Battered Pound Sterling Could Rebound Against Euro and Dollar if Stock Markets Stabilise

- Market sentiment has vice-like grip on GBP

- Improvement in stock markets could aid GBP short-term

- Markets firm following strong response by Federal Reserve

Image © Adobe Images

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

The British Pound suffered significant declines against the Euro and U.S. Dollar over the course of the past 24 hours amidst a fresh meltdown in global stock markets and the currency remains locked in downward trends against its two main rivals.

But should global markets stabilise - as appears to be the case on Friday - we would not be surprised to see some kind of recovery in the Pound, however we do not believe any rebounds would be sustainable and continue to believe any strength will be sold into until such a time as the narrative around the coronavirus shifts into more positive territory.

The Pound-to-Dollar exchange rate is now at 1.2558, having opened Thursday's session at 1.2820, meaning Sterling suffered a 1.82% decline against the Greenback on Thursday.

The Pound-to-Euro exchange rate is meanwhile at 1.1214, having opened Thursday at 1.1234 before falling 1.23%.

Focussing on anything other than the global market situation when discussing currencies is ultimately futile at present, nothing else really matters apart from the ongoing coronavirus-linked market meltdown.

"Brexit is in hibernation for now allowing GBP to focus on global trends," says Kamal Sharma, FX Strategist at Bank of America Merrill Lynch. "Sterling has not been immune to the global meltdown in risk markets and the aggressive carry funded unwind that has been the hallmark of recent FX price action."

Stocks remain under significant pressure and a new symptom of the market turmoil is an apparent drying up of liquidity: as stock markets fell on Thursday the Dollar suddenly leapt. However, typical safe haven assets such as gold and other precious metals also found themselves falling.

This suggests a chronic shortage of cash in the global market as margin calls are made on traders while there was also talk of cash issues in bond markets.

The result is that the Dollar suddenly attracted a premium and shot through the roof against all the major currencies.

Confirming a potential disruption to liquidity in the markets, the New York Federal Reserve then stepped into the breach to offer more by way of cash injections to various institutions that require it (Repo operations).

The NY Fed announced what amounts to a total of $1500bn in Fed term repo operations, a move that appears to have tamed some of the Dollar's advances and triggered something of a recovery in stocks.

"These changes are being made to address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak. Reserve management purchases into the second quarter will continue to be conducted with this maturity allocation. The terms of operations will be adjusted as needed to foster smooth Treasury market functioning and efficient and effective policy implementation," read a statement from the NY Fed.

"This is big. U.S. stock prices already reducing losses," says Vitor Constâncio, Former ECB Vice President.

"The Fed last night said that it will inject a record amount of USD 5 trillion of liquidity into the market to keep short-term financing rates stable. Importantly, the Fed also announced that it as a part of the reserve management will buy longer-dated bonds. It is basically a new QE programme and expectations for the introduction of an official QE programme being introduced next week are now growing," says Chief Analyst at Danske Bank, Arne Lohmann Rasmussen.

Stability in global stock markets appears to have endured through to the Friday session with global markets putting in some gains at the time of writing.

The British Pound is nevertheless showing no intention to rally and those holding Sterling who are looking to buy Euros and Dollars are unlikely to see any significant improvement for some time.

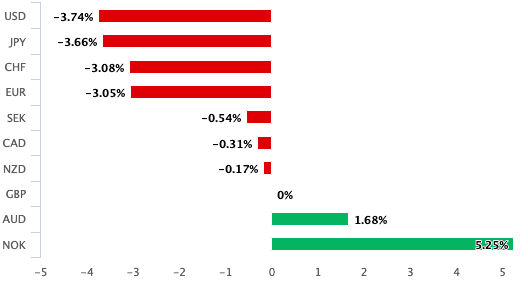

Above: GBP performance over the course of the week ending March 13.

The Pound is particularly prone to stock market sell-offs owing to the UK's sizeable and pervasive current account deficit which stood at 2.8% in the third quarter of 2019; the UK traditionally runs a deficit as a result of it importing more than it exports.

Sterling levels are therefore in part sustained by inflows of foreign capital that offset the downward pull of the trade imbalances.

"The Pound has essentially fallen back into its traditional status as a high-beta/current account deficit currency. Brexit appears to have vanished from investors' radar for now as broader market dynamics dominate," says Sharma. "GBP has broadly followed the contours of a traditional risk-off episode: current account deficit currencies have underperformed versus current account surplus currencies since 18 February."

The UK is traditionally seen as a solid destination of choice for investors due to reasons such as legal stability, ease of doing business, location etc., but should investors run scared owing to a global crisis then suddenly Sterling finds this source of support disappearing.

Yes, the budget and Bank of England actions from March 11 were deemed ultimately supportive and competent, but the measures appear to be no match for the impact of gargantuan flows of investor capital.

We would expect the Pound to only start recovering against the Euro, Dollar, Franc and Yen should markets believe a corner in the coronavirus crisi has been turned.

For now though, the turning point looks to be quite some distance off.

"For now, we think GBP falls back in line with the broader G10 FX dynamic and will respond to the ebb and flow of risk sentiment," says Sharma.