Pound Sterling Could be About to Head Lower Again says Wall St. Investment Bank as Rally against Euro and Dollar Stalls

- GBP rally stalls

- JP Morgan see another leg lower developing

- UK exposed to capital flight

- Coronacrisis not yet over

Image © Adobe Images

![]() - Spot GBP/EUR rate at time of writing: 1.1349

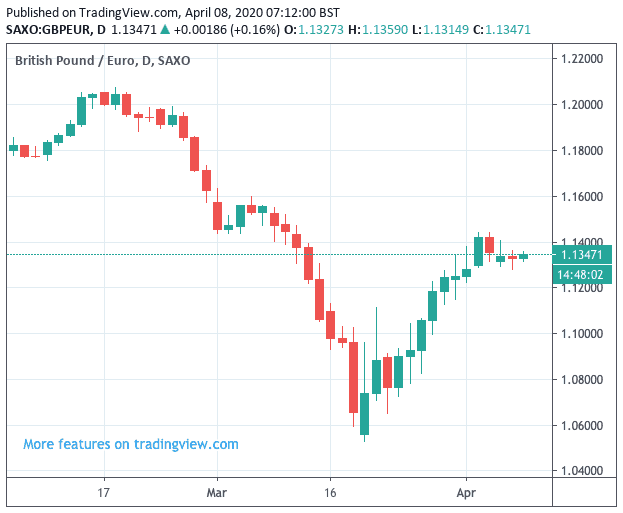

- Spot GBP/EUR rate at time of writing: 1.1349

- Bank transfer rates (indicative): 1.1060-1.1140

- FX specialist rates (indicative): 1.1200-1.1256 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2302

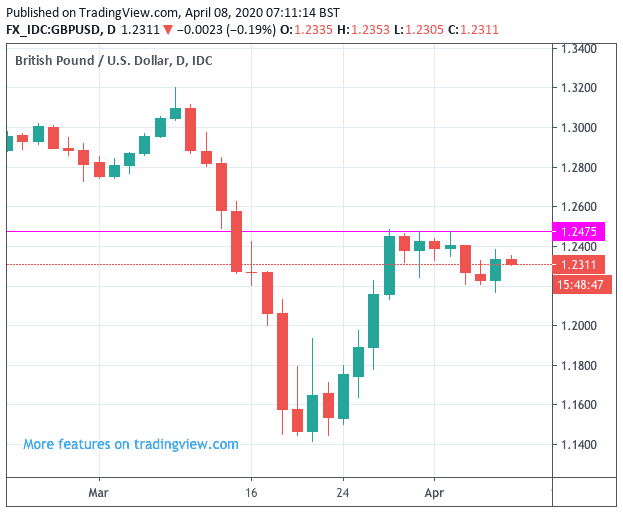

- Spot GBP/USD rate at time of writing: 1.2302

- Bank transfer rates (indicative): 1.1970-1.2060

- FX specialist rates (indicative): 1.2150-1.2200 >> More information

The British Pound is being forecast to decline once more by investment bank JP Morgan who says the UK still remains exposed to global capital flows and the market fallout from the coronavirus pandemic is not yet over.

The call comes as the Pound's late-March recovery rally stalls with April revealing a lack of upside momentum against both the Euro and U.S. Dollar which leaves it looking exposed to a reversal in fortunes.

The Pound-to-Euro exchange rate appears stuck around 1.1340 while the Pound-to-Dollar exchange rate is quoted at 1.2332 as it makes a steady grind lower after it was rejected at 1.2470 region on multiple occasions in the March 27-April 03 period.

We note that contributing factors to the decline are ongoing concerns about the health of the Prime Minister Boris Johnson who remains in ICU at St. Thomas Hospital in London and a stalling in the broader stock market recovery, which Sterling has shown itself to be correlated to.

"Short GBP/USD is the preferred candidate to raise our long USD, defensive exposure once again after the rounds of profit-takes of recent weeks," says Patrick R Locke, a Strategist at JP Morgan.

Above: GBP/USD daily chart showing stall at around 1.2470-1.2475

The Pound suffered a substantial decline during the early stages of March amidst a global financial market panic over the impact of the fast spreading covid-19 pandemic, confirming that it tends to suffer in times of market fear.

The GBP/EUR exchange rate fell from highs of 1.20 on February 17 to record a low of 1.0530 on March 19, the GBP/USD exchange rate meanwhile fell from highs at 1.30 on March 09 to plug a multi-year low at 1.1445 on March 19.

"It would be wrong, in our view, to dismiss that slump as an unwarranted overreaction on the part of GBP to the COVID-19 fallout to compound of course the unique damage from Brexit. After all, the UK is more exposed to a sudden stop in global capital flows given the UK’s outsize current account deficit," says Locke.

Above: GBP/EUR daily chart

Most currency analysts and strategists point the finger at the UK's current account deficit for leaving it exposed to the whims of international investor sentiment. Because the UK tends to import more than it exports, Sterling finds itself reliant on the inflows of international investor capital to keep it at elevated levels.

When these flows dry up, or reverse, in times of severe investor anxiety, the Pound gravitates to lower levels.

Furthermore, the currency has been found to be sensitive to global liquidity crunches: when cash dries up, as was the case during the recent market meltdown, the Pound fell.

"The UK has a larger international balance sheet than its peer group which leaves GBP susceptible to a certain repatriation of foreign capital," says Locke.

The analyst says there remains very little on offer that would convince foreign investors to increase investment flows into the UK during periods of significant economic disruption, as is presently the case.

"In addition, we are not convinced that this early in the process it is possible to handicap the relative resilience of different economics to the COVID fallout, irrespective of the extent and significance of domestic policy support. So while the UK government and BoE have been pro-active and indeed creative in broadening the reach of public sector support to the economy, we do not yet regard this as source of meaningful reassurance for GBP," says Locke.