Pound Sterling: Johnson's ICU Admission Deals Hammer Blow to UK Confidence, Sees Mixed Fortunes vs. Euro and Dollar

- GBP in mixed trade on Tuesday

- Johnson reported to be in good spirits, is stable

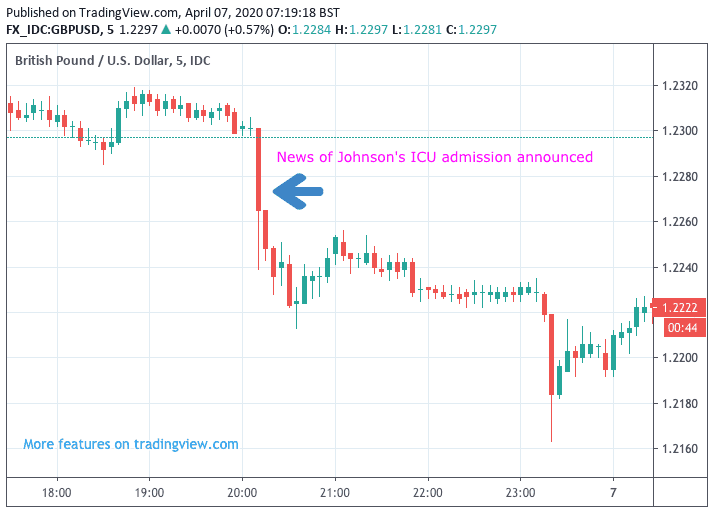

- GBP fell on news of Johnson admission to ICU

- HSBC say broader market sentiment to remain key driver of GBP

Above: File image of Boris Johnson hosting a cabinet meeting prior to the coronacrisis. Image courtesy of Gov.uk

![]() - Spot GBP/EUR rate at time of writing: 1.1338

- Spot GBP/EUR rate at time of writing: 1.1338

- Bank transfer rates (indicative): 1.1040-1.1100

- FX specialist rates (indicative): 1.1180-1.1240 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2365

- Spot GBP/USD rate at time of writing: 1.2365

- Bank transfer rates (indicative): 1.2030-1.2120

- FX specialist rates (indicative): 1.2200-1.2250 >> More information

The British Pound saw its recovery rally against the Euro stall but put in a strong advance against the U.S. Dollar on Tuesday, April 07 in what is proving to be a relatively mixed day for the UK currency on global markets.

The Dollar is clearly an under-performer - recording losses right across the board amidst a broad improvement in global stock markets - and this will explain a great deal of the Pound-to-Dollar exchange rate's advance to 1.2352; but we would need some organic strength in Sterling to generate further gains in the Pound-to-Euro exchange rate which appears to be locked at 1.1336.

Sterling has over the course of the past two days shown itself to be sensitive to news concerning the health of UK Prime Minister Boris Johnson who was on Monday night admitted to the Intensive Care Unit at St. Thomas Hosptital in London, news that triggered a sudden slip in the value of the currency.

However, Sterling soon found its feet again in the absence of any further negative news concerning Johnson and appears to once again be primarily driven by external factors, particularly the state of the global financial market.

We would however expect the Pound to show further sensitivities to any bad news concerning the Prime Minister, simply for the reason that this would inject uncertainty into the UK picture and recent history has proven Sterling has an intense dislike for uncertainty.

The mood concerning Johnson is currently on the more optimistic side with Downing Street saying he is in a stable condition and remains in good spirits.

They said he is being given "standard oxygen treatment" and said he has not had “mechanical ventilation or non-invasive respiratory support".

This suggests Johnson is being given oxygen through a mask but does not need the support of a ventilator while it was reported last night that Pneumonia had not been diagnosed.

"The Pound received a slight boost against the US dollar today after positive news of Prime Minister Boris Johnson’s stable condition of health injected some energy into the British currency," says Sebastien Clements, currency analyst at OFX.

According to 10 Downing Street, Johnson was moved into intensive care at 7PM on Monday night after his condition worsened amid concerns that he may need a ventilator to aid his fight against coronavirus.

The decision was made after his condition deteriorated through the afternoon and ultimately lead him to experience breathing difficulties.

