making it a 'live' event for Sterling.

Ahead of the event, foreign exchange strategists at JP Morgan say in a client note they retain a 'short' position on Sterling-Dollar, as they still anticipate weakness in the UK currency to play out and result in a move below the 1.22 level.

Being 'short' a currency is trader-speak for being engaged in a trade that benefits if the currency falls, therefore the 'short' Sterling stance reflects a high conviction that the Pound will remain under pressure.

At the time of p

The Wall Street investment bank says the immediate focus for Sterling is this week's Bank of England meeting, at which they say further quantitative easing measures will be announced in an effort to prop up the UK's coronavirus-hit economy.

JP Morgan economists expect Threadneedle Street to increase its quantitative easing programme by 50%, or £100bn.

Quantitative easing involves the buying of government debt (bonds, also known as gilts in the UK) by a central bank using newly created money. Hence, why quantitative easing is sometimes colloquially referred to as money printing.

The foreign exchange playbook suggests that when a central bank engages in, or increases, quantitative easing, the currency it issues should fall in value. Any further announcement by the Bank would take the UK's quantitative easing programme to an all-time high of 13.5% of GDP, which highlights the scale of the programme.

"GBP faces stiff headwinds from the combination of excessive QE, eye-popping fiscal issuance, and a large current account deficit," says Meera Chandan, FX Strategist at JP Morgan in London.

The Pound-to-Dollar exchange rate is currently quoted at 1.2467, the Pound-to-Euro exchange rate is at 1.1429.

JP Morgan analysis shows for high deficit countries such as the UK, New Zealand and Canada, the exchange rate consequences of a sizeable or "outsized" quantitative easing programme could be quite significant if it depresses capital inflows.

When a central bank buys government debt the yield on that debt falls, which in turn makes the debt less attractive to foreign buyers. Hence, a hefty quantitative easing programme at the Bank of England could well diminish inflows of capital that would normally support the Pound.

We would expect the market to potentially sell Sterling if the scale of any fresh quantitative easing comes in ahead of market expectations, but any decision to forgo a new announcement as potentially being supportive of the currency.

"We don't expect the Bank of England to add fresh stimulus this week, although the pressure to beef-up its QE programme will build over the next few months, not least because the economic recovery will be very gradual," says James Smith, Developed Markets Economist at ING Bank.

We are yet to sense any consensus as to what the Bank will do on Thursday, therefore the decision could come as a relative surprise to markets and it is surprises that have the greatest potential to move a currency.

"There is no rush to expand the size of the QE target this week. For one thing, purchases remain well below the £645bn QE ceiling the BoE has set itself: the size of the QE portfolios have reached £514bn in total last week, of which just under £12bn is in corporate bonds. Extrapolating the current pace of purchases, we estimate the BoE has just under two more months to go before reaching the ceiling, more if it tapers purchases," adds Smith.

However, for Sterling, the outlook is not just dependent on the Bank of England as the general tone of markets and expectations on Brexit trade negotiations will be of importance.

The Pound has tended to decline when markets decline, and rally when they move higher and there remains little evidence that this linkage is broken.

Therefore, should the recent multi-week stock market rally extend we might see Sterling increase in value against the likes of the Euro and U.S. Dollar, but should sentiment deteriorate the Pound could well shed some weight.

A new headache for global markets - and by extension Sterling - to consider is the potential for fresh geopolitical tensions to increase as the U.S. looks to confront China over the origins of the covid-19 pandemic.

"The prospect of renewed trade tensions between the world’s two biggest economic superpowers is not really the ideal scenario for risk as economies look to re-open from their lockdown measures. After a period of recent stability, the Chinese yuan has weakened noticeably since Trump’s suggestion of renewed tariffs. A weakening yuan tends to go hand in hand with a reduction in risk appetite," says Richard Perry, an analyst at Hantec Markets.

If we see a significant deterioration in U.S.-China relations we would expect markets to lose value and this would likely ensure Sterling loses purchasing power, particularly against the Dollar, Euro, Franc and Japanese Yen.

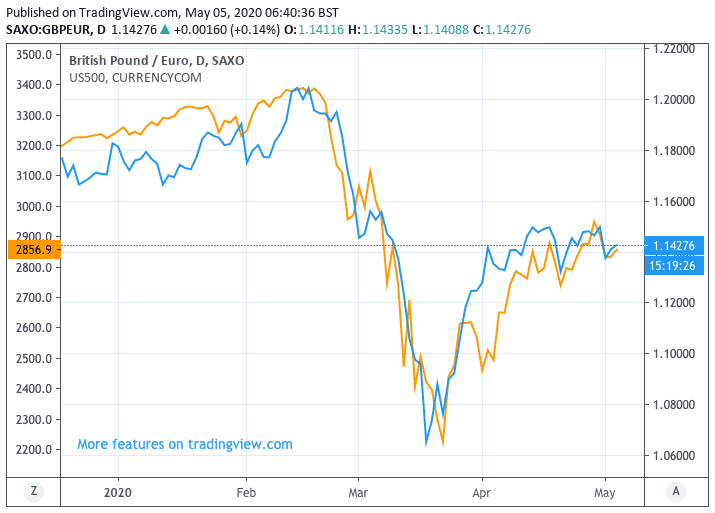

Above: GBP/EUR (blue) tracking global investor sentiment as proxied by the S&P 500 index (orange).

Another potential negative on the Pound's horizon is a failure of the UK and EU to agree a Brexit trade deal. The 1st of July is key in this regard as it as this point that the two sides must agree on whether or not to extend negotiations beyond year-end.

Failure to do so would rapidly raise expectations for a 'no deal' scenario whereby the two sides trade under basic WTO terms, which is a sub-par outcomes for both economies.

The UK has thus far steadfastly refused to entertain any extension to negotiations, a stance that has JP Morgan maintains their conviction that further downside in the Pound lies ahead.

"Our economists note that UK’s stance raises the odds that we enter July with no extension in place which would make for a messy outcome and at an extreme, could raise the possibility of a “no-deal”. Immediate attention will be on the May 11th second round of talks between UK-EU negotiations," says Chandan.