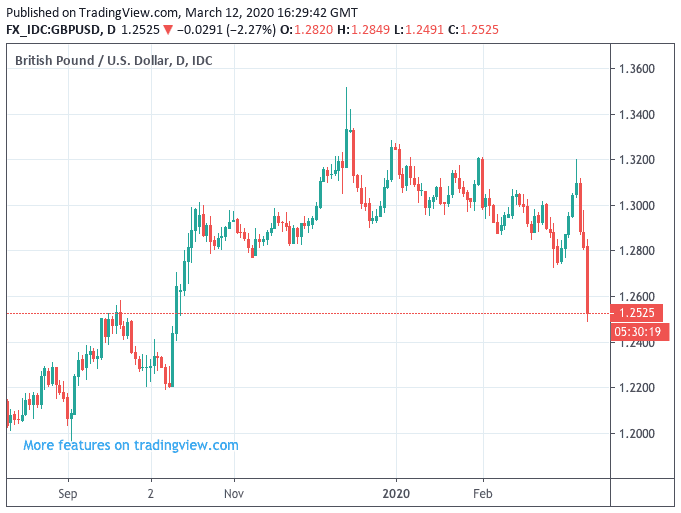

Pound-to-Dollar Rate in 2%+ Crash Amidst Market Meltdown

- USD demand soars

- Market meltdown extends

- Mistep by ECB's Lagarde prompts fresh market selloff

Image © Adobe Images

Time to make a money transfer but need the guidance of a market professional? Get in touch now.

The Dollar is surging higher across the board in a foreign exchange market that is witnessing the kind of volatility that has not been seen in years.

A massive meltdown in stock markets has started to have a material impact on foreign exchange markets and the clear winner is the Dollar:

The Pound-to-Dollar exchange rate is lower by 2.32% at the time of writing at 1.2519.

The Euro-to-Dollar exchange rate is meanwhile lower by 1.67% at 1.1072.

If we look at the rest of the market, we can see there is actually very little standing in the way of the greenback.

According to Ranko Berich, Head of Market Analysis at Monex Europe, today is the third biggest daily increase in the Bloomberg Dollar Index of the past decade.

The last time was saw a move in the GBP/USD of this magnitude was back on the night of the EU referendum of June 22, 2016.

The question is, why is the Dollar suddenly going berserk?

There is a clear theme playing out on global financial markets: get hold of cash.

When gold prices are on the move lower, (gold is 4% lower today) it would suggest a market that is not placing a premium on safety so much as the ability to hold cash.

The U.S. Dollar is the world's reserve currency, therefore it tends to benefit when markets exhibit the extraordinary panic, as we are currently witnessing.

Cash is king = the Dollar is king.

"Absolute meltdown in FX markets. Real scramble to get hold of USD liquidity and funding (where's the Fed when you really need them). Some of the biggest moves in G10 pairs for a long time. Will only stop once the mayhem in stocks/bonds stop," says Viraj Patel, FX and Macro Strategist at Arkera.

Confirming a potential disruption to liquidity in the markets, the New York Federal Reserve has stepped into the breach to offer more by way of cash injections to various institutions that demand it (Repo operations).

The NY Fed on Thursday announced what amounts to a total of $1500bn in Fed term repo operations, a move that appears to have tamed some of the Dollar's advances and triggered something of a recovery in stocks.

"These changes are being made to address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak. Reserve management purchases into the second quarter will continue to be conducted with this maturity allocation. The terms of operations will be adjusted as needed to foster smooth Treasury market functioning and efficient and effective policy implementation," read a statement from the NY FEd.

"This is big. U.S. stock prices already reducing losses," says Vitor Constâncio, Former ECB Vice President.

The apparent liquidity crunch - that is stoking demand for Dollars - appears to be a result of the ongoing market slump and volatility across a range of financial assets: negativity is feeding negativity in the current environment, creating a snowball effect.

The latest trigger to selling, in what had already been a bad day for investors, was the European Central Bank (ECB) which failed to calm investor nerves and provide the reassurances markets are desperate for.

"Eschewing the old-fashioned and arguably ineffective approach of headline rate cuts, it has instead gone for more QE and a direct loan programme for small businesses. But this good move was undermined by poor communication from Christine Lagarde, whose offhand comments about not closing the spread between Italian and German government bonds has sparked another significant ‘risk off’ moment across markets," says Chris Beauchamp, Chief Market Analyst at IG.

When asked about the widening spread between the yield paid between German and Italian bonds - which signifies market stresses - Lagarde said, "we are not here to close spreads".

This spooked markets who have for years come to rely on the mantra of Mario Draghi - Lagarde's predecessor at the ECB - that the ECB stood ready to do whatever it takes to underpin the Eurosystem.

"Then Lagarde made her comments on spreads (after the piece went through our publishing systems) which we really didn’t expect: “ECB NOT HERE TO CLOSE BOND SPREADS.” That might be true in some sense of what they deem their mandate, but not what you say when markets are selling off on a day like today. This doesn’t change the conclusion of our risk off trades, it does make our confidence stronger in calling for USD higher here as funding is becoming an issue in certain pockets (and spreading more widely too)," says Jordan Rochester, a strategist at Nomura.

"Investors were already reeling from Trump’s rather poorly-handled address last night, and to throw an ECB mis-step in on top of this was more than they could handle. As a result, there is still no sense of a firm floor in place for risk assets, and the ‘bear market’ headlines that will greet investors over the next 24 hours will only serve as a cue for more selling," says Beauchamp.