"There is really only one headline today – that UK PM Boris Johnson is in intensive care. Indeed, as several medical experts have attested, given the critical shortage of ICU beds he is likely to be on a ventilator very soon," says Michael Every, Global Strategist at Rabobank. "For the UK, this obviously dents confidence."

Political uncertainty has increased substantially since the news was announced, which as we have seen over recent years typically lends itself to a weaker Pound and explains why the currency has retreated from its recent highs.

The Pound will likely prove sensitive to the news flow surrounding the Prime Minister over coming hours and days, with any suggestions of an improvement in Johnson's health likely to be net supportive.

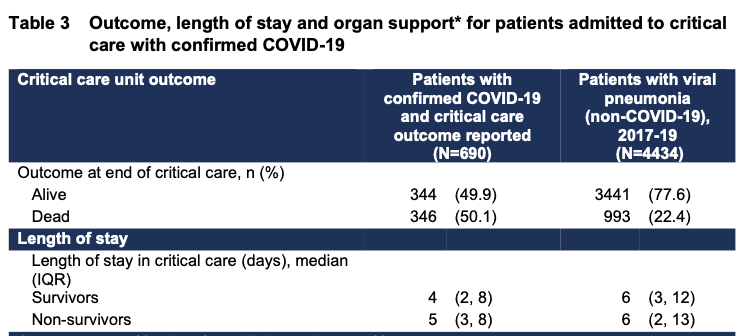

According to data released on Saturday by the Intensive Care National Audit and Research Centre, 50% of patients admitted to intensive care units suffering from Covid-19 die of the disease.

Of those aged 50-59, which includes Johnson, the fatality rate falls to 46% suggesting his age starts tipping the scales further in his favour.

Image courtesy of Intensive Care National Audit and Research Centre

The Way Out of the Coronacrisis is Still Unclear

However, it is not just political uncertainty due to the Prime Minister's ill health that will prove to be a concern for markets and Sterling, as Rabobank's Every says Johnson's deteriorating health draws questions on the broader market's assessment on the post-coronavirus outlook.

"Clearly, COVID-19 is not just potentially deadly for the elderly and vulnerable, but even for the relatively young and fit - Boris cycles regularly, is in his 50s, and unless underlying health conditions are being suppressed by No 10, is NOT a classic potential victim at all. That should immediately dent and/or shatter confidence in what is yet again emerging as a potential economic exit from this tragedy – ‘herd immunity’," says Every.

Currently markets are in a strong recovery move thanks to signs that the peak of the virus has now reached Europe and some countries are starting to lay the groundwork for a lifting of lockdown conditions.

Every says the current assumption amongst the press and investor community is that global lockdowns will 'flatten the curve', allowing life to get back to normal while continuing to care for the vulnerable who would remain exposed to covid-19.

"The problems with that approach are that this will involve millions of people staying under lockdown and socially distanced, even within families, between generations and the ‘vulnerable’ and ‘not vulnerable’ – how do we do that, practically?" asks Every.

Furthermore, the theory assumes immunity is developed after exposure to cover-19, but Avery points out the common cold is also a coronavirus, and for this strain of the virus there never has been a lasting immunity.

Indeed, press reports suggest that some individuals who have had the covid-19 strain are getting ill again, after it was assumed they had kicked the disease. One explanation is that the disease had 'deactivated' and simply 'reactivated' in these individuals.

Whatever the explanation, there is still no clear medical consensus and understanding of covid-19, which draws serious questions on the health of both the global population and economy.

HSBC: Market Recovery to Underpin Sterling's Recovery

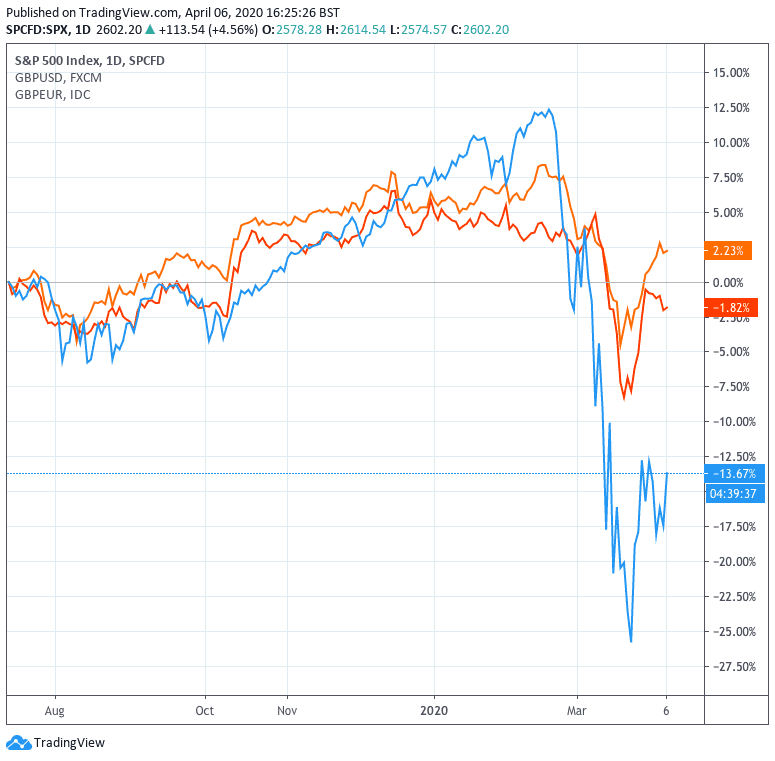

For Sterling, broader market sentiment regarding the global pandemic is critical. It is clear that the bigger driver of Sterling's valuation in the current econocrisis is broader investor sentiment, with the currency having shown a material improvement ever since global stock markets stabilised and started recovering.

We expect this link to remain intact and therefore note that the broader performance of global markets and investor sentiment will be in charge of the currencies movements. The British Pound started the week on a strong footing, amidst increasing signs the global investor community are now starting to see an end to the current coronavirus-inspired economic lockdowns on the horizon.

While the U.S. is still expected to remain locked down for the foreseeable future, owing to the country lagging the rest of the world in terms of infections, a slowing down in the rate of both infections and deaths in Europe are aiding a market recovery which in turn tends to benefit the Pound.

"Encouragingly in countries such as Italy and Spain infections rates are slowing and there is talk now of an easing in lockdown restrictions later this month," says Rupert Thompson, Chief Investment Officer at Kingswood, a wealth management group. "A considerable amount of bad news, however, is priced into markets."

David Bloom, Global Head of FX Research at HSBC says the Pound ultimately remains attuned to global market sentiment, rising when risk is improving and falling when risk deteriorates. Bloom say the majority of major currencies - including Sterling - continue to display a correlation to the performance of the S&P 500.

"Everything is behaving as it should," says Bloom in an interview with Bloomberg, "everyone is performing in their ranking at the moment and the Pound is doing fine."

Currencies that tend to move higher when the market recovers include the Australian, Canadian and New Zealand Dollars, while 'risk off' currencies such as the Yen and Dollar tend to fall when markets are bullish.

At the height of the coronavirus-inspired market sell-off, the Pound fell towards 1.15 against the Dollar and towards 1.05 against the Euro, however the currency turned around and started a recovery process in the March 19-23 period, following a decisive effort by global central banks and governments to prop up the global economy.

"The big thing that is interesting about Sterling is that we used to be much more of a 'risk off' currency, but we decided we didn't want to be part of a big closed economy called the Euro, wanted to go our own way which means we are more susceptible to global forces than we used to be," says Bloom.

Bloom is maintaining a year-end GBP/USD forecast for 1.35, saying the "UK is cheap, it is undervalued".

That Sterling's fortunes are so tightly connected to the fortunes of global markets, it therefore remains the case that any setbacks to the recovery theory will dent both stock markets and the Pound alike.

As mentioned, the medical community is still learning about covid-19 while world leaders grapple with the economic toll of the lockdowns on one hand, and protecting the health of their citizens on the other.

There is no clear exit strategy and no clear cure to the pandemic, which makes us nervous about the sustainability of the current improvement in sentiment.